Improving the validity of microsimulation results: Lessons from Slovakia

- Article

- Figures and data

- Jump to

Figures

Tables

Sources of external controls for calibration.

| Calibration category | Source of the official statistics |

|---|---|

| Age cohorts (0, 1–3, 4–16, 17–25, 26–45, 46-retirement age, over retirement age). Categories over 16 years considered separately for gender (male, female) | Statistical Office of the Slovak Republic (Demographic Balances of Population) |

| Labour market status (employees, unemployed, self-employed) | Statistical Office of the Slovak Republic (Labour Force Survey) |

| Household size (members 1, 2, 3, 4, 5+) | Statistical Office of the Slovak Republic (Population and Housing Census 2011) |

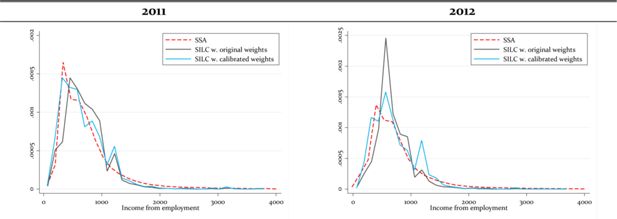

| Gross income from employment distribution (deciles 1–2, 3–5, 6–8 and 9–10) | Database of individual records from Social Security Agency (SSA) |

Descriptive statistics of grossing-up weights in SK-SILC samples.

| Policy year | 2011 | 2011 | 2012 | 2012 | 2013 | 2014 |

| Underlying SILC dataset | 2011 | 2011 | 2012 | 2012 | 2012 | 2012 |

| Grossing-up sample weight | Original | Calibrated | Original | Calibrated | Original | Calibrated |

| Mean | 349.5 | 350.0 | 350.4 | 350.0 | 351.2 | 351.8 |

| Std. Dev. | 126.0 | 468.7 | 132.0 | 482.5 | 521.3 | 581.1 |

| Minimum | 108.7 | 10.9 | 119.9 | 12.0 | 12.0 | 12.0 |

| Maximum | 1,226.1 | 5,505.1 | 1,083.9 | 4,481.0 | 5,974.1 | 8,961.1 |

| Dataset characteristics | ||||||

| Individuals | 15,440 | 15,440 | 15,426 | 15,426 | 15,426 | 15,426 |

| Households | 5,291 | 5,291 | 5,402 | 5,402 | 5,402 | 5,402 |

| Projected population | 5,395,519 | 5,396,355 | 5,404,664 | 5,398,917 | 5,417,340 | 5,427,220 |

| Projected households | 1,911,664 | 1,909,248 | 1,852,059 | 1,852,027 | 1,852,059 | 1,853,409 |

-

Source: Author’s calculations using SK-SILC.

Validation of weighting schemes: representation of gender and age cohorts.

| Original weights | Calibrated weights | |||

|---|---|---|---|---|

| 2011 | 2012 | 2011 | 2012 | |

| Female | 1.00 | 1.00 | 1.00 | 1.00 |

| Age cohort | ||||

| 0 | 0.55 | 0.78 | 1.00 | 1.04 |

| 0–3 | 0.63 | 0.84 | 1.00 | 1.01 |

| 0–16 | 0.82 | 0.96 | 1.00 | 1.00 |

| 0–26 | 0.98 | 1.04 | 1.00 | 1.00 |

| Prime age | 1.03 | 1.01 | 1.00 | 1.00 |

| Retirement age | 1.08 | 1.04 | 1.02 | 1.01 |

-

Source: Authors' calculations using SK-SILC and Slovak Statistical Office

-

Note: Ratios display number of individuals in SK-SILC dataset (weighted) to population by gender and in the respective age cohort.

-

Prime age: 15–64 years. Retirement age: males 62+, females 58+ in 2011 and 59+ in 2012.

Validation of weighting schemes: representation of economic activity.

| Original weights | Calibrated weights | |||

|---|---|---|---|---|

| 2011 | 2012 | 2011 | 2012 | |

| Employed | 1.01 | 0.97 | 0.96 | 0.96 |

| Employee | 1.20 | 1.15 | 1.08 | 1.08 |

| Self-employed | 1.01 | 0.96 | 1.02 | 1.01 |

| Unemployed | 0.97 | 0.94 | 0.99 | 0.99 |

| Economic active pop. | 1.01 | 0.97 | 0.97 | 0.97 |

| Economic inactive pop. | 0.99 | 1.03 | 1.04 | 1.04 |

| Population total | 1.00 | 1.00 | 1.00 | 1.00 |

-

Source: Authors’ calculations using SK-SILC and LFS.

