Modelling private wealth accumulation and spend-down in the Italian microsimulation model CAPP_DYN: A life-cycle approach

- Article

- Figures and data

- Jump to

Figures

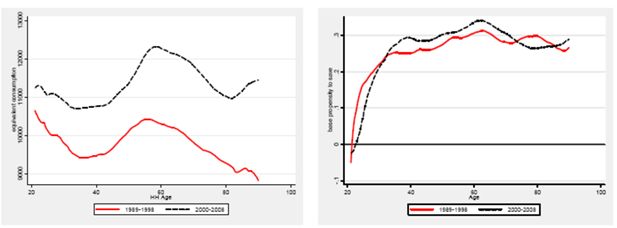

Average equivalent consumption (left) and propensity to save (right) household-head-age-profile.

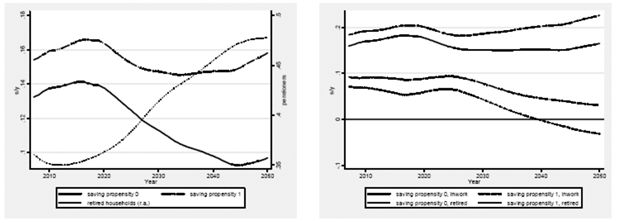

Average saving propensity (left), propensity to save for active households vs. for retired households (right), 2008–2050.

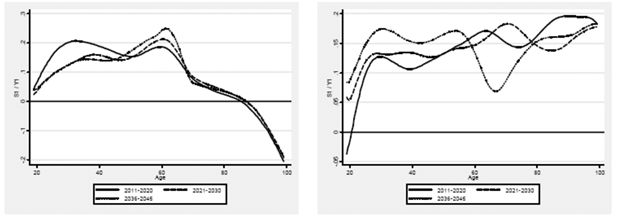

Propensity to save by age, LC (left) vs. NS (right) simulation, 2011–2020, 2021–2030, 2036–2045 (averages).

Source: Authors’ computations on simulation results.

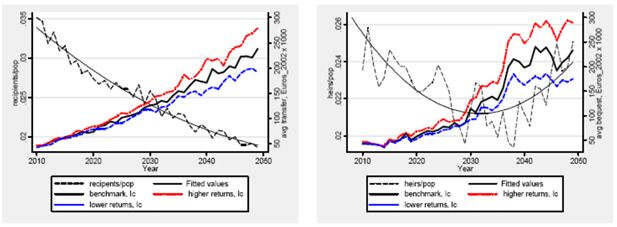

Evolution of iv and mc transfers recipient households’ share and of the average amount received, 2010–2050.

Source: Authors’ computations on simulation results (2008–2050).

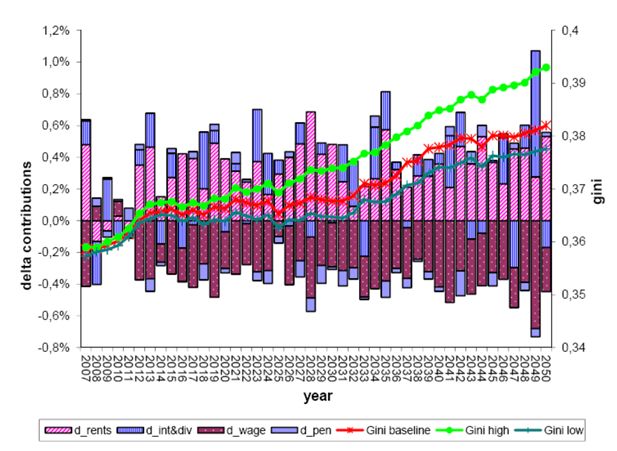

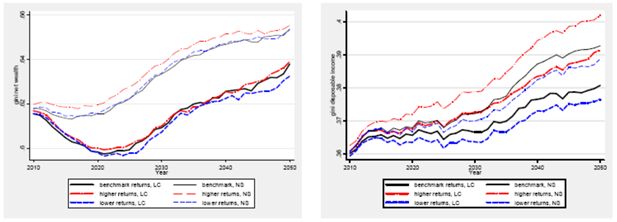

Evolution in the Gini of net worth (left) and disposable income (right), 2010–2050.

Source: Authors’ elaboration on simulation results.

