Making work pay in Croatia: An ex-ante evaluation of two in-work benefits using miCROmod

Figures

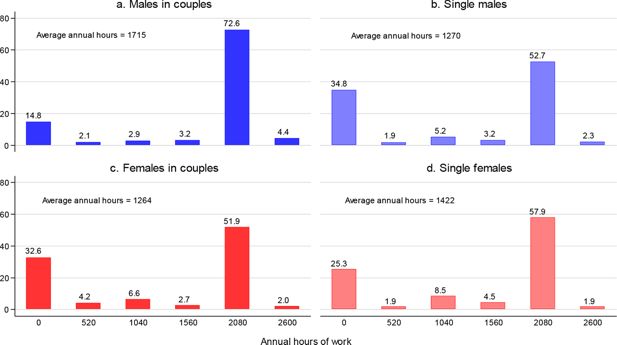

Distributions of discretised hours of work.

Source: Authors’ calculations based on the ILCS 2016 data.

Notes: The bar height measures the share (in %) of persons working the corresponding number of work hours annually. Sample sizes: 1,444 males from couples, 621 single males, 1,444 females from couples, 423 single females.

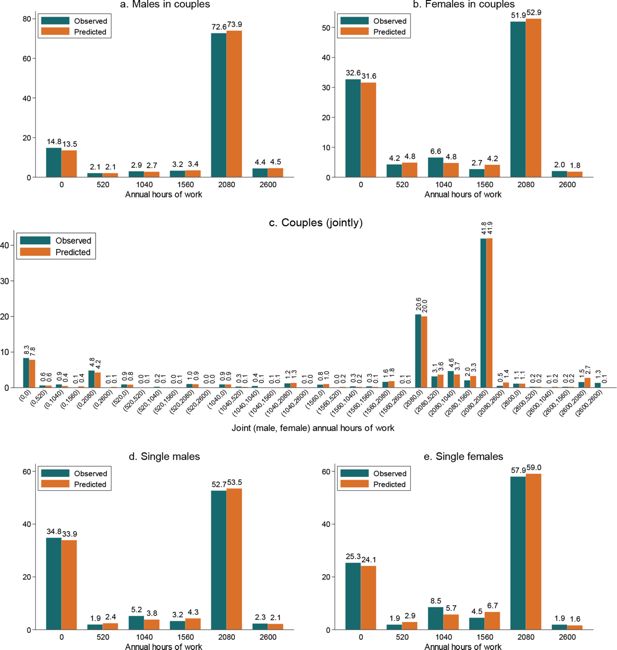

In-sample prediction performance: observed and predicted distributions of hours of work.

Source: Authors’ calculations based on the ILCS 2016 data and the estimates of the labour supply model given in Table 2 (for males and females in couples) and Table 3 (for singles).

Notes: The height of each bar labelled “observed” measures the share of males (panel a), females (panel b) or couples (panel c) observed to work the corresponding number of hours annually in 2015. The annual work hours are the hours after discretisation of their actually observed distribution. The height of each bar labelled “predicted” measures the sample average of the probability to work the corresponding number of hours or, in the case of the joint male-female distribution, the corresponding male-female combination of hours. The probabilities are calculated using the parameters of the labour supply model and data for 2015.

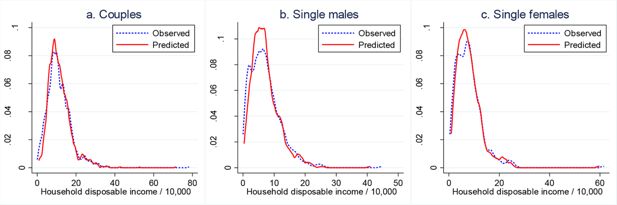

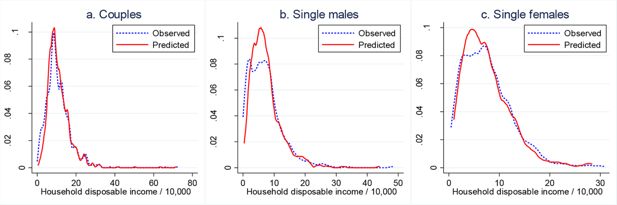

In-sample prediction performance: observed and predicted densities of total household disposable income.

