A microsimulation model to evaluate Italian households’ financial vulnerability

Cite this article

as: V. Michelangeli, M. Pietrunti; 2014; A microsimulation model to evaluate Italian households’ financial vulnerability; International Journal of Microsimulation; 7(3); 53-79.

doi: 10.34196/ijm.00107

- Article

- Figures and data

- Jump to

Figures

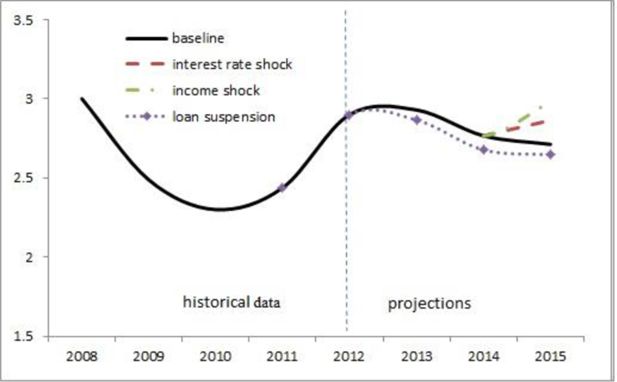

Figure 8

Percentage of vulnerable households with income below the median under alternative scenarios.

Tables

Table 1

Macroeconomic aggregates (Percentages).

| 2013 | 2014 | 2015 | |

| Income growth rate at current prices (national accounts) | 0.1 | 2.4 | 2.9 |

| Total debt growth (macro model for forecasting debt growth) | -1.0 | -0.3 | 1.8 |

| Euribor (3m Euribor and 3m Euribor futures) | 0.21 | 0.27 | 0.32 |

| Euribor change | -0.65 | 0.06 | 0.05 |

Table 2

Estimated mean and standard deviation for the income process.

| yd growth | y growth | |||

|---|---|---|---|---|

| μd | σd | μ | σ | |

| 1st – 25th percentile | 0.035 | 0.034 | 0.039 | 0.025 |

| 25th – 50th percentile | 0.029 | 0.023 | 0.029 | 0.025 |

| 50th – 75th percentile | 0.026 | 0.026 | 0.025 | 0.023 |

| 75th – 100th percentile | 0.025 | 0.024 | 0.023 | 0.024 |

Table 3

Adjustment factors for households’ income.

| 2013 | 2014 | 2015 | |

| Adjustment factor | 0.974 | 0.970 | 0.971 |

Table 4

Income growth (Percentages).

| 2013 | 2014 | 2015 | |

| National accounts | 0.1 | 2.4 | 2.9 |

| Model | 0.1 | 2.4 | 2.9 |

Table 5

Total debt growth (Percentages).

| 2013 | 2014 | 2015 | |

| Macro | -1.0 | -0.3 | 1.8 |

| Model with originations | -1.0 | -0.3 | 1.8 |

| Model without originations | -5.1 | -5.7 | -6.1 |

Table 6

Percentage of vulnerable households by age, education and occupation (Mean values).

