Tax-benefit microsimulation and income redistribution in Ecuador

Cite this article

as: H. Xavier Jara, M. Varela; 2019; Tax-benefit microsimulation and income redistribution in Ecuador; International Journal of Microsimulation; 12(1); 52-82.

doi: 10.34196/ijm.00194

- Article

- Figures and data

- Jump to

Figures

Tables

Table 1

Tax–benefit instruments in 2011: number of recipients/payers (in thousands).

| ECUAMOD | ENIGHUR | External | Ratios | |||

|---|---|---|---|---|---|---|

| (A) | (B) | (C) | (A)/(B) | (A)/(C) | (B)/(C) | |

| Social Benefits | ||||||

| Human Development Transfer | 1,538 | 1,681 | 1,854 | 0.92 | 0.83 | 0.91 |

| Joaquín Gallegos Lara | 9 | 9 | 14 | 1.00 | 0.64 | 0.64 |

| Taxes and Social Insurance Contributions (SICs) | ||||||

| Personal income tax | 334 | 204 | 476 | 1.64 | 0.70 | 0.43 |

| Employee SICs | 2,134 | 1,836 | 2,449 | 1.16 | 0.87 | 0.75 |

| Self-employed SICs | 255 | 74 | 341 | 3.46 | 0.75 | 0.22 |

-

Source: ECUAMOD version 1.4 calculations, ENIGHUR 2011–2012 and IESS (2015).

Table 2

Tax–benefit instruments in 2011: annual amounts (in millions).

| ECUAMOD | ENIGHUR | External | Ratios | |||

|---|---|---|---|---|---|---|

| (A) | (B) | (C) | (A)/(B) | (A)/(C) | (B)/(C) | |

| Social Benefits | ||||||

| Human Development Transfer | 661 | 706 | 724 | 0.94 | 0.91 | 0.97 |

| Joaquín Gallegos Lara | 26 | 24 | 41 | 1.07 | 0.62 | 0.58 |

| Taxes and Social Insurance Contributions (SICs) | ||||||

| Personal income tax | 639 | 171 | 784 | 3.75 | 0.82 | 0.22 |

| Employee SICs | 1,478 | 1,322 | 1,508 | 1.12 | 0.98 | 0.88 |

| Self-employed SICs | 332 | 268 | 176 | 1.24 | 1.88 | 1.52 |

| VAT | 1,708 | 592 | 3,073 | 2.88 | 0.56 | 0.19 |

-

Source: ECUAMOD version 1.4 calculations, ENIGHUR 2011–2012 and IESS (2018).

Table 3

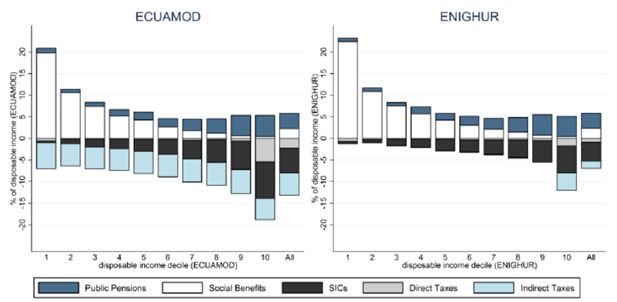

Progressivity of tax-benefit components in 2011– Suits index.

| Public Pensions | Social Benefits | Direct Taxes | Social Insurance Contributions | Indirect Taxes | |

|---|---|---|---|---|---|

| ECUAMOD | −0.21 | 0.62 | 0.74 | 0.25 | −0.03 |

| ENIGHUR | −0.19 | 0.61 | 0.42 | 0.24 | 0.83 |

-

Source: ECUAMOD version 1.4 calculations and ENIGHUR 2011–2012.

Table 4

Absolute poverty rates and income inequality in 2011.

| ECUAMOD (A) | ENIGHUR (B) | Ratio (A)/(B) | |

|---|---|---|---|

| Inequality | |||

| Gini | 46.1 | 47.7 | 0.97 |

| p90/p10 | 7.4 | 7.7 | 0.96 |

| Atkinson index (0.5) | 17.8 | 19.3 | 0.92 |

| Atkinson index (1) | 30.8 | 32.6 | 0.94 |

| Atkinson index (2) | 50.5 | 52.4 | 0.96 |

| Poverty headcount | |||

| Total | 20.8 | 21.7 | 0.96 |

| Urban | 12.5 | 13.3 | 0.94 |

| Rural | 37.6 | 38.5 | 0.98 |

| Extreme poverty headcount | |||

| Total | 5.7 | 6.2 | 0.94 |

| Urban | 2.3 | 2.7 | 0.85 |

| Rural | 12.7 | 13.3 | 0.95 |

-

Source: ECUAMOD version 1.4 calculations and ENIGHUR 2011–2012.