Source: Authors’ calculations based on the ILCS 2016 data and the estimates of the labour supply model given in Table 2 (for males and females in couples) and Table 3 (for singles).

Notes: The densities are kernel estimates. The “observed” density refers to the density of total household disposable income actually observed in the 2015 data. The “predicted” density refers to the density of the expected total household disposable income, where the expectation is taken over the alternative-specific incomes, with the choice probabilities as weights. The choice probabilities are calculated using the parameters of the labour supply model and data for 2015.

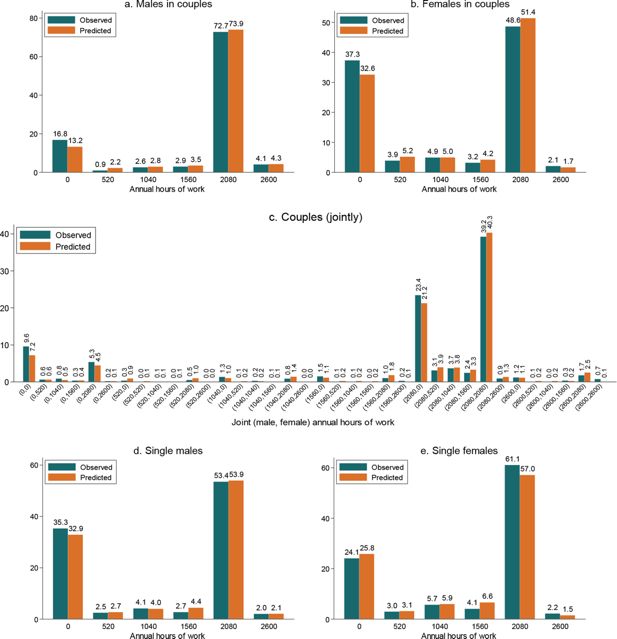

Out-of-sample prediction performance: observed and predicted distributions of hours of work.

Source: Authors’ calculations based on the ILCS 2015 data and the estimates of the labour supply model given in Table 2 (for males and females in couples) and Table 3 (for singles).

Notes: The height of each bar labelled “observed” measures the share of males (panel a), females (panel b) or couples (panel c) observed to work the corresponding number of hours annually in 2014. The annual work hours are the hours after discretisation of their actually observed distribution. The height of each bar labelled “predicted” measures the sample average of the probability to work the corresponding number of hours or, in the case of joint male-female distribution, the corresponding male-female combination of hours. The probabilities are calculated using the parameters of the labour supply model for 2015 and data for 2014.

Out-of-sample prediction performance: observed and predicted densities of total household disposable income.

Source: Authors’ calculations based on the ILCS 2015 data and the estimates of the labour supply model given in Table 2 (for males and females in couples) and Table 3 (for singles).

Notes: The model is estimated on the 2015 data, and the estimated parameters are used to predict the choice probabilities in the 2014 data. These probabilities are used in the calculation of the expected total disposable income for each household in the 2014 data. The density of this income is labelled “predicted”. The density labelled “observed” is the density of actually observed total household disposable income in the 2014 data.

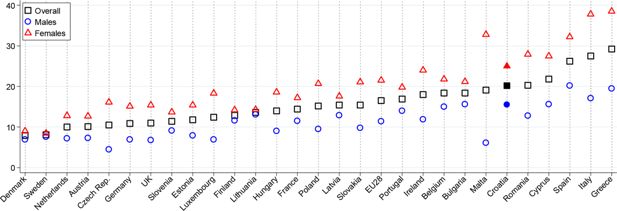

Population aged 20–64 not in employment, education, training, disability or retirement.

Source: Authors’ calculations based on Eurostat data on the unemployment rates, the inactivity rates and the structure of inactivity by the main reason.