-

Note: Ratios display number of individuals in SK-SILC dataset (weighted) to LFS in the respective category.

Validation of weighting schemes: representation of income.

| Amounts (ratios) | Individuals (ratios) | |||||||

|---|---|---|---|---|---|---|---|---|

| Weights | Original | Calibrated | Original | Calibrated | ||||

| Income from | 2011 | 2012 | 2011 | 2012 | 2011 | 2012 | 2011 | 2012 |

| Employment | 1.16 | 1.02 | 0.97 | 0.95 | 1.08 | 1.05 | 0.93 | 0.95 |

| Agreements | 0.43 | 0.34 | 0.43 | 0.34 | 0.36 | 0.38 | 0.33 | 0.36 |

| Self-employment * | 2.84 | 2.73 | 2.98 | 2.78 | 1.34 | 1.25 | 1.36 | 1.31 |

| Employment and agreements | 1.13 | 0.99 | 0.94 | 0.91 | 0.97 | 0.94 | 0.97 | 0.94 |

-

Source: Authors' calculations using SK-SILC and SSA.

-

*

Validation of income for self-employed is only indicative. SK-SILC reports for self-employed the value of profit/loss in the current year, while the SSA database reports the assessment base which is based on the value of return in the year t-2 (inconsistency both in variable and time).

-

Note: Amounts (ratios) display aggregate amount of income of individuals in SK-SILC dataset (weighted) to aggregate income computed by using records from SSA. Individuals (ratios) display aggregate number of individuals in SK-SILC dataset (weighted) to aggregate computed by using records from SSA.

Non-simulated benefits and pensions.

| Amounts (ratios) | Recipients (ratios) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Weights | Original | Calibrated | Original | Calibrated | |||||

| Benefits | 2011 | 2012 | 2011 | 2012 | 2011 | 2012 | 2011 | 2012 | |

| Maternity | 0.63 | 0.60 | 1.22 | 1.27 | 0.57 | 0.61 | 1.01 | 1.28 | |

| Sickness | 0.31 | 0.34 | 0.50 | 0.59 | n.a. | n.a. | n.a. | n.a. | |

| Pensions | |||||||||

| Old age | 1.16 | 1.09 | 1.09 | 1.08 | 1.10 | 1.04 | 1.04 | 1.03 | |

| Disability | 0.87 | 0.88 | 1.03 | 1.10 | 0.84 | 0.86 | 1.03 | 1.10 | |

| Widow/er | 0.98 | 1.05 | 0.97 | 1.06 | 1.06 | 0.99 | 1.01 | 0.97 | |

| orphans | 0.83 | 0.82 | 0.93 | 0.57 | 0.69 | 0.68 | 0.79 | 0.52 | |

-

Source: Authors' calculations using SK-SILC and SSA.

Simulated benefits: Ratios of aggregate amounts.

| Model | EUROMOD | SIMTASK | ||

|---|---|---|---|---|

| Weights | Original | Calibrated | Original | Calibrated |

| 2011 | ||||

| Unemp.benefit | 0.54 | 0.46 | 0.55 | 0.47 |

| Parental allowance | 0.78 | 1.18 | 0.64 | 0.99 |

| Child benefit | 0.87 | 1.00 | 1.08 | 1.16 |

| Child birth grant | 0.61 | 1.10 | 0.61 | 1.10 |

| Material needs benefit | 1.24 | 1.82 | 0.83 | 1.19 |

| 2012 | ||||

| Unemp.benefit | 0.38 | 0.37 | 0.40 | 0.38 |

| Parental allowance | 1.09 | 1.07 | 0.87 | 0.96 |

| Child benefit | 0.97 | 0.98 | 1.17 | 1.14 |

| Child birth grant | 0.80 | 1.08 | 0.81 | 1.08 |

| Material needs benefit | 1.46 | 1.92 | 1.00 | 1.27 |

-

Source: Authors' calculations using SIMTASK and EUROMOD, official statistics SSA (unemployment benefit), other benefits COLSAF (Central Office of Labour, Social Affairs and Family).

-

Note: Numbers display ratios of aggregate number of payments to individuals computed by EUROMOD and SIMTASK to aggregate amounts referred by official statistics.

