Micro simulations on the effects of ageing-related policy measures: The social affairs department of the Netherlands Ageing and Pensions Model

Cite this article

as: J. van Sonsbeek; 2011; Micro simulations on the effects of ageing-related policy measures: The social affairs department of the Netherlands Ageing and Pensions Model; International Journal of Microsimulation; 4(1); 72-99.

doi: 10.34196/ijm.00046

- Article

- Figures and data

- Jump to

Figures

Tables

Table 1

Average life expectancies at 65 of the 2006–2045 pensioner cohorts.

| Subgroup | Average mortality age | Δ Average |

|---|---|---|

| By income | ||

| - 1st quintile | 83.5 | -2.5 |

| - 2nd quintile | 84.5 | -1.5 |

| - 3rd quintile | 85.6 | −0.4 |

| - 4th quintile | 86.8 | +0.8 |

| - 5th quintile | 88.5 | +2.5 |

| By gender | ||

| - Women | 86.9 | +0.9 |

| - Men | 85.1 | −0.9 |

| By household status | ||

| - Singles | 84.4 | −1.6 |

| - Cohabitants | 86.7 | +0.7 |

| By origin | ||

| - Natives | 86.6 | +0.6 |

| - Immigrants | 84.0 | −2.0 |

| Total | 86.0 |

Table 2

Option value parameters.

| Parameter | Mean value | Distribution |

|---|---|---|

| − κ (leisure preference) | 2.0 | U (1, 3) |

| − ρ (time preference) | 0.17 | 0 U(0, 0.05) U(0.05, 0.1) U(0.1, 0.2) U(0.2, 1.0) |

| − γ (risk aversion) | 0.7 | U(0.5, 0.9) |

| − τ (expected wage decrease after age 60) | 0.045 | U(0, 0.09) |

Table 3

Share of lifetime state pension income compared to share of state pension cohorts.

| Subgroup | Share of cohorts turning 65 | Share of lifetime pension costs | Ratio |

|---|---|---|---|

| By income | |||

| - 1st quintile | 19.4% | 15.4% | 0.79 |

| - 2nd quintile | 19.8% | 18.5% | 0.93 |

| - 3rd quintile | 20.0% | 19.4% | 0.97 |

| - 4th quintile | 20.3% | 21.8% | 1.08 |

| - 5th quintile | 20.5% | 24.9% | 1.21 |

| By gender | |||

| - Women | 49.4% | 52.6% | 1.06 |

| - Men | 50.6% | 47.4% | 0.94 |

| By household status | |||

| - Singles | 30.6% | 34.0% | 1.11 |

| - Cohabitants | 69.4% | 66.0% | 0.95 |

| By origin | |||

| - Natives | 73.5% | 82.4% | 1.12 |

| - Immigrants | 26.5% | 17.6% | 0.66 |

Table 4

Characteristics of retirees by retirement age (birth cohorts 1946–1970).

| Retirement age | Share of population retiring | Time preference | Leisure preference | Risk aversion | Wage decrease | Share of disability |

|---|---|---|---|---|---|---|

| ≤ 59 | 0.427 | |||||

| 60 | 0.029 | 0.26 | 2.15 | 0.70 | 0.046 | 0.14 |

| 61 | 0.025 | 0.21 | 2.07 | 0.70 | 0.046 | 0.16 |

| 62 | 0.027 | 0.20 | 2.04 | 0.70 | 0.046 | 0.17 |

| 63 | 0.035 | 0.21 | 2.04 | 0.70 | 0.047 | 0.14 |

| 64 | 0.036 | 0.21 | 2.07 | 0.70 | 0.048 | 0.18 |

| 65 | 0.217 | 0.20 | 2.05 | 0.69 | 0.046 | 0.03 |

| 66 | 0.043 | 0.14 | 1.97 | 0.70 | 0.046 | 0.14 |

| 67 | 0.042 | 0.13 | 1.97 | 0.71 | 0.046 | 0.15 |

| 68 | 0.040 | 0.12 | 1.94 | 0.71 | 0.045 | 0.14 |

| 69 | 0.080 | 0.08 | 1.81 | 0.73 | 0.039 | 0.06 |

Table 5

Overview of key SADNAP results compared to other models.