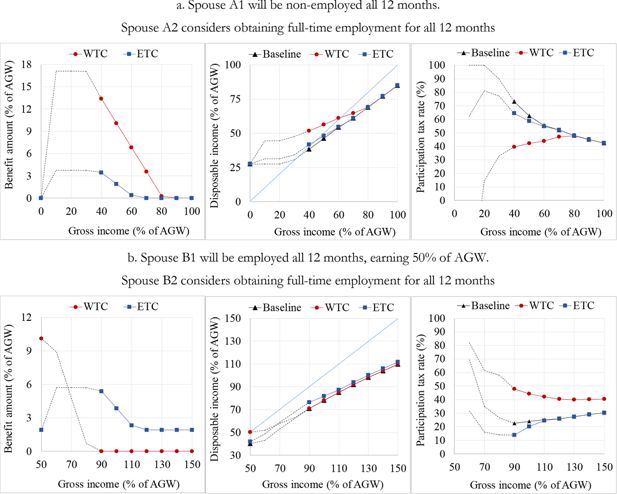

Illustration of the WTC and ETC with two hypothetical couples. a. Spouse A1 will be non-employed all 12 months. Spouse A2 considers obtaining full-time employment for all 12 months b. Spouse B1 will be employed all 12 months, earning 50% of AGW. Spouse B2 considers obtaining full-time employment for all 12 months

Notes: Gross income is the sum of the gross employment incomes of both spouses. The participation tax rate is one minus the change in disposable income taking place upon the transition from non-employment to employment, expressed as a share of gross income that would be earned in the case of employment. In panel a., the benefit amount and disposable income at a gross income of zero are identical for the WTC and ETC scenarios; therefore, the markers overlap, i.e., the one showing the WTC scenario is hidden. In Croatia in 2015, the minimum gross wage for full-time employment was approximately 38% of the average gross wage. Therefore, the actors A2 and B2 cannot be legally employed at a gross wage below the minimum wage. Accordingly, we show the results for gross wages beyond 38% of the AGW (represented by full lines and markers on the graphs). However, for the sake of illustration, the points below 38% of the AGW are also shown (represented by dotted lines on the graphs).

Source: Authors’ simulations using miCROmod.

Tables

Discretisation of the distribution of hours of work.

| Alternative | Annual hours | Weekly equivalent | ||

|---|---|---|---|---|

| Interval | Median hours in the interval | Interval | Median hours in the interval | |

| 1 | [0, 260) | 0 | [0, 5) | 0 |

| 2 | [260, 780) | 520 | [5, 15) | 10 |

| 3 | [780, 1300) | 1040 | [15, 25) | 20 |

| 4 | [1300, 1820) | 1560 | [25, 35) | 30 |

| 5 | [1820, 2600) | 2080 | [35, 50) | 40 |

| 6 | ≥ 2600 | 2600 | ≥50 | 50 |

-

Notes: Each interval is left-closed and right-opened. The weekly equivalents are obtained by dividing the annual hours by 52 (the number of weeks in a year).

Estimates of preference and opportunity parameters for couples.

| Parameter | Estimate | Std. err. | |

|---|---|---|---|

| Preferences | |||

| 0.464 | [0.214]* | ||

| −0.005 | [0.002]* | ||

| 4.606 | [2.858] | ||

| −0.115 | [0.167] | ||

| 10.769 | [2.506]*** | ||

| −0.434 | [0.149]** | ||

| 0.023 | [0.017] | ||

| 0.009 | [0.011] | ||

| 0.267 | [0.060]*** | ||

| −0.188 | [0.056]** | ||

| 0.002 | [0.001]** | ||

| 0.059 | [0.083] | ||

| 0.401 | [0.123]** | ||

| 0.641 | [0.228]** | ||

| −0.204 | [0.042]*** | ||

| 0.002 | [0.000]*** | ||

| 0.200 | [0.067]** | ||

| 0.194 | [0.109] | ||

| 0.959 | [0.231]*** | ||

| Male opportunity measure | |||

| 4.164 | [1.115]*** | ||

| −0.211 | [0.027]*** | ||

| 0.180 | [0.017]*** | ||

| Female opportunity measure | |||

| 3.203 | [0.716]*** | ||

| −0.167 | [0.019]*** | ||

| 0.136 | [0.012]*** | ||

| Male and female opportunity densities | |||

| 2.901 | [0.115]*** | ||

| 2.865 | [0.121]*** | ||

| Log-likelihood | −2,477.53 | ||

| No. of couples | 1,444 | ||

-

Source: Authors’ estimation using ILCS 2016 data.

-

Notes: Maximum simulated likelihood estimates with 50 simulations. */**/*** indicate statistical significance at the 10/5/1% level. 1[.] is an indicator variable that equals one if the condition in parentheses is true, and zero otherwise. C is measured in tens of thousands of HRK. LM and LF are measured in thousands of hours. Age and experience are measured in years.