Personal income tax and social insurance contributions: Aggregate amounts.

| Model | EUROMOD | SIMTASK | |||

|---|---|---|---|---|---|

| Weights | Original | Calibrated | Original | Calibrated | |

| 2011 | |||||

| Personal income tax | 1.17 | 1.05 | 1.14 | 1.03 | |

| Social insurance contrib. (SIC) | |||||

| SIC: Employer | 1.24 | 1.03 | 1.23 | 1.02 | |

| SIC: Employee | 1.25 | 1.04 | 1.25 | 1.04 | |

| SIC: Self-employed | 1.72 | 1.77 | 1.44 | 1.50 | |

| Health Insurance contrib. (HIC) | |||||

| HIC: economic | 1.19 | 1.01 | 1.18 | 1.00 | |

| active pop | |||||

| HIC: economic | 1.02 | 1.09 | 0.94 | 1.02 | |

| inactive pop. | |||||

| 2012 | |||||

| Personal income tax | 0.94 | 0.97 | 0.91 | 0.95 | |

| Social insurance contrib. (SIC) | |||||

| SIC: Employer | 1.09 | 1.01 | 1.09 | 1.01 | |

| SIC: Employee | 1.11 | 1.02 | 1.11 | 1.02 | |

| SIC: Self-employed | 1.63 | 1.67 | 1.38 | 1.41 | |

| Health Insurance contrib. (HIC) | |||||

| HIC: economic | 1.07 | 1.01 | 1.06 | 0.99 | |

| active pop. | |||||

| HIC: economic | 1.03 | 1.06 | 0.96 | 0.99 | |

| inactive pop. | |||||

-

Source: Authors' calculations using SIMTASK and EUROMOD, official statistics Ministry of Finance (PIT and HIC), SSA (SIC).

-

Note: Numbers display ratios of aggregate number of recipients computed by EUROMOD and SIMTASK to aggregate number of recipients referred by official statistics.

Simulated benefits (calibrated weights).

| Aggregate amounts (I) | |||||

| 2013 | 2014 | 2013 | 2014 | ||

| Unemp. benefit | 0.41 | 0.48 | Child birth grant | 1.03 | 1.21 |

| Parental allowance | 0.94 | 0.92 | Material needs benefit | 1.32 | 1.15 |

| Child benefit | 1.15 | 1.15 | |||

| Recipients (II) | |||||

| 2013 | 2014 | 2013 | 2014 | ||

| Unemp. benefit | 0.48 | 0.54 | Material needs benefit | 1.07 | 1.05 |

| Parental allowance | 0.97 | 0.97 | Housing allowance | 1.10 | 1.03 |

| Child benefit | 1.08 | 1.09 | Activation allowance | 1.59 | 1.31 |

| Child birth grant | 0.98 | 1.21 | Protection allowance | 1.07 | 0.86 |

-

Source: Authors' calculations using SIMTASK, official stat. SSA (unemployment benefit), COLSAF (other benefits).

-

Note: Numbers display ratios of aggregate amount of payments to individuals (I) and number of recipients (II) computed by SIMTASK to official statistics.

Personal income tax, social and health insurance contributions (calibrated weights).

| 2013 | 2014 | 2013 | 2014 | ||

|---|---|---|---|---|---|

| Personal income tax | 1.00 | 0.99 | SIC employer | 0.99 | 1.00 |

| HIC: economic active pop. | 1.04 | 1.06 | SIC employee | 1.00 | 1.00 |

| HIC: economic inactive pop. | 0.96 | 1.02 | SIC self-employed | 1.42 | 1.71 |

-

Source: Authors' calculations using SIMTASK, official stat. Ministry of Finance (PIT an HIC), SSA (SIC).

-

Note: Numbers display ratios of aggregate amount of payments computed by SIMTASK to aggregate amounts computed by using official statistics. SIC stands for social insurance contribution and HIC for health insurance contributions.