| Indicator | Year | SADNAP estimate | Comparable estimate | By |

|---|---|---|---|---|

| Grey pressure | 2040 | 49% | 49% | CBS |

| State pension expenses | 2040 | 9.6% | 8.8% | CPB based on 2004 population projection, would be 9.9% based on 2008 population projection |

| Number of state pensions | 2024 | 4.132 mln | 4.125 mln | SVB 2009–2024 projection |

| Expected replacement rate when retiring | All | 0.73 | 0.73 0.64 | CBS Euwals, de Mooij, van Vuuren (2009) |

| Gini coefficient | 2040 | 0.29 | 0.23 | Knoef et al. on household income (SADNAP estimate on individual income) |

| Retirement age | 2007 | 61.9 | 61.7 | Adviescommissie Arbeidparticipatie (2008) |

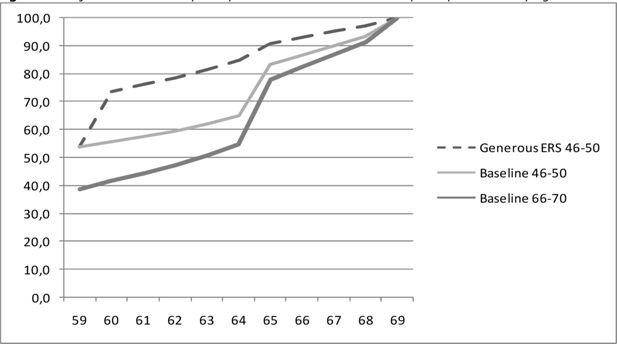

| Retirement age increase (compared to generous ERS) | 2015 | 2.5 | 4 / 0 2 – 2.5 | De Vos and Kapteyn for men / women Euwals, de Mooij, van Vuuren (2009) |

Table 6

Some characteristics of the two main data sources on state pensions.

| SVB file 2006 (65+) | CBS entitlement file 2005 (15-64) | |||

|---|---|---|---|---|

| Number | % | Number | % | |

| Gender | ||||

| - Male | 1,130,506 | 43.5 | 5,563,649 | 50.5 |

| - Female | 1,469,568 | 56.5 | 5,458,248 | 49.5 |

| Origin | ||||

| - Native6 | 9,656,948 | 87.6 | ||

| - Immigrant (1st gen) | 1,364,949 | 12.4 | ||

| Household status | ||||

| - Single | 2,667,713 | 24.2 | ||

| - Cohabiting | 8,337,017 | 75.8 | ||

| State pension entitlement | ||||

| - Complete | 2,200,342 | 84.6 | 9,443,153 | 85.7 |

| - Reduced | 399,802 | 15.4 | 1,572,768 | 14.3 |

| Country of residence | ||||

| - Netherlands | 2,364,891 | 91.0 | ||

| - Abroad | 235,183 | 9.0 | ||

| Total | 2,600,074 | 100.0 | 11,021,897 | 100.0 |

Table 7

Some characteristics of the main data source on company pensions.