Estimates of preference and opportunity parameters for singles.

| Parameter | Males | Females | |||

|---|---|---|---|---|---|

| Estimate | Std. err. | Estimate | Std. err. | ||

| Preferences | |||||

| 0.404 | [0.177]* | 0.825 | [0.237]** | ||

| −0.006 | [0.002]** | −0.006 | [0.003]* | ||

| 12.797 | [3.809]** | 27.226 | [4.830]*** | ||

| −0.586 | [0.248]* | −1.365 | [0.300]*** | ||

| 0.007 | [0.019] | −0.024 | [0.026] | ||

| −0.157 | [0.045]** | −0.230 | [0.061]*** | ||

| 0.002 | [0.001]** | 0.002 | [0.001]** | ||

| 0.071 | [0.256] | ||||

| 0.776 | [0.165]*** | 0.366 | [0.203] | ||

| 1.413 | [0.395]*** | 0.561 | [0.553] | ||

| Opportunity measure | |||||

| 3.267 | [1.144]** | 4.567 | [1.275]*** | ||

| −0.229 | [0.030]*** | −0.261 | [0.038]*** | ||

| 0.202 | [0.020]*** | 0.174 | [0.028]*** | ||

| Opportunity density | |||||

| 2.718 | [0.183]*** | 2.614 | [0.215]*** | ||

| Log-likelihood | −550.02 | −394.81 | |||

| No. of individuals | 621 | 423 | |||

-

Source, Authors’ estimation using ILCS 2016 data.

-

Notes: Maximum simulated likelihood estimates with 50 simulations. */**/*** indicate statistical significance at the 10/5/1% level. 1[.] is an indicator variable that equals one if the condition in parentheses is true, and zero otherwise. C is measured in tens of thousands of HRK. LM and LF are measured in thousands of hours. Age and experience are measured in years.

Elasticity of the labour supply for couples.

| Elasticity of the probability of participation | Elasticity of the expected work hours | |||||||

|---|---|---|---|---|---|---|---|---|

| Males | Females | Males | Females | |||||

| Own elasticity | Cross elasticity | Own elasticity | Cross elasticity | Own elasticity | Cross elasticity | Own elasticity | Cross elasticity | |

| All | 0.179 | −0.010 | 0.325 | −0.030 | 0.232 | −0.017 | 0.423 | −0.046 |

| Income quintile group | ||||||||

| first | 0.498 | 0.035 | 0.677 | 0.046 | 0.593 | 0.037 | 0.823 | 0.043 |

| second | 0.212 | −0.005 | 0.442 | −0.026 | 0.276 | −0.008 | 0.569 | −0.035 |

| third | 0.126 | −0.013 | 0.336 | −0.017 | 0.179 | −0.016 | 0.454 | −0.027 |

| fourth | 0.102 | −0.025 | 0.238 | −0.051 | 0.148 | −0.036 | 0.328 | −0.071 |

| fifth | 0.072 | −0.026 | 0.166 | −0.056 | 0.109 | −0.039 | 0.237 | −0.080 |

| Age | ||||||||

| 30 or less | 0.135 | 0.003 | 0.484 | −0.015 | 0.218 | 0.001 | 0.699 | −0.049 |

| 31–50 | 0.144 | −0.007 | 0.311 | −0.033 | 0.195 | −0.014 | 0.408 | −0.048 |

| 50 or more | 0.285 | −0.020 | 0.314 | −0.025 | 0.341 | −0.029 | 0.382 | −0.036 |

