Taxation of closely held corporations – efficiency aspects

Cite this article

as: P. Ericson, J. Fall; 2011; Taxation of closely held corporations – efficiency aspects; International Journal of Microsimulation; 4(2); 27-40.

doi: 10.34196/ijm.00051

- Article

- Figures and data

- Jump to

Figures

Tables

Table 1

Average tax _ rates and size of alternative forms of organisations in SWEDEN 2005.

| Sole propriatorship | CHC | WHC privat | WHC public | |||||

|---|---|---|---|---|---|---|---|---|

| Distribution of wages and dividens | Distribution of dividends | Distribution of wages and dividens | Distribution of dividends | |||||

| Number of firms | 735,917 | 190,981 | 96,638 | 339 | ||||

| AETR (%) | 55.4 | 31.8 | 24.3 | 27.3 | 27.6 | 32 | ||

| RAETR(%) | 60.1 | 34.5 | 26.3 | 29.6 | 30 | 34.7 | ||

| Turnover (MSEK) | 181,602 | 1,143,356 | 4,218,370 | 158,377 | ||||

| Wage bill (MSEK) | 8,381 | 180,418 | 448,064 | 16,663 | ||||

| Number of employees | 49,017 | 692,719 | 1,491,231 | 79,725 | ||||

-

Source: Sørensen (2008)

Table 2

Number of observations.

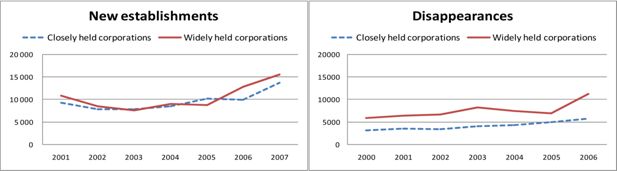

| Year | Closely held corporations | Widely held corporations |

|---|---|---|

| 2001 | 167,069 | 42,526 |

| 2002 | 171,550 | 38,718 |

| 2003 | 173,980 | 37,329 |

| 2004 | 179,884 | 35,976 |

| 2005 | 185,568 | 35,061 |

| 2006 | 189,178 | 37,395 |

| 2007 | 190,097 | 40,748 |

Table 3

Statistics on variables in a model aiming to explain the probability of becoming a CHC owner.

| Variable | |

|---|---|

| New CHC owner in 2006 (dependent variable) | 0.9% |

| Sole propriator/partnership last year | 7.9% |

| Avarage difference in disposable income (TSEK/YEAR) | 5.0 |

| Woman | 50.2% |

| Age < 30 | 9.3% |

| Single | 22.4% |

| Born in Sweden | 86.9% |

| Living in a large city | 34.4% |

| University degree | 19.8% |

Table 4

Probit estimates of the probability to become a CHC owner.

| Parameter | Estimate | P-value |

|---|---|---|

| Inte rcept | −2.5002 | <.0001 |

| Sole propriator/partnership last year | 0.3729 | <.0001 |

| Difference in disposable income | 0.00538 | <.0001 |

| Woman | −0.2528 | <.0001 |

| Age < 30 | −0.1446 | <.0001 |

| Single | −0.1535 | <.0001 |

| Born in Sweden | 0.179 | <.0001 |

| Living in a large city | 0.1476 | <.0001 |

| Unive rsity degree | −0.0512 | 0.0095 |

| Discriminatory power | 0.35 | Somers’ D |

Table 5

Disposable income elasticities to become a CHC owner.

| Hourly wage rate (decile) | Average hourly wage rate (SEK) | Elasticity |

|---|---|---|

| All | 156 | 0.07 |

| 1 | 95 | 0.01 |

| 2 | 111 | 0.01 |

| 3 | 120 | 0.01 |

| 4 | 127 | 0.01 |

| 5 | 135 | 0.02 |

| 6 | 144 | 0.03 |

| 7 | 156 | 0.06 |

| 8 | 172 | 0.11 |

| 9 | 200 | 0.17 |

| 10 | 301 | 0.24 |

Download links

A two-part list of links to download the article, or parts of the article, in various formats.