Shares of equalised disposable income by deciles.

| EUROSTAT | EUROMOD | SIMTASK | |||

|---|---|---|---|---|---|

| Original | Calibrated | Original | Calibrated | ||

| 2011 | |||||

| Decile 1 | 3.5 | 3.9 | 3.7 | 3.8 | 3.5 |

| Decile 2 | 5.7 | 6.1 | 5.7 | 6.0 | 5.6 |

| Decile 3 | 6.9 | 7.5 | 7.1 | 7.1 | 6.8 |

| Decile 4 | 7.9 | 8.2 | 8.1 | 8.0 | 7.7 |

| Decile 5 | 8.6 | 8.9 | 8.8 | 8.9 | 8.6 |

| Decile 6 | 9.5 | 9.8 | 9.4 | 9.8 | 9.5 |

| Decile 7 | 10.7 | 10.6 | 10.5 | 10.9 | 10.7 |

| Decile 8 | 12.1 | 11.9 | 11.8 | 12.1 | 12.1 |

| Decile 9 | 14.1 | 14.0 | 14.4 | 14.0 | 14.6 |

| Decile 10 | 21.0 | 19.1 | 20.5 | 19.3 | 20.8 |

| 2012 | |||||

| Decile 1 | 3.6 | 3.9 | 3.5 | 3.9 | 4.0 |

| Decile 2 | 5.7 | 6.2 | 5.9 | 6.1 | 5.4 |

| Decile 3 | 6.8 | 7.4 | 7.1 | 7.3 | 7.0 |

| Decile 4 | 7.7 | 8.2 | 8.0 | 8.2 | 7.9 |

| Decile 5 | 8.7 | 9.0 | 8.7 | 9.0 | 8.7 |

| Decile 6 | 9.7 | 9.8 | 9.6 | 9.9 | 9.7 |

| Decile 7 | 10.9 | 10.8 | 10.7 | 10.9 | 10.8 |

| Decile 8 | 12.3 | 11.9 | 12.0 | 12.1 | 12.3 |

| Decile 9 | 14.3 | 13.9 | 14.3 | 14.0 | 14.4 |

| Decile 10 | 20.3 | 18.8 | 20.1 | 18.7 | 19.9 |

-

Source: EUROSTAT and authors' calculations using SIMTASK and EUROMOD.

-

Note: The ratio of disposable income in the corresponding decile to the population. Computed for individuals based on household disposable income and equalised by the modified OECD equivalence scale.

Income inequality and poverty rates.

| EUROSTAT | EUROMOD | SIMTASK | |||

|---|---|---|---|---|---|

| Weights | Original | Calibrated | Original | Calibrated | |

| 2011 | |||||

| GINI | 25.7 | 23.3 | 25.6 | 23.5 | 26.0 |

| S80S20 ratio * | 3.8 | 3.3 | 3.7 | 3.4 | 3.9 |

| At risk of poverty rate ** | |||||

| Total popul. | 13.0 | 12.1 | 13.4 | 12.1 | 13.5 |

| Females | 12.8 | 12.0 | 13.5 | 12.0 | 13.6 |

| Males | 13.1 | 12.3 | 13.3 | 12.2 | 13.3 |

| 2012 | |||||

| GINI | 25.3 | 22.4 | 24.4 | 22.6 | 24.7 |

| S80S20 ratio * | 3.7 | 3.2 | 3.6 | 3.3 | 3.6 |

| At risk of poverty rate ** | |||||

| Total popul. | 13.2 | 11.5 | 12.9 | 11.7 | 13.1 |

| Females | 13.2 | 11.3 | 12.4 | 11.5 | 12.8 |

| Males | 13.3 | 11.6 | 13.3 | 11.9 | 13.4 |

-

Source: EUROSTAT and authors' calculations using SIMTASK and EUROMOD.

-

*

The ratio of total income received by the top 20 % of population to that received by the bottom 20%.

-

**

Percentage of population below 60% of median equalised income.

-

Measures are computed for individuals based on disposable household income and equalised by the modified OECD equivalence scale.

Summary statistics SK-SILC 2013 (Income reference period 2012).

| Mean (Std.Dev) | Number of individuals | ||||||

|---|---|---|---|---|---|---|---|

| SK SILC | Admin. Data | SK SILC | Admin. Data | ||||

| Weights | Original | Calibrated | Original | Calibrated | |||

| Labour income (monthly) | |||||||

| Gross wage employment | 692.97 | 722.59 | 805.00 | * | 1,983,176 | 1,788,927 | 1,881,598 |

| (369.69) | (530.82) | 775.60 | ** | ||||

| Income from self-employment | 722.89 | 709.50 | 382.43 | ** | 347,397 | 361,935 | 277,125 |

| (558.06) | (540.66) | ||||||

| Other payments made by employers | 17.24 | 20.79 | 315,322 | 278,861 | |||

| (20.29) | (29.89) | ||||||

| Income from agreements | 70.16 | 68.96 | 143.94 | ** | 364,458 | 341,729 | 955,330 |