| Education | ||||||||

| Low | 0.344 | 0.020 | 0.567 | 0.012 | 0.421 | 0.023 | 0.690 | 0.002 |

| Middle | 0.180 | −0.009 | 0.339 | −0.034 | 0.237 | −0.016 | 0.446 | −0.050 |

| High | 0.108 | −0.025 | 0.226 | −0.034 | 0.145 | −0.036 | 0.306 | −0.053 |

| Preschool children (age 0–6) | ||||||||

| No | 0.182 | −0.013 | 0.292 | −0.033 | 0.233 | −0.021 | 0.377 | −0.046 |

| Yes | 0.171 | −0.002 | 0.425 | −0.021 | 0.231 | −0.006 | 0.575 | −0.047 |

| Number of children (age 0–17) | ||||||||

| No | 0.226 | −0.021 | 0.302 | −0.036 | 0.280 | −0.030 | 0.382 | −0.050 |

| 1 or 2 | 0.149 | −0.008 | 0.318 | −0.030 | 0.200 | −0.015 | 0.420 | −0.048 |

| 3 or more | 0.224 | 0.005 | 0.444 | −0.013 | 0.287 | 0.001 | 0.578 | −0.025 |

-

Source: Authors’ calculationsbased on the estimates of the labour supply model from Table 2 and the ILCS2016 data.

-

Notes: For definitions of the elasticities, see Section 4.4. The elasticities are calculated assuming a 10% increase in the gross wage, either the individual’s own (for own elasticities) or that of the partner (for cross elasticities). Income refers to the expected household disposable income equivalised using the modified OECD equivalence scale; the expectation is taken over the 36 alternatives, with the estimated choice probabilities as weights.

Elasticity of the labour supply for singles.

| Elasticity of the probability of participation | Elasticity of the expected work hours | |||

|---|---|---|---|---|

| Males | Females | Males | Females | |

| All | 0.266 | 0.276 | 0.305 | 0.346 |

| Income quintile | ||||

| first | 0.598 | 0.695 | 0.663 | 0.822 |

| second | 0.352 | 0.364 | 0.405 | 0.463 |

| third | 0.242 | 0.319 | 0.289 | 0.403 |

| fourth | 0.216 | 0.174 | 0.252 | 0.241 |

| fifth | 0.150 | 0.089 | 0.170 | 0.132 |

| Age | ||||

| 30 or less | 0.294 | 0.337 | 0.368 | 0.517 |

| 31–50 | 0.248 | 0.263 | 0.284 | 0.332 |

| 50 or more | 0.291 | 0.272 | 0.317 | 0.304 |

| Education | ||||

| Low | 0.316 | 0.487 | 0.357 | 0.557 |

| Middle | 0.251 | 0.307 | 0.293 | 0.388 |

| High | 0.282 | 0.200 | 0.304 | 0.260 |

| Preschool children (age 0–6) | ||||

| No | 0.266 | 0.272 | 0.305 | 0.342 |

| Yes | – | 0.326 | – | 0.418 |

| Number of children (age 0–17) | ||||

| No | 0.268 | 0.267 | 0.309 | 0.336 |

| 1 or 2 | 0.189 | 0.298 | 0.051 | 0.371 |

| 3 or more | – | 0.389 | – | 0.480 |

-

Source: Authors’ calculations based on the estimates of the labour supply model from Table 3 and the ILCS 2016 data.

-

Notes: For definitions of the elasticities, see Section 4.4. The elasticities are calculated assuming a 10% increase in gross wage, either own (for own elasticities) or the partner’s (for cross elasticities). Income refers to the expected household disposable income equivalised using the modified OECD equivalence scale; the expectation is taken over the six alternatives, with the estimated choice probabilities as weights. There are no single males with children aged 0–6 or with three or more children.

Parameters of WTC and ETC.

| WTC | ETC | |

|---|---|---|

| Maximum benefit amount, M | (a)+(b)+(c)+(d) | 3,623 |

| (a) Basic element | 6,735 | – |

| (b) Lone parent element | 6,907 | – |

| (c) Couple element | 6,907 | – |

| (d) 1560 hours element | 2,784 | – |

| Income threshold, T | 22,060 | 36,360 |

| Withdrawal rate, r | 0.41 | 0.19 |

-

Notes: All monetary parameters are expressed in HRK. These values of parameters ensure that the total amount of each benefit given to the sample couples is HRK 300 million in a framework without behavioural effects.

