Agent-based Multi-layer Network Simulations for Financial Systemic Risk Measurement: a Proposal for Future Developments

Cite this article

as: L. Riccetti; 2022; Agent-based Multi-layer Network Simulations for Financial Systemic Risk Measurement: a Proposal for Future Developments; International Journal of Microsimulation; 15(2); 44-61.

doi: 10.34196/ijm.00262

Figures

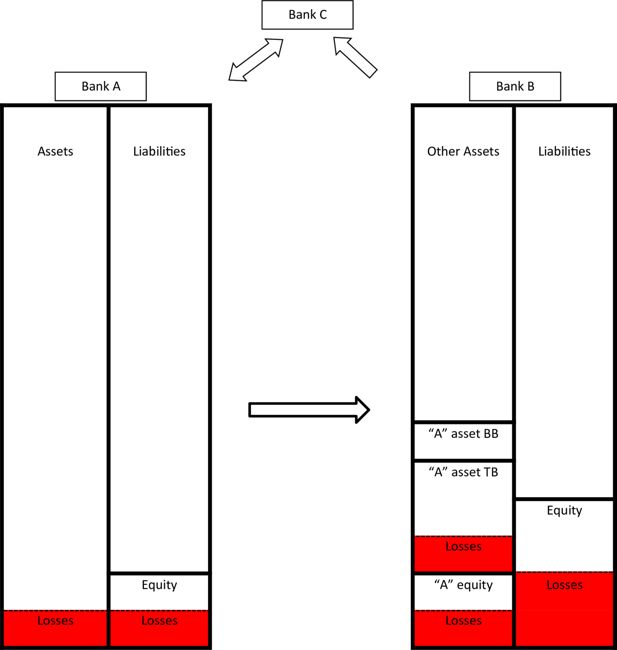

Figure 1

Bank A suffers a loss. This causes losses to banks B and C. For instance, we assume (using only equity and “other assets” exposures) that it largely reduces the value of bank A’s equity held by bank B (“A” equity), reduces less the value of the “other assets” held by bank B in its trading book (“A” asset TB), and does not reduce the value of the “other assets” held by bank B in its banking book (“A” asset BB). The same happens in the balance sheets of bank C. Moreover, for example, the losses of bank B implies losses for bank C that owns instruments issued by B, while the losses of bank C implies further losses to bank A, as indicated by the arrows. The figure is purely schematic and is not intended to indicate the relative magnitudes of the various parts of the balance sheet.

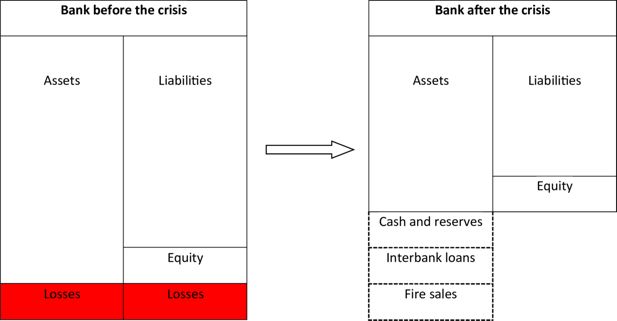

Figure 2

Undercapitalized banks have to sell some assets to deleverage in order to conform to regulatory constraints. Banks should follow a strategy in order to dispose of the assets that minimize the reduction of the return, in particular trying to avoid fire sales. The figure is purely schematic and is not intended to indicate the relative magnitudes of the various parts of the balance sheet.

Tables

Table 1

The team. The activities are linked to the related tasks described below.

| Researchers in | Activities | Tasks |

|---|---|---|

| Econometrics | Time-series analysis, with a particular focus on price modelling of financial instruments. | 1 and 3 |

| Financial markets | Study of asset pricing theory and price modelling with the econometricians. | 1 and 3 |

| Banking and financial regulation | Analysis of bank strategies to comply to regulatory constraint (task 2), and analysis of bank balance sheets (tasks 1 and 3). | 1-2-3 |

| Network analysis | Network simulations engineering. | 4 |

Data and code availability

Please contact the authors for information on data and code availability.

Download links

A two-part list of links to download the article, or parts of the article, in various formats.