| 2012 | 2013 | 2014 | 2015 | Total population (2012) | |

|---|---|---|---|---|---|

| Age | |||||

| < 35 | 16.8 | 14.2 | 12.9 | 10.7 | 9.5 |

| 35–44 | 33.5 | 31.1 | 29.3 | 28.9 | 20.2 |

| 45–54 | 28.4 | 32.7 | 35.0 | 35.7 | 21.3 |

| 55–64 | 9.4 | 9.6 | 11.0 | 12.2 | 16.2 |

| > 65 | 11.9 | 11.9 | 11.3 | 12.1 | 32.8 |

| Education | |||||

| No education or primary education | 6.2 | 6.3 | 6.3 | 6.1 | 23.3 |

| Lower secondary education | 39.7 | 38.4 | 38.3 | 36.0 | 35.8 |

| Upper secondary education | 39.7 | 40.7 | 41.2 | 45.3 | 27.8 |

| Undergraduate or post-graduate | 14.5 | 14.8 | 14.4 | 13.6 | 13.1 |

| Occupation | |||||

| Not working | 16.0 | 15.7 | 15.1 | 14.4 | 41.0 |

| Working | 84.0 | 84.2 | 84.4 | 85.4 | 59.0 |

Table 7

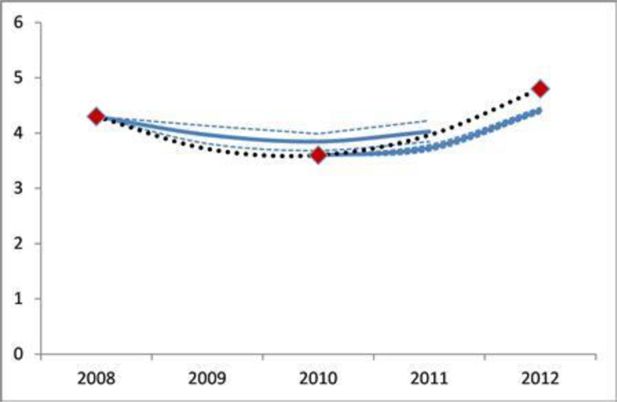

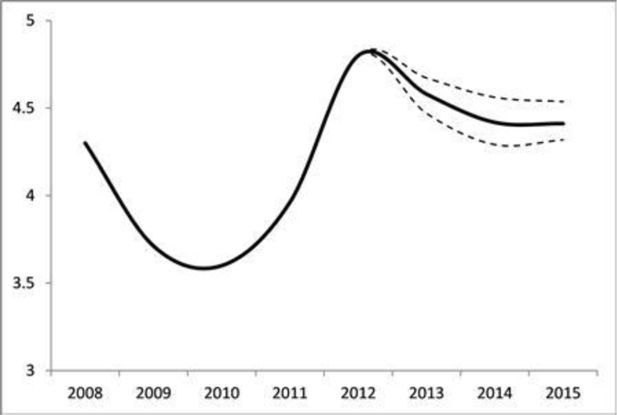

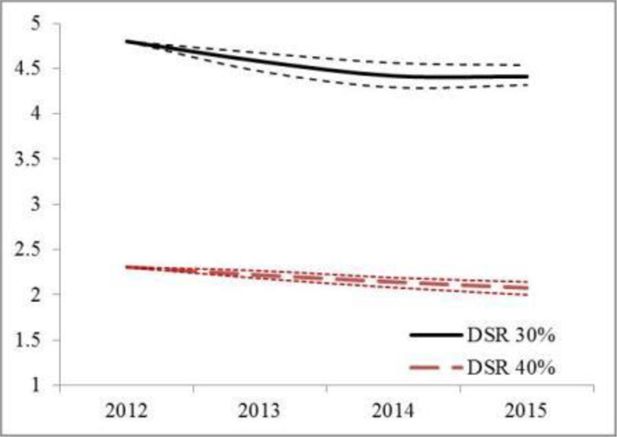

Percentage of vulnerable households under alternative scenarios.

| 2012 | 2013 | 2014 | 2015 | ||||

|---|---|---|---|---|---|---|---|

| Baseline | Suspension of payments | Interest rate shock | Income shock | ||||

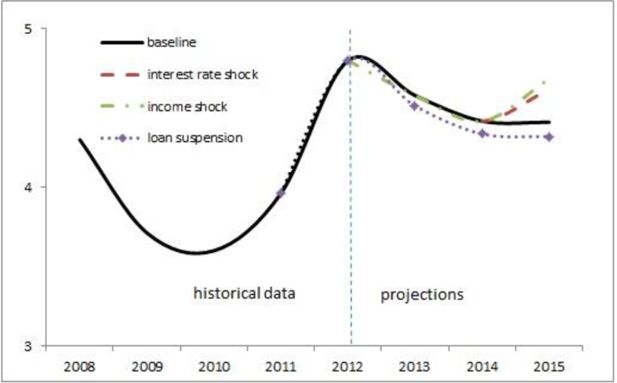

| Central estimate | 4.8 | 4.6 | 4.4 | 4.4 | 4.3 | 4.6 | 4.7 |

| 10th-90th percentiles | -- | 4.5–4.7 | 4.3–4.6 | 4.3–4.5 | 4.2–4.5 | 4.5–4.7 | 4.6–4.8 |