Aggregate effects of the WTC and ETC on the labour supply.

| Annual hours of work | ||||||

|---|---|---|---|---|---|---|

| 0 | 520 | 1040 | 1560 | 2080 | 2600 | |

| Males | ||||||

| a. Baseline | 13.36 | 2.04 | 2.63 | 3.39 | 74.09 | 4.49 |

| b. WTC reform | 13.74 | 2.18 | 2.79 | 3.52 | 73.42 | 4.35 |

| c. ETC reform | 13.02 | 2.08 | 2.80 | 3.50 | 74.16 | 4.45 |

| WTC reform vs. baseline (b – a) | 0.37 | 0.14 | 0.15 | 0.14 | −0.66 | −0.14 |

| ETC reform vs. baseline (c – a) | −0.35 | 0.04 | 0.16 | 0.11 | 0.07 | −0.04 |

| Females | ||||||

| d. Baseline | 30.60 | 5.34 | 5.01 | 4.24 | 53.00 | 1.81 |

| e. WTC reform | 31.39 | 5.40 | 4.99 | 4.23 | 52.23 | 1.76 |

| f. ETC reform | 29.43 | 5.39 | 5.26 | 4.43 | 53.71 | 1.79 |

| WTC reform vs. baseline (e – d) | 0.79 | 0.06 | −0.02 | −0.01 | −0.77 | −0.05 |

| ETC reform vs. baseline (f – d) | −1.17 | 0.05 | 0.25 | 0.19 | 0.71 | −0.03 |

-

Source: Authors’ simulations using miCROmod.

-

Notes: Each figure represents the probability of working a certain number of hours (0, 520, 1040, 1560, 2080 or 2600) in a certain scenario (baseline, WTC reform or ETC reform).

The effects of the WTC and ETC on the probability of participation for males and females depending on the employment status of their spouses.

| WTC reform vs. baseline | ETC reform vs. baseline | |||

|---|---|---|---|---|

| Males | Females | Males | Females | |

| Aggregate effect | −0.37 | −0.79 | 0.35 | 1.17 |

| a. Type-specific effect on the probability of participation | ||||

| Spouse not employed | 0.38 | 1.63 | 0.51 | 1.38 |

| Spouse employed | −0.74 | −1.21 | 0.27 | 1.14 |

| b. Contribution to the aggregate effect | ||||

| Spouse not employed | 0.13 | 0.24 | 0.17 | 0.20 |

| Spouse employed | −0.50 | −1.03 | 0.18 | 0.97 |

-

Source: Authors’ simulations using miCROmod.

-

Notes: Each figure represents the change (expressed in percentage points) in the probability of participation upon the introduction of the WTC or ETC. The aggregate effect is equal to the effect on the probability of non-participation (zero work hours) reported in the first column of Table 7, multiplied by –1; thus, it measures the change in the probability of participation (rather than non-participation) upon the introduction of the WTC or ETC. Panel (a) displays the changes in the participation probability for males and females depending on whether their spouses are employed or not. In panel (b), the aggregate effect is decomposed into the respective contributions of the two types: the aggregate effect equals the sum of the two contributions. Each contribution is calculated as the product of a type-specific effect from panel (a) and the share of that type in all males or females.

Effects of the WTC and ETC on the state budget and employment income.

| Baseline | WTC reform | ETC reform | |||

|---|---|---|---|---|---|

| Without labour supply resp. | With labour supply resp. | Without labour supply resp. | With labour supply resp. | ||

| 1. Employment income | 44,094 | 44,094 | 43,756 | 44,094 | 44,222 |

| 2. Employer SIC | 7,353 | 7,353 | 7,297 | 7,353 | 7,375 |

| 3. Employee SIC | 8,592 | 8,592 | 8,527 | 8,592 | 8,617 |

| 4. PITS | 2,515 | 2,515 | 2,507 | 2,515 | 2,515 |

| 5. Means-tested benefits | 1,096 | 1,096 | 1,089 | 1,096 | 1,082 |

| 6. Other benefits | 2,341 | 2,341 | 2,338 | 2,341 | 2,338 |

| 7. WTC or ETC | 0 | 300 | 393 | 300 | 316 |

| 8. Total taxes = (2)+(3)+(4) | 18,460 | 18,460 | 18,330 | 18,460 | 18,507 |

| 9. Total benefits = (5)+(6)+(7) | 3,437 | 3,737 | 3,820 | 3,737 | 3,736 |

| 10. Net taxes = (8 – 9) | 15,023 | 14,723 | 14,510 | 14,723 | 14,771 |

| 11.Net taxes (vs. baseline) | 0 | −300 | −513 | −300 | −252 |

-

Source: Authors’ simulations using miCROmod.

-

Notes: Amounts expressed in millions of HRK. SIC – social insurance contributions. PITS – personal income tax plus surtax.

