Distributional impacts of behavioral effects – ex-ante evaluation of the 2017 unemployment insurance reform in Finland

- Article

- Figures and data

- Jump to

Figures

Tables

Potential benefit durations (PBD) in the Finnish earnings-related unemployment benefit scheme before and after 2017.

| Pre-reform | Post-reform | |

|---|---|---|

| Less than 3 years of work history | 400 | 300 |

| Over 3 years of work history and less than 58 years of age | 500 | 400 |

| Eligible for the unemployment tunnel | max 1,532 | max 1,532 |

-

Source: Law on unemployment benefits, see https://www.finlex.fi/fi/laki/ajantasa/2002/20021290

-

Notes: The reform applies only to new unemployment spells starting from the beginning of 2017. The maximum duration of the unemployment benefits for those eligible for the unemployment tunnel assumes 258 working days a year.

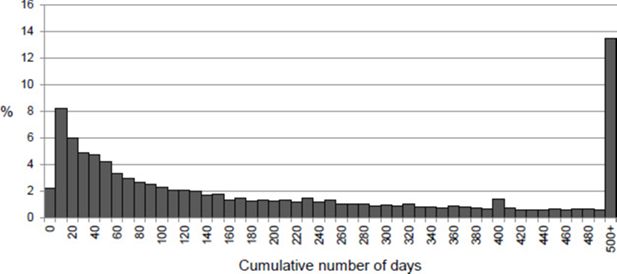

The distribution of demographic and economic characteristics by duration categories.

| Potential duration (new/old) | N | % | Female % | Average age | Average work history | Average benefit €/day | Receipt of benefits % | |

|---|---|---|---|---|---|---|---|---|

| Housing benefits | Social assistance | |||||||

| 300/400 | 24,941 | 8 | 50 | 30 | 2 | 57.1 | 28 | 15 |

| 400/500 | 248,562 | 75 | 49 | 43 | 11 | 70.3 | 13 | 8 |

| 500+/500+ | 56,535 | 17 | 48 | 61 | 14 | 70.0 | 6 | 3 |

| All | 330,038 | 100 | 49 | 45 | 11 | 69.2 | 13 | 8 |

-

Notes: Information for work history is available since 1997, thus the maximum work history is 17 years. The receipts indicate simulated receipt during the year, not necessarily simultaneously with the unemployment benefit spell.

Pros and cons of the two approaches of labour supply estimation.

| Discrete choice model | External elasticities | |

|---|---|---|

| Pros | • Empirically fit for the specific context • Better accuracy |

• Light data requirement • Genuine causal relationship (however, possibly from a different population) • Transparency, simplicity |

| Cons | • Heavy data requirement • Complexity, sensitivity • Changes in PBD typically ignored |

• Elasticities subject to context-specific inaccuracy • More inaccuracy in the distributional effects |

The distribution of predicted employment probabilities and subsequent elasticities in different scenarios.

| Min | P10 | P25 | Median | P75 | P90 | Max | |

|---|---|---|---|---|---|---|---|

| Predicted employment probabilities | 0.30 | 0.43 | 0.48 | 0.53 | 0.58 | 0.62 | 0.78 |

| Weighted elasticities (mean = 0.4) | 0.23 | 0.33 | 0.37 | 0.40 | 0.44 | 0.47 | 0.59 |

| Weighted elasticities (mean = 0.7) | 0.40 | 0.58 | 0.64 | 0.71 | 0.77 | 0.83 | 1.03 |

| Constant elasticities (mean = 0.7) | 0.70 | 0.70 | 0.70 | 0.70 | 0.70 | 0.70 | 0.70 |

| Weighted elasticities (mean = 1.0) | 0.57 | 0.83 | 0.92 | 1.01 | 1.10 | 1.18 | 1.47 |

-

Source: Authors’ calculations.