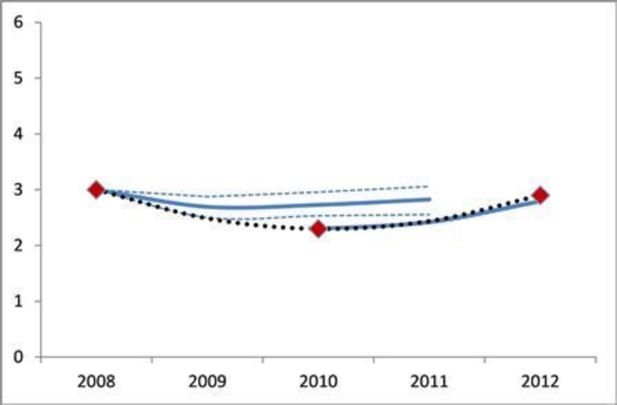

Table 8

Percentage of vulnerable households with income below the median under alternative scenarios.

| 2012 | 2013 | 2014 | 2015 | ||||

|---|---|---|---|---|---|---|---|

| Baseline | Suspension of payments | Interest rate shock | Income shock | ||||

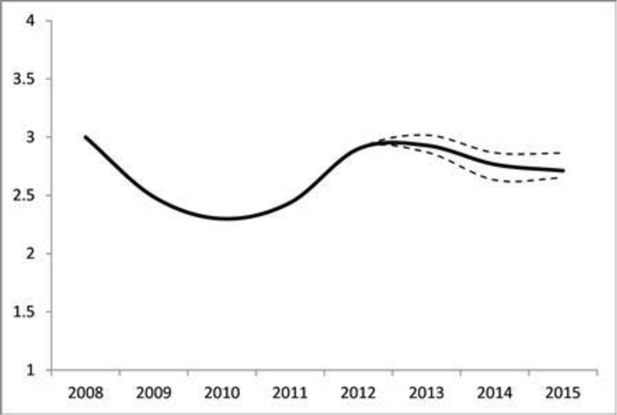

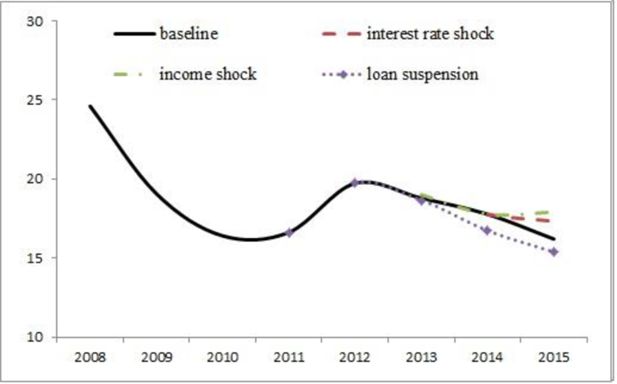

| Central estimate | 2.9 | 2.9 | 2.8 | 2.7 | 2.6 | 2.9 | 3.0 |

| 10th-90th percentiles | -- | 2.9–3.0 | 2.6–2.9 | 2.7–2.9 | 2.6–2.8 | 2.7–3.0 | 2.9–3.1 |