Effects of the WTC and ETC on inequality and poverty.

| Baseline | WTC reform | ETC reform | |||

|---|---|---|---|---|---|

| Without labour supply responses | With labour supply responses | Without labour supply responses | With labour supply responses | ||

| Gini coefficient | 29.30 | 28.50 | 28.70 | 28.90 | 28.68 |

| Poverty headcount | 16.85 | 14.40 | 15.39 | 16.06 | 15.66 |

| Poverty gap | 5.80 | 4.86 | 4.70 | 5.52 | 5.30 |

| Poverty severity | 3.08 | 2.68 | 2.44 | 2.95 | 2.80 |

-

Source: Authors’ simulations using miCROmod.

-

Notes: All indices are based on the equivalised (OECD scale) household disposable income. The poverty line equals 60% of the overall median.

Descriptive statistics for the variables used in the Heckman selection model.

| Males (N=3543) | Females (N=3823) | |||||||

|---|---|---|---|---|---|---|---|---|

| Employed (N=2830) | Non-employed (N=713) | Employed (N=2544) | Non-employed (N=1279) | |||||

| Mean | SD | Mean | SD | Mean | SD | Mean | SD | |

| hourly wage | 41.97 | 29.01 | – | – | 35.97 | 22.34 | – | – |

| ln(hourly wage) | 3.61 | 0.48 | – | – | 3.46 | 0.47 | – | – |

| age | 41.44 | 10.83 | 43.22 | 11.62 | 42.60 | 10.15 | 45.02 | 10.61 |

| education | 12.79 | 2.21 | 11.86 | 1.92 | 13.29 | 2.63 | 11.49 | 2.09 |

| experience | 18.71 | 11.00 | 12.36 | 11.60 | 18.27 | 10.87 | 8.99 | 11.10 |

| 1[urban settlement] | 0.21 | 0.41 | 0.19 | 0.39 | 0.25 | 0.43 | 0.15 | 0.36 |

| 1[health limitation] | 0.10 | 0.30 | 0.22 | 0.42 | 0.13 | 0.34 | 0.22 | 0.41 |

| 1[severe health limitation] | 0.02 | 0.14 | 0.08 | 0.27 | 0.02 | 0.14 | 0.06 | 0.24 |

| 1[in consensual union] | 0.65 | 0.48 | 0.46 | 0.50 | 0.71 | 0.45 | 0.83 | 0.38 |

| no. of children aged 0–6 | 0.24 | 0.56 | 0.14 | 0.49 | 0.18 | 0.46 | 0.24 | 0.59 |

| no. of children aged 7–14 | 0.33 | 0.73 | 0.20 | 0.57 | 0.33 | 0.63 | 0.37 | 0.73 |

| other market income | 0.21 | 0.22 | 0.15 | 0.20 | 0.27 | 0.24 | 0.22 | 0.22 |

| social insurance income | 0.06 | 0.09 | 0.07 | 0.11 | 0.06 | 0.10 | 0.07 | 0.11 |

-

Source: Authors’ calculations based on the ILCS 2016 data.

-

Notes: N is the number of observations. Hourly wage is in HRK. Age, education and experience are in years. Other market income and social insurance income are in tens of thousands of HRK, and both are divided by the square root of the number of household members. 1[.] is an indicator variable that equals one if the condition in brackets is true, and zero otherwise.

Estimates of the Heckman selection model for the prediction of missing wage rates.