-

Notes: Computed for individuals according to their household disposable income per capita. Household disposable income is calculated as the sum of all income sources of all household members net of income tax and SICs.

Table 5

Effect of the tax-benefit system on income inequality and poverty in 2011.

| Market income | Disposable income (DPI) | Difference | |

|---|---|---|---|

| Gini coefficient | |||

| ECUAMOD | 50.2 | 46.1 | 4.1 |

| ENIGHUR | 50.2 | 47.7 | 2.5 |

| Poverty headcount | |||

| ECUAMOD | 24.9 | 20.8 | 4.1 |

| ENIGHUR | 24.9 | 21.7 | 3.2 |

| Extreme poverty headcount | |||

| ECUAMOD | 9.4 | 5.7 | 3.7 |

| ENIGHUR | 9.4 | 6.2 | 3.2 |

-

Source: ECUAMOD version 1.4 calculations and ENIGHUR 2011–2012.

Table 6

Effect of tax-benefit components on income inequality in 2011.

| Disposable income (DPI) | DPI minus Public Pensions | DPI minus Social Benefits | DPI plus Direct Taxes | DPI plus SICs | DPI minus Indirect Taxes | |

|---|---|---|---|---|---|---|

| (A) | (B) | (C) | (D) | (E) | (F) | |

| ECUAMOD | 46.1 | 46.3 | 47.8 | 47.1 | 47.4 | 46.2 |

| ENIGHUR | 47.7 | 47.9 | 49.4 | 48.0 | 48.6 | 46.9 |

-

Source: ECUAMOD version 1.4 calculations and ENIGHUR 2011–2012.

Table 7

Effect of tax-benefit components on income poverty in 2011.

| Disposable income (DPI) | DPI minus Public Pensions | DPI minus Social Benefits | DPI plus Direct Taxes | DPI plus SICs | DPI minus Indirect Taxes | |

|---|---|---|---|---|---|---|

| (A) | (B) | (C) | (D) | (E) | (F) | |

| Poverty headcount | ||||||

| ECUAMOD | 20.8 | 22.3 | 24.2 | 20.7 | 20.3 | 22.9 |

| ENIGHUR | 21.7 | 23.1 | 25.1 | 21.6 | 21.4 | 21.7 |

| Extreme poverty headcount | ||||||

| ECUAMOD | 5.7 | 6.7 | 8.6 | 5.7 | 5.7 | 6.6 |

| ENIGHUR | 6.2 | 7.1 | 9.1 | 6.1 | 6.2 | 6.2 |

-

Source: ECUAMOD version 1.4 calculations and ENIGHUR 2011–2012.

Table A.1

Simulation of taxes and benefits in ECUAMOD.

| Policy instrument | Treatment in ECUAMOD | Why not fully simulated? |

|---|---|---|

| Simulated tax-benefit instruments | ||

| Employee social insurance contributions | Simulated | - |

| Armed forces and police | ||

| social insurance | Simulated | - |

| contributions | ||

| Self-employed social insurance contributions | Simulated | - |

| Employer social insurance contributions | Simulated | - |

| Government social | ||

| insurance contributions for | Simulated | - |

| armed forces and police | ||

| Personal income tax | Simulated | - |

| Human development transfer (HDT) | Simulated | - |

| Joaquín Gallegos Lara | Partially simulated | Eligibility for the benefit cannot be simulated to lack of information about severity of disability in the data |

| Value added tax (VAT) | Simulated | - |

| Special consumption tax (excise duties) | Simulated | - |

| Non-simulated tax-benefit instruments | ||

| Old-age pension | Included | No data on contribution records |

| Invalidity pension | Included | No data on contribution records |

| Survivors’ pension | Included | No data on contribution records |

| Injury benefit | Included | No data on contribution records |

| Severance payments | Included | No data on contribution records No information about students’ |

| Scholarships | Included | grades to determine eligibility for scholarships |

| Housing grant | Included | No information about the price of the property individuals intend to buy nor about the cost of planned remodelling for their current house |

| Property tax and property transfer tax | Included | No information on property values in the data |

| Wealth tax | Included | No information on wealth in the data |

| Motor vehicle tax | Included | No information on vehicle values in the data |

-

Source: Authors’ compilation.

Download links

A two-part list of links to download the article, or parts of the article, in various formats.