Table 1

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Percentage of vulnerable households over total households | ||||

| 1st–25th percentile | 1.5 | 1.6 | 1.6 | 1.6 |

| 25th–50th percentile | 1.4 | 1.4 | 1.2 | 1.1 |

| Below the median | 2.9 | 2.9 | 2.8 | 2.7 |

| 50th–75th percentile | 1.2 | 1.0 | 0.9 | 0.8 |

| 75th–100th percentile | 0.7 | 0.7 | 0.7 | 0.8 |

| TOTAL | 4.8 | 4.6 | 4.4 | 4.4 |

| Percentage of vulnerable households over indebted households | ||||

| 1st–25th percentile | 7.6 | 7.4 | 6.8 | 6.7 |

| 25th–50th percentile | 7.0 | 6.3 | 5.2 | 4.6 |

| Below the median | 14.6 | 13.6 | 12.0 | 11.2 |

| 50th–75th percentile | 6.0 | 4.4 | 3.8 | 3.3 |

| 75th–100th percentile | 3.5 | 3.0 | 3.2 | 3.3 |

| TOTAL | 24.1 | 21.2 | 19.1 | 18.1 |

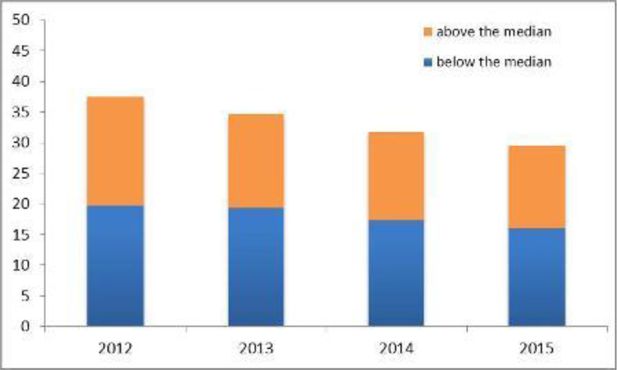

| Percentage of debt held by vulnerable households | ||||

| 1st–25th percentile | 9.5 | 10.4 | 9.7 | 9.2 |

| 25th–50th percentile | 10.2 | 9.1 | 7.9 | 7.0 |

| Below the median | 19.7 | 19.3 | 17.4 | 16.0 |

| 50th–75th percentile | 7.9 | 6.4 | 5.9 | 5.2 |

| 75th–100th percentile | 9.8 | 9.1 | 8.7 | 8.2 |

| TOTAL | 37.5 | 34.7 | 31.8 | 29.5 |

-

Note: Households are divided into classes according to their equalized income gross of imputed rents. The reported values have been approximated to the first decimal.

Table 2

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Percentage of vulnerable households over total households | ||||

| 1st–25th percentile | 1.5 | 1.6 | 1.5 | 1.6 |

| 25th–50th percentile | 1.4 | 1.3 | 1.2 | 1.1 |

| Below the median | 2.9 | 2.9 | 2.7 | 2.6 |

| 50th–75th percentile | 1.2 | 1.0 | 0.9 | 0.8 |

| 75th–100th percentile | 0.7 | 0.7 | 0.7 | 0.8 |

| TOTAL | 4.8 | 4.5 | 4.3 | 4.3 |

| Percentage of vulnerable households over indebted households | ||||

| 1st–25th percentile | 7.6 | 7.2 | 6.5 | 6.4 |

| 25th–50th percentile | 7.0 | 6.2 | 5.2 | 4.4 |

| Below the median | 14.6 | 13.3 | 11.6 | 10.9 |

| 50th–75th percentile | 6.0 | 4.4 | 3.8 | 3.3 |

| 75th–100th percentile | 3.5 | 3.0 | 3.2 | 3.3 |

| TOTAL | 24.1 | 20.9 | 18.8 | 17.8 |

| Percentage of debt held by vulnerable households | ||||

| 1st–25th percentile | 9.5 | 10.1 | 9.1 | 8.8 |

| 25th–50th percentile | 10.2 | 8.9 | 7.9 | 6.8 |

| Below the median | 19.7 | 18.7 | 16.7 | 15.4 |

| 50th–75th percentile | 7.9 | 6.4 | 5.9 | 5.2 |

| 75th–100th percentile | 9.8 | 9.1 | 8.7 | 8.2 |

| TOTAL | 37.5 | 34.0 | 31.4 | 29.1 |

Table 3

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Percentage of vulnerable households over total households | ||||