| State pension entitlements | Private pension entitlements | |||

|---|---|---|---|---|

| Number | % | Number | % | |

| Gender | ||||

| - Male | 5,563,649 | 50.5 | 3,151,280 | 54.2 |

| - Female | 5,458,248 | 49.5 | 2,664,918 | 45.8 |

| Origin | ||||

| - Native | 9,656,948 | 87.6 | 5,288,526 | 90.9 |

| - Immigrant (1st gen) | 1,364,949 | 12.4 | 527,672 | 9.1 |

| Household status | ||||

| - Single | 2,667,713 | 24.2 | 1,325,328 | 22.8 |

| - Cohabiting | 8,337,017 | 75.8 | 4,484,873 | 77.2 |

| State pension entitlement | ||||

| - Complete | 9,443,153 | 85.7 | 5,074,905 | 87.3 |

| - Reduced | 1,572,768 | 14.3 | 739,206 | 12.7 |

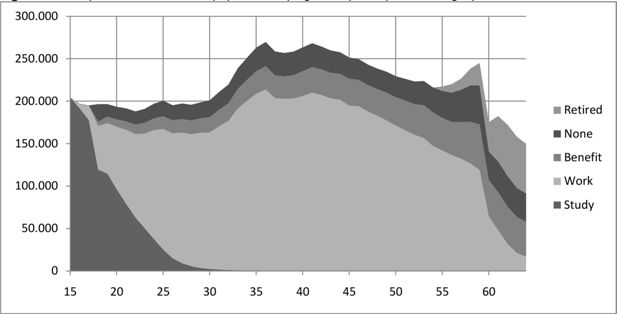

| Participation status | ||||

| - Study | 1,207,782 | 11.0 | 128,824 | 2.2 |

| - Work | 6,916,620 | 62.9 | 4,474,776 | 76.9 |

| - Benefit | 1,320,852 | 12.0 | 644,887 | 11.1 |

| - None | 1,217,069 | 11.1 | 318,848 | 5.5 |

| - (Early) retired | 342,141 | 3.1 | 246,483 | 4.2 |

| Total | 11,021,897 | 100.0 | 5,816,198 | 100.0 |

Table 8

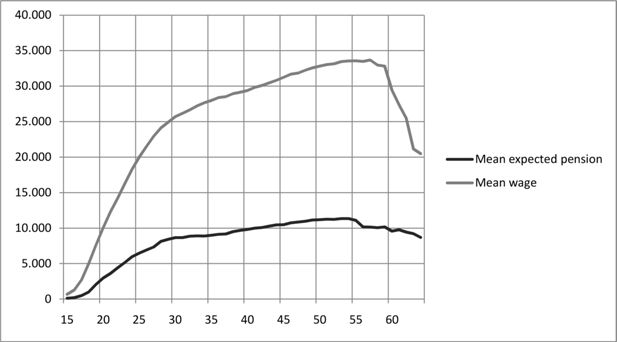

Expected private pension by main subgroups.

| Wage (mean) | Expected private pension (mean) | Expected replacement rate (median) | |

|---|---|---|---|

| Age-category | |||

| - 15-19 | € 12,546 | € 3,740 | 1.283 |

| - 20-24 | € 20,605 | € 7,005 | 0.857 |

| - 25-29 | € 25,580 | € 9,128 | 0.779 |

| - 30-34 | € 28,623 | € 10,445 | 0.754 |

| - 35-39 | € 30,294 | € 11,323 | 0.747 |

| - 40-44 | € 31,855 | € 12,194 | 0.729 |

| - 45-49 | € 33,582 | € 13,020 | 0.702 |

| - 50-54 | € 34,911 | € 13,668 | 0.675 |

| - 55-59 | € 36,016 | € 12,460 | 0.638 |

| - 60-64 | € 36,594 | € 10,335 | 0.575 |

| Gender | |||

| - Male | € 37,892 | € 13,965 | 0.644 |

| - Female | € 21,984 | € 8,275 | 0.839 |

| Origin | |||

| - Native | € 31,008 | € 11,714 | 0.743 |

| - Immigrant | € 27,282 | € 7,791 | 0.607 |

| Household status | |||

| - Single | € 28,989 | € 9,952 | 0.761 |

| - Cohabiting | € 31,147 | € 11,767 | 0.725 |

| State pension entitlement | |||

| - Complete | € 30,536 | € 11,628 | 0.751 |

| - Reduced | € 32,062 | € 9,484 | 0.576 |

| All | € 30,703 | € 11,394 | 0.732 |

Table 9

presents an overview of the macro data sources used.

| Age | Gender | Ethnicity | Household status | Participatio n status | Income | |

|---|---|---|---|---|---|---|

| Birth cohorts | n/a | E | E | n/a | n/a | n/a |

| Immigrant cohorts | E | E | E | - | - | - |

| Mortality rates | E | E | I | I | - | I |

| Emigration rates | E | E | E | - | - | - |

| Cohabiting rates | E | E | - | n/a | - | - |

| Participation rates | E | E | - | - | n/a | - |

| Benefit rates | E | E | - | - | E | - |

Download links

A two-part list of links to download the article, or parts of the article, in various formats.