| Males | Females | |||

|---|---|---|---|---|

| Estimate | Std. err. | Estimate | Std. err. | |

| Wage equation | ||||

| age | 0.000 | [0.010] | −0.019 | [0.010]* |

| age2/100 | −0.006 | [0.012] | 0.009 | [0.011] |

| education | 0.092 | [0.004]*** | 0.094 | [0.004]*** |

| experience | 0.025 | [0.006]*** | 0.042 | [0.005]*** |

| experience2/100 | −0.030 | [0.011]* | −0.056 | [0.011]*** |

| 1[urban settlement] | 0.138 | [0.020]*** | 0.141 | [0.018]*** |

| constant | 2.238 | [0.173]*** | 2.237 | [0.177]*** |

| Selection equation | ||||

| age | −0.119 | [0.030]*** | −0.021 | [0.024] |

| age2/100 | −0.005 | [0.035] | −0.084 | [0.028]** |

| education | 0.130 | [0.015]*** | 0.137 | [0.012]*** |

| experience | 0.240 | [0.014]*** | 0.199 | [0.008]*** |

| experience2/100 | −0.291 | [0.031]*** | −0.270 | [0.016]*** |

| 1[urban settlement] | −0.030 | [0.074] | 0.093 | [0.067] |

| 1[health limitation] | −0.548 | [0.084]*** | −0.227 | [0.071]** |

| 1[severe health limitation] | −0.909 | [0.144]*** | −0.559 | [0.143]*** |

| 1[in consensual union] | 0.255 | [0.085]** | 0.021 | [0.072] |

| no. of children aged 0–6 | −0.018 | [0.068] | −0.446 | [0.056]*** |

| no. of children aged 7–14 | −0.026 | [0.055] | −0.195 | [0.044]*** |

| other market income | 0.355 | [0.155]* | −0.174 | [0.128] |

| social insurance income | −0.089 | [0.318] | −0.458 | [0.271] |

| constant | 1.476 | [0.569]** | −0.394 | [0.495] |

| rho | −0.266 | [0.078]** | 0.446 | [0.096]*** |

| sigma | 0.421 | [0.006]*** | 0.402 | [0.008]*** |

| lambda | −0.112 | [0.033]** | 0.179 | [0.041]*** |

| No. of censored observations | 713 | 1,279 | ||

| No. of uncensored observations | 2,830 | 2,544 | ||

| Log-likelihood | −2,693.9 | −2,685.7 | ||

-

Source: Authors’ estimation based on the ILCS 2016 data.

-

Notes: Maximum likelihood estimates. */**/*** indicate statistical significance at the 10/5/1% level. 1[.] is an indicator variable that equals one if the condition in brackets is true, and zero otherwise. Hourly wage is in HRK. Age, education and experience are in years. Age, education and experience are in years. Other market income and social insurance income are in tens of thousands of HRK, and both are divided by the square root of the number of household members.

Descriptive statistics for the variables used in the estimation of the labour supply model.

| Couples (N=1444) | Singles (N=1044) | |||||||

|---|---|---|---|---|---|---|---|---|

| Males (N=1444) | Females (N=1444) | Males (N=621) | Females (N=423) | |||||

| Mean | SD | Mean | SD | Mean | SD | Mean | SD | |

| consumption (C) | 11.21 | 6.27 | 11.21 | 6.27 | 7.10 | 4.88 | 7.85 | 5.50 |

| leisure hours (L) | 7.04 | 0.78 | 7.50 | 0.97 | 7.49 | 0.98 | 7.34 | 0.91 |

| no. of preschool children | 0.36 | 0.65 | 0.36 | 0.65 | 0.00 | 0.00 | 0.07 | 0.27 |

| age | 44.84 | 8.24 | 41.70 | 8.29 | 42.49 | 10.26 | 42.67 | 10.05 |

| experience | 20.68 | 8.97 | 14.40 | 10.38 | 15.62 | 11.21 | 16.37 | 11.25 |

| 1[health limitation] | 0.13 | 0.34 | 0.14 | 0.35 | 0.15 | 0.35 | 0.16 | 0.37 |

| 1[severe health limitation] | 0.03 | 0.17 | 0.03 | 0.18 | 0.04 | 0.19 | 0.02 | 0.14 |

| 1[H>0] | 0.85 | 0.35 | 0.67 | 0.47 | 0.65 | 0.48 | 0.75 | 0.44 |

| 1[H=2080] | 0.73 | 0.45 | 0.52 | 0.50 | 0.53 | 0.50 | 0.58 | 0.49 |

-

Source: Authors’ calculations based on the ILCS 2016 data.

-

Notes: N is the number of observations. Consumption is measured in tens of thousands of HRK. Leisure hours are annual and are measured in thousands of hours. 1[.] denotes an indicator variable that equals one if the condition in brackets is true, and zero otherwise.

Data and code availability

The data is proprietary. The data (referred to as ILCS in the paper) were collected by the Croatian Bureau of Statistics and are available only to Croatian scientific researchers, upon signing a special agreement.

The model is proprietary, with executable also not available.