| 1st–25th percentile | 1.5 | 1.6 | 1.6 | 1.7 |

| 25th–50th percentile | 1.4 | 1.4 | 1.2 | 1.2 |

| Below the median | 2.9 | 2.9 | 2.8 | 2.9 |

| 50th–75th percentile | 1.2 | 1.0 | 0.9 | 0.9 |

| 75th–100th percentile | 0.7 | 0.7 | 0.7 | 0.8 |

| TOTAL | 4.8 | 4.6 | 4.4 | 4.6 |

| Percentage of vulnerable households over indebted households | ||||

| 1st–25th percentile | 7.6 | 7.4 | 6.8 | 6.9 |

| 25th–50th percentile | 7.0 | 6.3 | 5.2 | 4.9 |

| Below the median | 14.6 | 13.6 | 12.0 | 11.8 |

| 50th–75th percentile | 6.0 | 4.4 | 3.8 | 3.5 |

| 75th–100th percentile | 3.5 | 3.0 | 3.2 | 3.4 |

| TOTAL | 24.1 | 21.2 | 19.1 | 19.0 |

| Percentage of debt held by vulnerable households | ||||

| 1st–25th percentile | 9.5 | 10.4 | 9.7 | 9.7 |

| 25th–50th percentile | 10.2 | 9.1 | 7.9 | 7.6 |

| Below the median | 19.7 | 19.3 | 17.4 | 17.1 |

| 50th–75th percentile | 7.9 | 6.4 | 5.9 | 5.7 |

| 75th–100th percentile | 9.8 | 9.1 | 8.7 | 8.7 |

| TOTAL | 37.5 | 34.7 | 31.8 | 31.4 |

Table 4

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Percentage of vulnerable households over total households | ||||

| 1st–25th percentile | 1.5 | 1.6 | 1.6 | 1.7 |

| 25th–50th percentile | 1.4 | 1.4 | 1.2 | 1.3 |

| Below the median | 2.9 | 2.9 | 2.8 | 3.0 |

| 50th–75th percentile | 1.2 | 1.0 | 0.9 | 0.9 |

| 75th–100th percentile | 0.7 | 0.7 | 0.7 | 0.7 |

| TOTAL | 4.8 | 4.6 | 4.4 | 4.7 |

| Percentage of vulnerable households over indebted households | ||||

| 1st–25th percentile | 7.6 | 7.4 | 6.8 | 6.9 |

| 25th–50th percentile | 7.0 | 6.3 | 5.2 | 5.4 |

| Below the median | 14.6 | 13.6 | 12.0 | 12.3 |

| 50th–75th percentile | 4.0 | 4.4 | 3.8 | 3.8 |

| 75th–100th percentile | 3.5 | 3.0 | 3.2 | 3.0 |

| TOTAL | 24.1 | 21.2 | 19.1 | 19.3 |

| Percentage of debt held by vulnerable households | ||||

| 1st–25th percentile | 9.5 | 10.4 | 9.7 | 9.5 |

| 25th–50th percentile | 10.2 | 9.1 | 7.9 | 8.0 |

| Below the median | 19.7 | 19.3 | 17.4 | 17.3 |

| 50th–75th percentile | 7.9 | 6.4 | 5.9 | 5.5 |

| 75th–100th percentile | 9.8 | 9.1 | 8.7 | 8.2 |

| TOTAL | 37.5 | 34.7 | 31.8 | 31.2 |

Table 4

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Percentage of vulnerable households over total households | ||||