Tables

Three-stage least-squares regression of planned age of retirement and the expected replacement rate.

| Equation | Obs | Parms | RMSE | R-sq | chi2 | P | |||

|---|---|---|---|---|---|---|---|---|---|

| 1. PRA | 27194 | 21 | 3.435451 | 0.257 | 9408.45 | 0 | |||

| 2. ERR | 27194 | 21 | 0.163388 | 0.149 | 5043.9 | 0 | |||

| Planned Age of Retirement | Expected Replacement Rate | ||||||||

| B | SE | B | Se | ||||||

| year_contrib | −0.5187 *** | 0.0138 | PRA | 0.0026 ** | 0.0010 | ||||

| year_contrib² | −0.0093 *** | 0.0003 | year_contrib | 0.0064 *** | 0.0009 | ||||

| age*contrib. | 0.0148 *** | 0.0003 | age*contrib | 0.0000 | 0.0000 | ||||

| female | −2.0137 *** | 0.0523 | NDC | −0.0292 | 0.0180 | ||||

| NDC | 0.1496 | 0.3824 | single | −0.0024 | 0.0050 | ||||

| Education (omit.lower secondary) | |||||||||

| upper_secondary | 0.2877 *** | 0.0557 | upper secondary | 0.0130 *** | 0.0026 | ||||

| degree_or_more | 0.8929 *** | 0.0842 | degree or more | 0.0094 * | 0.0040 | ||||

| self_employed | 1.2709 *** | 0.0646 | self employed | −0.1168 *** | 0.0033 | ||||

| public | −0.2373 *** | 0.0632 | public | 0.0457 *** | 0.0030 | ||||

| home_owner | −0.1369 * | 0.0564 | partime | −0.0363 *** | 0.0047 | ||||

| South | 0.6384 *** | 0.0580 | Centre | 0.0321 *** | 0.0030 | ||||

| single | 0.3774 *** | 0.1072 | South | 0.0427 *** | 0.0030 | ||||

| tau2002 | 0.0625 | 0.0751 | tau2002 | −0.0298 *** | 0.0035 | ||||

| tau2004 | 0.2979 *** | 0.0774 | tau2004 | −0.0453 *** | 0.0036 | ||||

| tau2006 | 0.0922 | 0.0805 | tau2006 | −0.0739 *** | 0.0037 | ||||

| tau2008 | 0.8402 *** | 0.0978 | tau2008 | −0.0793 *** | 0.0047 | ||||

| Cohort effect (omit. Cohorts <1953) | |||||||||

| coor_53 | 1.1369 *** | 0.1010 | coor_53 | 0.0122 ** | 0.0046 | ||||

| coor_58 | 2.0562 *** | 0.1234 | coor_58 | 0.0165 ** | 0.0056 | ||||

| coor_63 | 2.5093 *** | 0.1462 | coor_63 | 0.0257 *** | 0.0065 | ||||

| coor_68 | 2.5112 *** | 0.1672 | coor_68 | 0.0393 *** | 0.0071 | ||||

| coor-73 | 2.3387 *** | 0.1844 | coor-73 | 0.0660 *** | 0.0075 | ||||

| coor_78 | 2.0769 *** | 0.2041 | coor_78 | 0.0688 *** | 0.0081 | ||||

| intercept | 61.3483 *** | 0.1937 | intercept | 0.4269 *** | 0.0635 | ||||

| Endogenous variables: PRA, ERR | |||||||||

-

*

p<.05.

-

**

p<.01.

-

***

p<.001.

-

Source: Authors’ computations on SHIW 2000–2008.

Dynamic panel-data estimation of the consumption rule, two-step system GMM 16.