The static effect of the reform in subgroups of recipients of earnings-related unemployment benefit.

| Unaffected, N | Affected, N | Affected, % | ∆ Disp. inc, €/year | ∆ Disp. inc, % | ||

|---|---|---|---|---|---|---|

| All | 290,778 | 39,260 | 11.9 | −479.9 | −3.2 | |

| Potential duration | 300/400 days | 20,725 | 4,216 | 16.9 | −315.7 | −2.3 |

| (new/old) | 400/500 days | 213,325 | 35,044 | 14.1 | −499.6 | −3.3 |

| 500+ days | 56,728 | 0 | 0.0 | |||

| Sex | Male | 149,319 | 20,345 | 12.0 | −602.4 | −4.1 |

| Female | 141,460 | 18,914 | 11.8 | −348.1 | −2.2 | |

| Decile | I | 12,287 | 5,828 | 32.2 | −428.3 | −4.3 |

| II | 24,774 | 6,847 | 21.7 | −645.6 | −4.9 | |

| III | 31,281 | 6,100 | 16.3 | −692.4 | −4.7 | |

| IV | 34,531 | 4,815 | 12.2 | −518.6 | −3.1 | |

| V | 36,222 | 4,156 | 10.3 | −449.8 | −2.4 | |

| VI | 36,562 | 3,523 | 8.8 | −252.7 | −1.2 | |

| VII | 35,869 | 2,818 | 7.3 | −320.6 | −1.4 | |

| VIII | 32,626 | 2,378 | 6.8 | −302.9 | −1.1 | |

| IX | 29,077 | 1,871 | 6.0 | −223.6 | −0.7 | |

| X | 17,548 | 926 | 5.0 | −435.1 | −0.9 | |

| 18−25 | 18,294 | 1,299 | 6.6 | −222.1 | −1.7 | |

| 26−35 | 62,895 | 9,164 | 12.7 | −365.9 | −2.5 | |

| 36^5 | 60,064 | 10,656 | 15.1 | −466.4 | −2.9 | |

| 46−57 | 82,974 | 16,023 | 16.2 | −562.6 | −3.7 | |

| 58− | 66,551 | 2,118 | 3.1 | −573.3 | −4.2 | |

| Family type | Single dweller | 66,664 | 10,283 | 13.4 | −941.8 | −6.8 |

| Single parent | 18,747 | 3,703 | 16.5 | −670.8 | −3.5 | |

| Couple | 104,205 | 10,949 | 9.5 | −282.7 | −1.9 | |

| Couple w/ | ||||||

| children | 95,348 | 13,060 | 12.0 | −202.3 | −1.0 |

-

Source: Authors’ calculations.

-

Notes: The mean changes in disposable income are in equivalent household disposable income among the affected, euros in the 2016 price level.

The effects of the reform on different income units by benefit elasticities, million euros in 2016 price level.

| Pre-reform total | 0.0 (static) | 0.4 | A, by elasticity 0.7 (baseline) | 0.7 (constant) | 1.0 | |

|---|---|---|---|---|---|---|

| Earnings-related scheme | 2,558 | −175 | −193 | −209 | −209 | −225 |

| Flat-rate scheme | 1,517 | +94 | +83 | +75 | +75 | +68 |

| Wage sum | 80,466 | +0 | +66 | +118 | +119 | +169 |

| Taxes | 33,275 | −25 | −19 | −12 | −11 | −4 |

| Housing benefits | 2,103 | +7 | +6 | +6 | +6 | +6 |

| Social assistance | 1,003 | +3 | +2 | +2 | +1 | +1 |

| Total, fiscal | +48 | +83 | +115 | +115 | +146 | |

| Total, households | −48 | −17 | +3 | +4 | +22 | |

| Unemployment days | 91,700,229 | 0 | – | −1,027,728 | −1,028,853 | – |

| 575,876 | 1,465,234 |

-

Source: Authors’ calculations.