| 1st–25th percentile | 1.0 | 1.0 | 1.0 | 1.0 |

| 25th–50th percentile | 0.6 | 0.6 | 0.5 | 0.5 |

| Below the median | 1.6 | 1.6 | 1.5 | 1.4 |

| 50th–75th percentile | 0.4 | 0.3 | 0.3 | 0.3 |

| 75th–100th percentile | 0.3 | 0.3 | 0.3 | 0.3 |

| TOTAL | 2.3 | 2.2 | 2.1 | 2.1 |

| Percentage of vulnerable households over indebted households | ||||

| 1st–25th percentile | 4.8 | 4.5 | 4.2 | 4.1 |

| 25th–50th percentile | 3.1 | 2.7 | 2.2 | 1.9 |

| Below the median | 7.9 | 7.3 | 6.4 | 5.9 |

| 50th–75th percentile | 2.1 | 1.6 | 1.3 | 1.2 |

| 75th–100th percentile | 1.5 | 1.3 | 1.3 | 1.3 |

| TOTAL | 11.5 | 10.2 | 9.2 | 8.5 |

| Percentage of debt held by vulnerable households | ||||

| 1st–25th percentile | 6.6 | 6.9 | 6.3 | 5.8 |

| 25th–50th percentile | 4.9 | 4.2 | 3.6 | 3.0 |

| Below the median | 11.5 | 11.1 | 9.9 | 8.6 |

| 50th–75th percentile | 3.4 | 3.0 | 2.5 | 2.1 |

| 75th–100th percentile | 3.3 | 3.1 | 3.1 | 2.9 |

| TOTAL | 18.2 | 17.1 | 15.7 | 13.8 |

Table 5

| 2012 | 2013 | 2014 | 2015 | ||

|---|---|---|---|---|---|

| Percentage of vulnerable households over total households | |||||

| 1st–25th percentile | 1.5 | 1.6 | 1.4 | 1.3 | |

| 25th–50th percentile | 1.4 | 1.4 | 1.2 | 1.0 | |

| Below the median | 2.9 | 2.9 | 2.6 | 2.3 | |

| 50th–75th percentile | 1.2 | 1.0 | 0.9 | 0.8 | |

| 75th–100th percentile | 0.7 | 0.7 | 0.7 | 0.8 | |

| TOTAL | 4.8 | 4.6 | 4.3 | 4.0 | |

| Percentage of vulnerable households over indebted households | |||||

| 1st–25th percentile | 7.6 | 8.0 | 7.5 | 7.0 | |

| 25th–50th percentile | 7.0 | 6.9 | 6.1 | 5.1 | |

| Below the median | 14.6 | 14.7 | 13.5 | 12.1 | |

| 50th–75th percentile | 6.0 | 4.8 | 4.5 | 4.2 | |

| 75th–100th percentile | 3.5 | 3.3 | 3.7 | 4.1 | |

| TOTAL | 24.1 | 23.0 | 21.9 | 20.8 | |

| Percentage of debt held by vulnerable households | |||||

| 1st–25th percentile | 9.5 | 10.7 | 10.1 | 9.7 | |

| 25th–50th percentile | 10.2 | 9.4 | 8.6 | 7.4 | |

| Below the median | 19.7 | 19.9 | 18.3 | 16.9 | |

| 50th–75th percentile | 7.9 | 6.7 | 6.5 | 6.1 | |

| 75th–100th percentile | 9.8 | 9.4 | 9.6 | 9.7 | |

| TOTAL | 37.5 | 35.9 | 34.1 | 32.8 | |

Table 6

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Percentage of vulnerable households over total households | ||||