| ln{C/HR} | B | Se |

|---|---|---|

| Lag.ln{C/HR} | 0.0821 *** | 0.0209 |

| In_af_en | 0.0114 *** | 0.0024 |

| In_ar_h | −0.0171 *** | 0.0014 |

| In_ar_h*n_houses | 0.0040 *** | 0.0006 |

| In_pf | 0.0092 *** | 0.0012 |

| quintile 2_income | −0.1347 *** | 0.0181 |

| quintile 3_income | −0.1832 *** | 0.0206 |

| quintile 4_income | −0.2559 *** | 0.0232 |

| quintile 5_income | −0.3105 *** | 0.0272 |

| hh_age | −0.2152 *** | 0.0491 |

| hh_age² | 0.0066 *** | 0.0013 |

| hh_age³ | −0.0001 *** | 0.0000 |

| hh_age4 | 0.0000 *** | 0.0000 |

| hh_age_self_emp | −0.0026 *** | 0.0004 |

| hh_age_upper_secondary | −0.0009 *** | 0.0002 |

| hh_age_degree_or_more | −0.0032 *** | 0.0004 |

| h_res_life | −0.0143 *** | 0.0027 |

| hh_retired | −0.1282 *** | 0.0213 |

| earners_ratio | −0.2058 *** | 0.0326 |

| n_child_in the family | 0.0232 ** | 0.0087 |

| South | −0.0489 *** | 0.0109 |

| Household types (omitt. Nuclear family) | ||

| Single | 0.0108 | 0.0211 |

| nuclear single headed | 0.1754 *** | 0.0356 |

| non_nuclear single headed | 0.4704 *** | 0.0350 |

| non_nuclear | 0.1948 *** | 0.0174 |

| Time dummies (omit.tau2002) | ||

| tau1993 | 0.0148 | 0.0191 |

| tau1995 | 0.0623 ** | 0.0193 |

| tau1998 | −0.0699 *** | 0.0210 |

| tau2000 | −0.4194 *** | 0.0194 |

| tau2004 | −0.0219 | 0.0176 |

| tau2006 | 0.0228 | 0.0186 |

| tau2008 | 0.0018 | 0.0182 |

| intercept | −0.2847 | 0.6923 |

-

N = 23,426, number of groups = 10,284.

-

Arellano-Bond test for AR(1) in first differences: z = −18.00 Pr > z = 0.000.

-

Arellano-Bond test for AR(2) in first differences: z = 0.49 Pr > z = 0.627.

-

Sargan test of overid. restrictions: chi2(7) = 7.60 Prob > chi2 = 0.369.

-

Hansen test of overid. restrictions: chi2(7) = 4.79 Prob > chi2 = 0.685.

-

Difference-in-Hansen tests of exogeneity of instrument subsets:

-

GMM instruments for levels.

-

Hansen test excluding group: chi2(6) = 4.60 Prob > chi2 = 0.596.

-

Difference (null H = exogenous): chi2(1) = 0.20 Prob > chi2 = 0.658.

-

*

p<.05.

-

**

p<.01.

-

***

p<.001.

-

Source: Authors’ computations on SHIW data, Historical Archive, panel component, waves 1991–2008.

Two-step estimation for intergenerational giving with Heckman correction.

| Donor side N=16,871 | |||||

|---|---|---|---|---|---|

| Logit Probability of being Donor | OLS ln{Ratio} | ||||

| B | Se | B | Se | ||

| age | 0.0807 *** | 0.0243 | age | −0.7785 ** | 0.2404 |

| age2 | −0.0007 *** | 0.0002 | age2 | 0.0113 ** | 0.0036 |

| in_work | 0.3522 *** | 0.052 | age3 | −0.0001 ** | 0.000 |

| quintile 3_wealth | 0.4146 *** | 0.0543 | in work | −0.4384 *** | 0.0866 |

| quintile 4_wealth | 0.6046 *** | 0.0531 | retired | −0.2449 ** | 0.0849 |

| quintile 5_wealth | 0.6989 *** | 0.0531 | unemp | −0.4619 ** | 0.1649 |

| child_unemp | 0.2835 *** | 0.0625 | ch_unemp | 0.3006 *** | 0.0817 |

| wed_or_birth | 3.2668 *** | 0.1205 | quintile 3_wealth | −0.5422 *** | 0.0752 |

| upper_secondary | 0.5074 *** | 0.0463 | quintile 4_wealth | −0.8931 *** | 0.0736 |

| degree_or_more | 0.742 *** | 0.0502 | quintile 5_wealth | −1.4278 *** | 0.0733 |

| Italy | −0.2737 *** | 0.0747 | Italy | 0.7029 *** | 0.0951 |

| _intercept | −4.4368 *** | 0.8158 | mills_ratio | 0.2653 *** | 0.0414 |

| _intercept | 15.5409 ** | 5.3305 | |||

-

T

-

*

p<.05.

-

**

p<.01.

-

***

p<.001.

-

Source: Authors’ computations on SHARE data, wave 2004.

Two-step estimation for intergenerational receiving without Heckman correction.

| Recipient side | |||||

|---|---|---|---|---|---|

| N=29,652 Logit Probability of being Recipient | N= 1,872 OLS ln{Amount} | ||||

| B | t | B | Se | ||

| In(af parents) | 0.169 *** | 0.061 | In(af parents) | 0.0892 *** | 0.0079 |

| age | −0.0883 *** | 0.052 | age | 0.0253 * | 0.0147 |

| age² | 0.0007 *** | 0.0543 | age² | −0.0004 * | 0.0002 |

| married | 0.3004 ** | 0.0531 | grandchildren | −0.1051 * | 0.0567 |

| single | 0.6497 *** | 0.0531 | married | 0.1911 *** | 0.0494 |

| divorced | 0.6462 *** | 0.0625 | Italy | 0.2481 ** | 0.0944 |

| in work | −0.2689 *** | 0.1205 | _intercept | 7.028 *** | 0.2699 |

| degree | 0.3421 *** | 0.0463 | |||

| grandchildren | 0.2863 *** | 0.0502 | |||

| Italy | 0.1984 ** | 0.0747 | |||

| _intercept | −1.3815 *** | 0.8158 | |||

-

T

-

*

p<.05.