The effects of the reform on inequality indicators by benefit elasticity.

| Pre-reform total | 0.0 (static) | 0.4 | ∆ by elasticity 0.7 (baseline) | 0.7 (constant) | 1.0 | ||

|---|---|---|---|---|---|---|---|

| Gini index | 26.64 | +0.02 | +0.01 | +0.01 | +0.01 | 0.00 | |

| At-risk-of poverty, % | All | 12.98 | +0.03 | +0.02 | +0.02 | +0.01 | +0.01 |

| (60) | < 18 yrs | 11.88 | +0.03 | +0.03 | +0.03 | +0.03 | +0.02 |

| > 65 yrs | 13.08 | −0.02 | 0.00 | +0.02 | +0.02 | +0.03 | |

| Median income (€/year) | 23 820 | −12 | −3 | +4 | +4 | +8 |

-

Source: Authors’ calculations.

Results from the logistic regression modelling employment probability (n = 15,975).

| Goodness of fit criterion | Intercept only | Intercept and covariates | ||||

|---|---|---|---|---|---|---|

| AIC | 22,101 | 21,836 | ||||

| SC | 22,108 | 22,097 | ||||

| −2 Log L | 22,099 | 21,768 | ||||

| Coefficient | (S.E.) | OR | ||||

| Intercept | 0.037 | (0.172) | 1.038 | |||

| Education | ||||||

| No post-basic level education or | ref | |||||

| level of education unknown | ||||||

| Upper secondary education | 0.246 | (0.050) | 1.128 | |||

| Lowest level tertiary education | 0.150 | (0.058) | 1.162 | |||

| Higher tertiary or doctorate level | 0.190 | (0.071) | 1.210 | |||

| Number of children | ||||||

| 0 | ref | |||||

| 1 | ||||||

| 2 | −0.032 | |||||

| −0.093 | (0.053) (0.074) | 0.968 0.911 | ||||

| >2 | −0.327 | (0.158) | 0.721 | |||

| Sex | ||||||

| Male | ref | |||||

| Female | −0.125 | (0.033) | 0.882 | |||

| Coresidence status | ||||||

| Single dweller | ref | |||||

| Couple | 0.288 | (0.035) | 1.334 | |||

| Age | ||||||

| < 25 | ref | |||||

| 25–29 | −0.264 | (0.172) | 0.768 | |||

| 30–34 | −0.362 | (0.168) | 0.696 | |||

| 35–39 | −0.373 | (0.168) | 0.689 | |||

| 40–44 | −0.447 | (0.167) | 0.639 | |||

| 45–49 | −0.495 | (0.166) | 0.610 | |||

| 50–54 | −0.582 | (0.166) | 0.559 | |||

| > 55 | −0.709 | (0.166) | 0.492 | |||

| Region | ||||||

| Uusimaa | ref | |||||

| Varsinais-Suomi | 0.154 | (0.064) | 1.167 | |||

| Satakunta | 0.209 | (0.079) | 1.233 | |||

| Kanta-Hame | 0.372 | (0.104) | 1.451 | |||

| Pirkanmaa | 0.144 | (0.062) | 1.154 | |||

| Paijat-Hame | 0.289 | (0.088) | 1.336 | |||

| Kymenlaakso | 0.412 | (0.088) | 1.510 | |||

| South Karelia | 0.193 | (0.109) | 1.212 | |||

| Etela-Savo | 0.326 | (0.102) | 1.385 | |||

| Pohjois-Savo | 0.507 | (0.081) | 1.660 | |||

| North Karelia | 0.311 | (0.089) | 1.365 | |||

| Central Finland | 0.283 | (0.071) | 1.327 | |||

| South Ostrobothnia | 0.651 | (0.094) | 1.918 | |||

| Ostrobothnia | 0.359 | (0.108) | 1.432 | |||

| Central Ostrobothnia | 0.231 | (0.156) | 1.260 | |||

| North Ostrobothnia | 0.346 | (0.064) | 1.413 | |||

| Kainuu | 0.397 | (0.107) | 1.487 | |||

| Lapland | 0.408 | (0.083) | 1.503 | |||

| Aland | 0.383 | (0.414) | 1.466 | |||

-

Source: Authors’ calculations with the research data.