| 1st–25th percentile | 1.5 | 1.6 | 1.6 | 1.6 |

| 25th–50th percentile | 1.4 | 1.3 | 1.2 | 1.1 |

| Below the median | 2.9 | 2.9 | 2.7 | 2.7 |

| 50th–75th percentile | 1.2 | 0.9 | 0.9 | 0.8 |

| 75th–100th percentile | 0.7 | 0.7 | 0.7 | 0.8 |

| TOTAL | 4.8 | 4.5 | 4.4 | 4.4 |

| Percentage of vulnerable households over indebted households | ||||

| 1st–25th percentile | 7.6 | 7.4 | 6.8 | 6.6 |

| 25th–50th percentile | 7.0 | 6.2 | 5.1 | 4.5 |

| Below the median | 14.6 | 13.4 | 11.9 | 11.2 |

| 50th–75th percentile | 6.0 | 4.2 | 3.8 | 3.3 |

| 75th–100th percentile | 3.5 | 3.0 | 3.1 | 3.3 |

| TOTAL | 24.1 | 20.8 | 18.9 | 18.0 |

| Percentage of debt held by vulnerable households | ||||

| 1st–25th percentile | 9.5 | 10.4 | 9.6 | 9.2 |

| 25th–50th percentile | 10.2 | 8.9 | 7.8 | 6.9 |

| Below the median | 19.7 | 18.9 | 17.2 | 15.9 |

| 50th–75th percentile | 7.9 | 6.3 | 5.8 | 5.2 |

| 75th–100th percentile | 9.8 | 8.9 | 8.6 | 8.2 |

| TOTAL | 37.5 | 34.2 | 31.3 | 29.3 |

-

Note: we randomly assigned a fraction of individuals declaring a fixed rate mortgage to hold a variable rate mortgage so that about 70 per cent of the mortgages are at variable rate. We also assume that the credit loans are adjustable rate.

Table 7

Estimated mean and standard deviation for the income process (SHIW 2008-2012).

| yd growth | y growth | |||

|---|---|---|---|---|

| μd | σd | μ | σ | |

| 1st – 25th percentile | -0.020 | 0.040 | -0.028 | 0.032 |

| 25th – 50th percentile | -0.014 | 0.029 | -0.016 | 0.025 |

| 50th – 75th percentile | -0.014 | 0.036 | -0.014 | 0.025 |

| 75th – 100th percentile | -0.010 | 0.029 | -0.011 | 0.001 |

Table 8

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Percentage of vulnerable households over total households | ||||

| 1st–25th percentile | 1.5 | 1.6 | 1.7 | 1.8 |

| 25th–50th percentile | 1.4 | 1.4 | 1.3 | 1.2 |

| Below the median | 2.9 | 3.0 | 3.0 | 3.0 |

| 50th–75th percentile | 1.2 | 0.9 | 0.9 | 0.8 |

| 75th–100th percentile | 0.7 | 0.7 | 0.7 | 0.7 |

| TOTAL | 4.8 | 4.6 | 4.5 | 4.6 |

| Percentage of vulnerable households over indebted households | ||||

| 1st–25th percentile | 7.6 | 7.5 | 7.3 | 7.3 |

| 25th–50th percentile | 7.0 | 6.4 | 5.5 | 4.9 |

| Below the median | 14.6 | 13.9 | 12.8 | 12.4 |

| 50th–75th percentile | 6.0 | 4.4 | 3.8 | 3.4 |

| 75th–100th percentile | 3.5 | 3.0 | 2.9 | 3.0 |

| TOTAL | 24.1 | 21.4 | 19.6 | 18.9 |

| Percentage of debt held by vulnerable households | ||||

| 1st–25th percentile | 9.5 | 10.5 | 10.0 | 9.8 |

| 25th–50th percentile | 10.2 | 9.3 | 8.5 | 7.5 |

| Below the median | 19.7 | 19.7 | 18.4 | 17.1 |

| 50th–75th percentile | 7.9 | 6.2 | 5.7 | 5.1 |

| 75th–100th percentile | 9.8 | 9.1 | 7.8 | 7.8 |

| TOTAL | 37.5 | 35.0 | 32.0 | 30.2 |

-

Note: we randomly assigned a fraction of individuals declaring a fixed rate mortgage to hold a variable rate mortgage so that about 70 percent of the mortgages are at variable rate. We also assume that the credit loans are adjustable rate.

Download links

A two-part list of links to download the article, or parts of the article, in various formats.