Taxation of married couples in Germany and the UK: One-Earner Couples Make the Difference

Figures

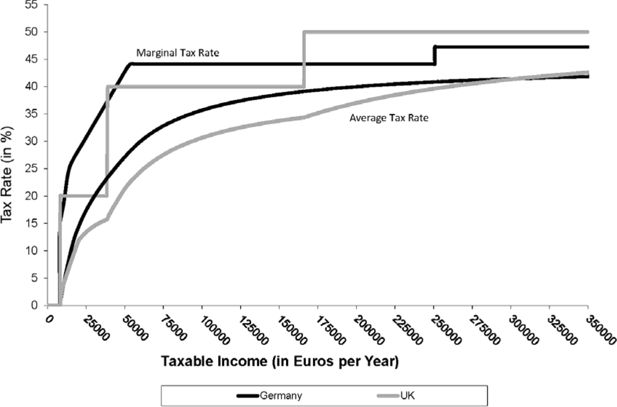

Income tax schedules (Singles, UK vs. Germany).

Note: Omitting reduction of the Personal Allowance above 100,000 GBP in the UK.

Source: German Income Tax Law (Einkommensteuergesetz, EStG) and British Income Tax Law (see HM Revenue and Customs under http://www.hmrc.gov.uk).

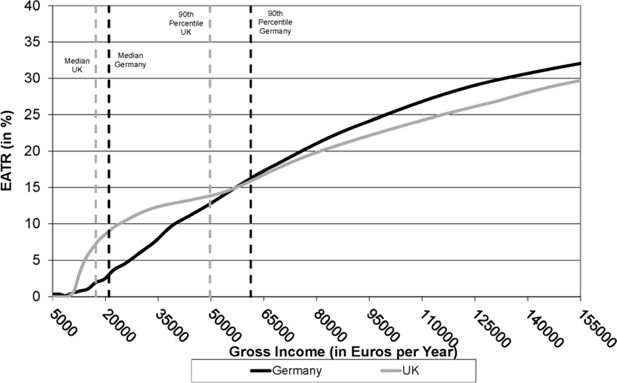

Effective tax liability: average across all groups (UK vs. Germany).

Notes: Displaying individuals, not tax units. I.e., in case of jointly taxed couples, where at least one spouse has positive gross income, spouses are displayed separately, each of them with their individual gross income. EATR denotes effective average tax rates, which are defined in Section 3.2.

Source: EU-SILC data (UDB, 2008); FRS data (2008/09). Own calculations using EUROMOD.

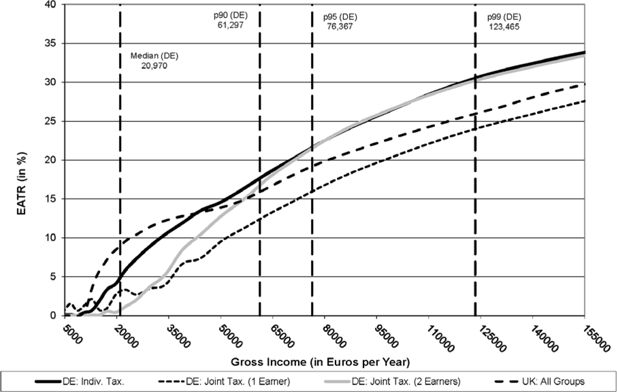

Effective tax liabilities by groups: United Kingdom (UK) vs. Germany (DE).

Notes: Displaying individuals, not tax units. I.e., in case of jointly taxed couples, spouses are displayed separately, each with their individual gross income. EATR denotes effective average tax rates, which are defined in Section 3.2.

Source: EU-SILC data (UDB, 2008); FRS data (2008/09). Own calculations using EUROMOD.

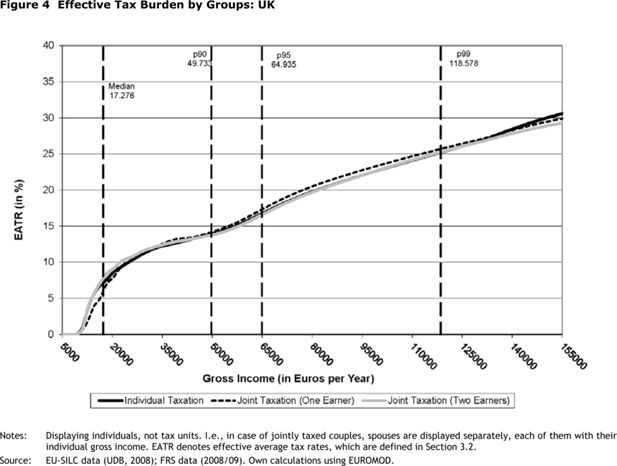

Effective tax burden by groups: UK.

Notes: Displaying individuals, not tax units. I.e., in case of jointly taxed couples, spouses are displayed separately, each of them with their individual gross income. EATR denotes effective average tax rates, which are defined in Section 3.2.

Source: EU-SILC data (UDB, 2008); FRS data (2008/09). Own calculations using EUROMOD.