-

**

p<.01.

-

***

p<.001.

-

Source: Authors’ computations on SHARE data, wave 2004.

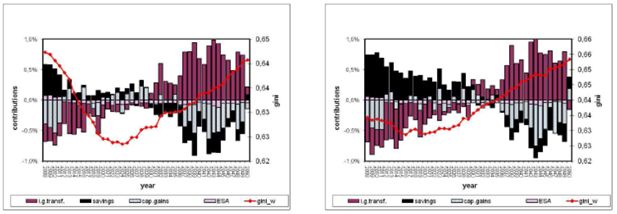

Cumulated contributions to wealth Gini variation, LC vs. NS simulation, 2008–2050 (in percent).

| W0 | Capgains | S | ig_tr | ESA | d.gini | |

|---|---|---|---|---|---|---|

| 1.LC approach | 0.146 | −3.918 | −0.511 | 6.757 | −1.958 | 0.516 |

| 2.NS approach | 0.128 | −4.522 | 6.754 | 2.979 | −1.705 | 3.634 |

| (1)– (2) | −0.018 | −0.604 | 7.264 | −3.778 | 0.253 | 3.118 |

-

Source: Authors’ computations on simulated data.

Cumulated contributions to disposable income Gini variation, LC approach, different returns scenarios, 2008–2050 (in percent).

| After_tax pensions | After-tax earnings | Rents on real estate net of liabilities | Interests on financial wealth | d.gini | avg r-g | |

|---|---|---|---|---|---|---|

| 2.low returns | 5.55 | −1.42 | 2.50 | 3.51 | 10.13 | 0.13 |

| 1.Benchmark | 5.28 | −6.69 | 7.57 | 4.92 | 11.08 | 0.61 |

| 3.High returns | 4.79 | −14.70 | 16.89 | 6.89 | 13.88 | 1.28 |

| (3)-(2) | −0.76 | −13.28 | 14.40 | 3.39 | 3.75 | 1.15 |

-

Source: Authors’ computations on simulated data.

Cumulated variation in incomes shares (in percent).

| Sources | 2008 | 2050 | 2050–2008 | 2008 | 2050 | 2050–2008 | 2008 | 2050 | (2050)-(2008) |

|---|---|---|---|---|---|---|---|---|---|

| After-tax earnings | 51.0 | 43.8 | −7.2 | 51.4 | 46.2 | −5.2 | 50.7 | 40.0 | −10.7 |

| After-tax pensions | 29.7 | 29.7 | 29.9 | 31.3 | 1.5 | 29.5 | 27.2 | −2.3 | |

| Rents on real estate net of negative interests | 14.6 | 18.3 | 3.7 | 14.1 | 15.1 | 1.1 | 15.2 | 23.7 | 8.6 |

| Interests on financial wealth | 4.7 | 8.2 | 3.4 | 4.7 | 7.4 | 2.7 | 4.7 | 9.1 | 4.4 |

-

Source: Authors’ computations on simulated data.

Table A1 Exogenous parameters (per year).

| Low returns scenario | Benchmark returns scenario | High returns scenario |

|---|---|---|

| Productivity | Productivity | Productivity |

| Same as benchmark | G (average earnings growth) | Same as benchmark |

| “ | 0.88% (2008–2009) | “ |

| “ | 1.00% (2010–2013) | “ |

| “ | 1.20% (2014–2019) | “ |

| “ | 1.90% (2020–2029) | “ |

| “ | 2.00% (2030–2050) | “ |

| Capital gains | Capital gains | Capital gains |

| rh ~N µ=0.75%; sd=8% | rh ~N µ= 1.5%; sd= 8% | rh ~N µ=2.5%; sd=8% |

| rf ~N µ=1.5%; sd=18%; | rf ~N µ=3%; sd=18%; | rf ~N µ=5%; sd=18%; |

| kurt = 2.4% | kurt=2.4% | kurt=2.4% |

| resa=0.9% | resa=0.9% | resa=0.9% |

| Interests and rents | Interests and rents | Interests and rents |

| Same as benchmark | rm ~N µ=3%; sd= 0.5% | Same as benchmark |

| “ | home equity annual rent: 3.5% | “ |

| “ | real interest rate on non-risky AF: 1% | “ |

| “ | real interest rate on risky AF: 3% | “ |