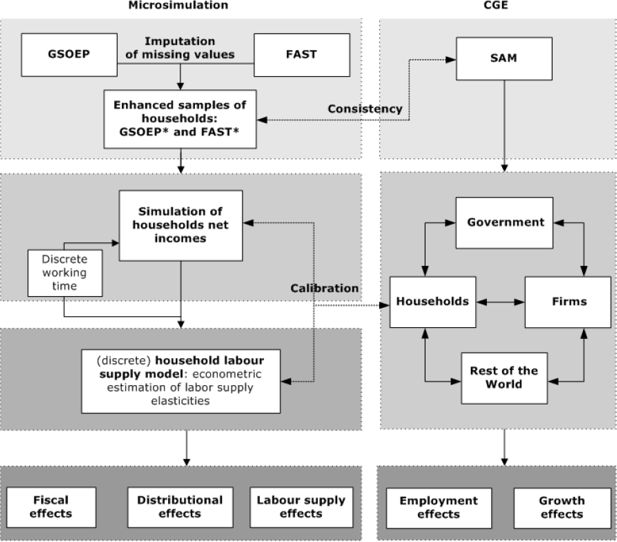

FiFoSiM – An integrated tax benefit microsimulation and CGE model for Germany

Cite this article

as: A. Peichl, T. Schaefer; 2009; FiFoSiM – An integrated tax benefit microsimulation and CGE model for Germany; International Journal of Microsimulation; 2(1); 1-15.

doi: 10.34196/ijm.00008

- Article

- Figures and data

- Jump to

Figures

Tables

Table 1

Strength and limitations of the dual database.

Table 2

Calculation of personal income tax.

| Sum of net incomes from 7 categories (receipts from each source minus expenses) | |

| = | adjusted gross income |

| − | deductions (social security and insurance contributions, personal expenses) |

| = | taxable income (x) |

| . | tax formula |

| = | tax payment (T) |

Table 3

Duration of unemployment benefit entitlement.

| Old regulation until 31.01.2006 | New regulation from 01.02.2006 | ||||

|---|---|---|---|---|---|

| Employment period (months) | Age (Years) | Benefit period (months) | Employment period (months) | Age (Years) | Benefit period (months) |

| 12 | 6 | 12 | 6 | ||

| 16 | 8 | 16 | 8 | ||

| 20 | 10 | 20 | 10 | ||

| 24 | 12 | 24 | 12 | ||

| 30 | 45 | 14 | 30 | 55 | 15 |

| 36 | 45 | 18 | 36 | 55 | 18 |

| 44 | 47 | 22 | |||

| 52 | 52 | 26 | |||

| 64 | 57 | 32 | |||

Table 4

Fiscal effects of reform without behavioural reactions.

| Personal income tax (€ billion) | ||

|---|---|---|

| Reform phase | FAST* | GSOEP* |

| Pre-reform | 181.16 | 180.69 |

| Introduction | 179.15 | 179.08 |

| Final | 168.12 | 166.89 |

Table 5

Estimated results (FAST*) of the reforms proposed by Mitschke.

| Reform phase | ||

|---|---|---|

| Introduction | Final | |

| PIT revenue | − €2 billion | − €13 billion |

| Labour supply | +103,000 | +251,000 |

| Employment | +370,000 | +540,000 |

| Economic growth | +1.1% | +1.7% |

Download links

A two-part list of links to download the article, or parts of the article, in various formats.