| (154.41) | (93.76) | ||||||

| Non-labour income (monthly) | |||||||

| Unemployment benefit | 271.20 | 259.96 | 312.00 | 58,064 | 60,399 | 143,896 | |

| (164.21) | (148.52) | ||||||

| Maternity benefit | 431.87 | 451.57 | 443.00 | 35,203 | 71,317 | 24,221 | |

| (179.48) | (168.34) | ||||||

| Child birth grant | 60.46 | 62.95 | 153.67 | 38,020 | 70,298 | 56,994 | |

| (22.24) | (23.17) | ||||||

| Child benefit (incl. additional child benefit) | 23.49 | 23.34 | 37.78 | 779,739 | 738,748 | 688,344 | |

| (12.27) | (11.19) | ||||||

| Parental allowance | 200.71 | 200.43 | 195.87 | 140,111 | 164,278 | 142,274 | |

| (78.99) | (71.97) | ||||||

| Material needs benefit | 132.63 | 122.99 | 132.62 | 102,402 | 118,566 | 183,091 | |

| (120.49) | (103.3) | ||||||

| Nursing allowance | 150.05 | 140.28 | 142.22 | 32,411 | 41,248 | 58,700 | |

| (100.47) | (89.04) | ||||||

| Sickness and nursing benefits | 78.84 | 101.03 | 209.70 | 107,431 | 139,511 | 119,092 | |

| (81.78) | (96.78) | ||||||

| Disability pension | 272.53 | 261.98 | 260.90 | 201,729 | 257,721 | 227,801 | |

| (112.53) | (98.64) | ||||||

| Old-age pension | 375.44 | 374.58 | 367.00 | 1,072,056 | 1,062,519 | 980,863 | |

| (112.07) | (108.71) | ||||||

| Early retirement pension | 348.33 | 325.15 | 374.00 | 16,765 | 16,862 | 24,404 | |

| (107.57) | (104.03) | ||||||

| Widow’s pension | 153.16 | 156.99 | 237.00 | 339,647 | 346,049 | 336,877 | |

| (97.51) | (100.6) | ||||||

| Orphan’s pension | 159.09 | 146.41 | 126.00 | 19,479 | 16,972 | 26,923 | |

| (65.77) | (55.18) | ||||||

| Sample size | 15,426 | 15,426 | |||||

-

Source: Author’s calculations using SK SILC, official statistics Statistical Office, SSA and COLSAF.

-

*

Mean monthly wage reported by the Statistical Office.

-

**

Means computed by using data from SSA.

Simulated benefits: Ratios of aggregate number of recipients.

| Model | EUROMOD | SIMTASK | ||

|---|---|---|---|---|

| Weights | Original | Calibrated | Original | Calibrated |

| 2011 | ||||

| Unemp. benefit | 0.50 | 0.44 | 0.51 | 0.45 |

| Parental allowance | 0.68 | 1.03 | 0.67 | 1.03 |

| Child benefit * | 0.88 | 1.00 | 1.08 | 1.15 |

| Child birth grant | 0.59 | 1.07 | 0.59 | 1.07 |

| Material needs benefit | 1.00 | 1.36 | 0.73 | 1.01 |

| Housing allowance | 1.92 | 2.62 | 0.79 | 1.15 |

| Activation allowance | 4.68 | 6.47 | 1.00 | 1.50 |

| Protection allowance | 1.41 | 1.87 | 0.58 | 0.68 |

| 2012 | ||||

| Unemp. benefit | 0.38 | 0.41 | 0.40 | 0.43 |

| Parental allowance | 0.88 | 0.87 | 0.87 | 0.99 |

| Child benefit * | 0.96 | 0.94 | 1.15 | 1.08 |

| Child birth grant | 0.75 | 1.02 | 0.75 | 1.02 |

| Material needs benefit | 1.07 | 1.43 | 0.81 | 1.04 |

| Housing allowance | 2.12 | 2.78 | 0.82 | 1.10 |

| Activation allowance | 5.25 | 6.83 | 1.25 | 1.56 |

| Protection allowance | 2.06 | 2.80 | 0.73 | 0.92 |

-

Source: Authors' calculations using SIMTASK and EUROMOD, official statistics SSA (unemployment benefit).

-

*

Official statistics on child benefit recipients is taken as the average of monthly data over the year.

Official statistics on other benefits is the total number of individual recipients (incidence).

-

Note: Numbers display ratios of aggregate number of recipients computed by EUROMOD and SIMTASK referred by official statistics. COLSAF (other benefits). to aggregate number of recipients.