The Emergency Family Income (IFE) in Argentina: could it become a permanent safety net?

Cite this article

as: L. E Calcagno; 2021; The Emergency Family Income (IFE) in Argentina: could it become a permanent safety net?; International Journal of Microsimulation; 14(2); 32-49.

doi: 10.34196/ijm.00235

Figures

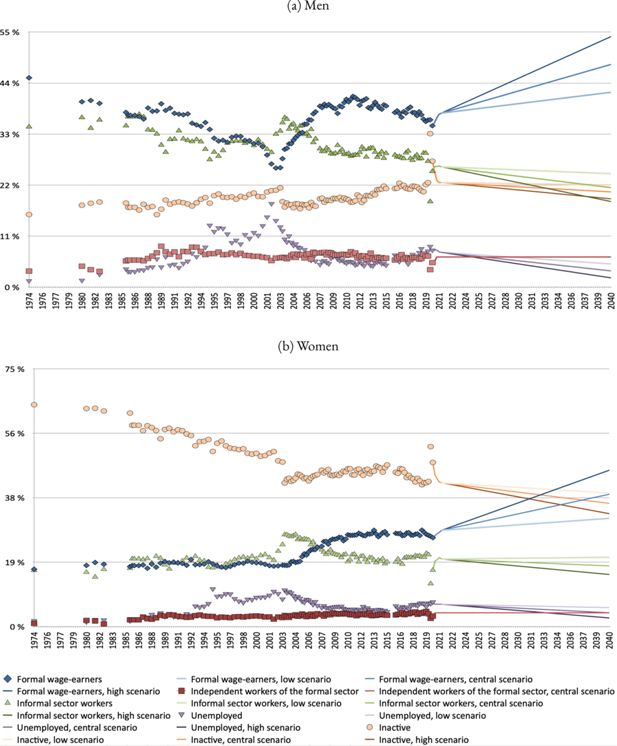

Figure 2

Labour-market participation rates for people aged 16 to 69, past rates, and projected scenarios (1974-2040). Source: historical values taken from EPH survey (1974-2020).

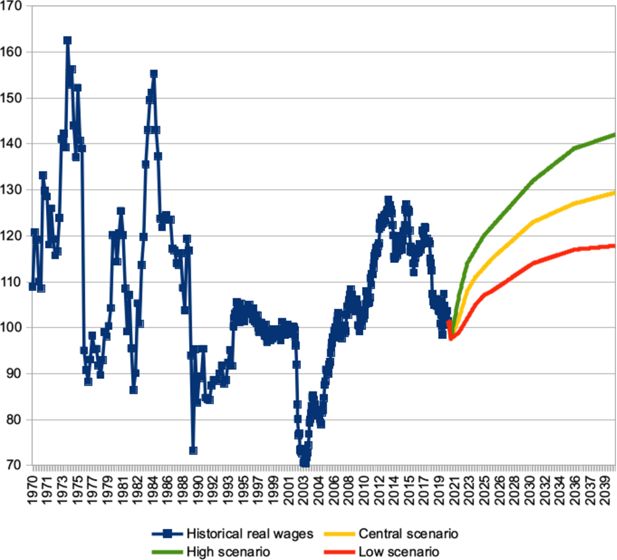

Figure 3

Quarterly real wage evolution, by scenario (1970-2040). Sources: for historical values, see Calcagno (2018). The base period is December 2006.

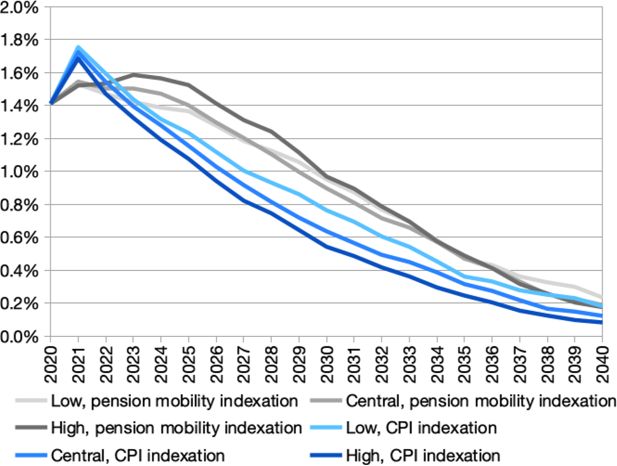

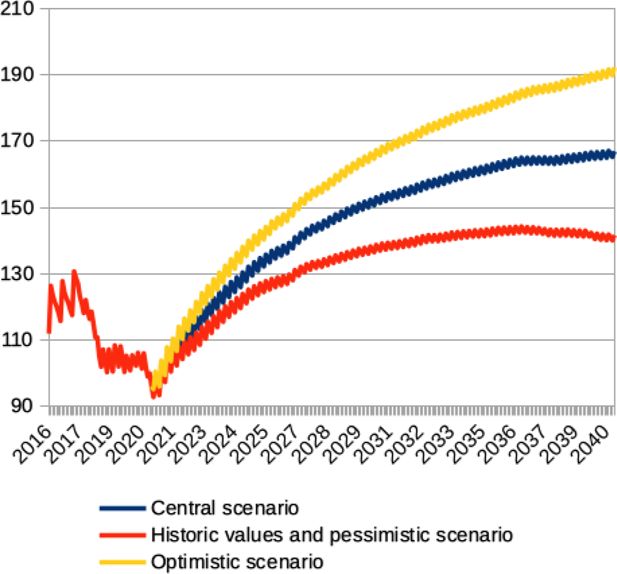

Figure 5

Real pension mobility by economic scenario (2016-2040). Note: The base period is December 2020.

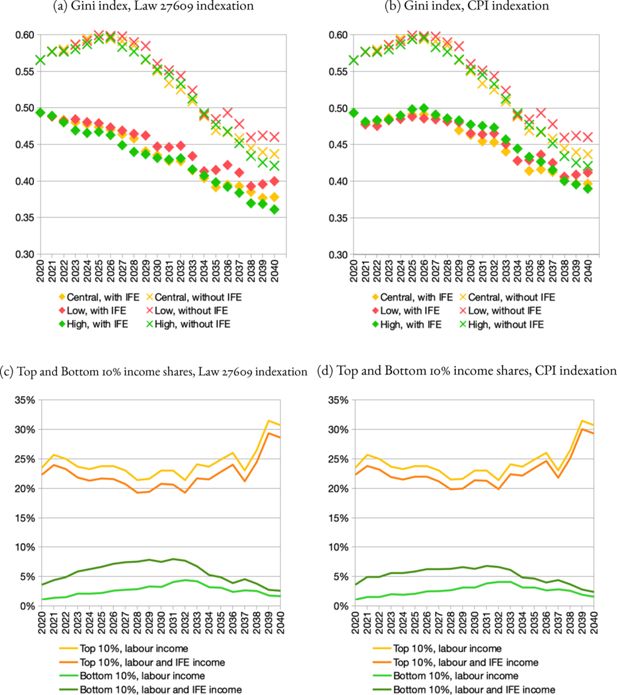

Figure 7

Gini index and top and bottom 10% share of income with and without a permanent IFE benefit (2020-2040). Note: Households with neither labour nor IFE income are excluded from this analysis. For the share of the top and bottom 10% in thetotal of a given income type however, the determination of the wealthiest and poorest households is always done with respect tototal income (labour, pension, IFE and family benefits). The Top and Bottom 10% shares are only computed in the centraleconomic scenario. Household income is equivalised following CEDLAS and The World Bank (2014), who adopted thecalibration established by Deaton and Zaidi (2002).

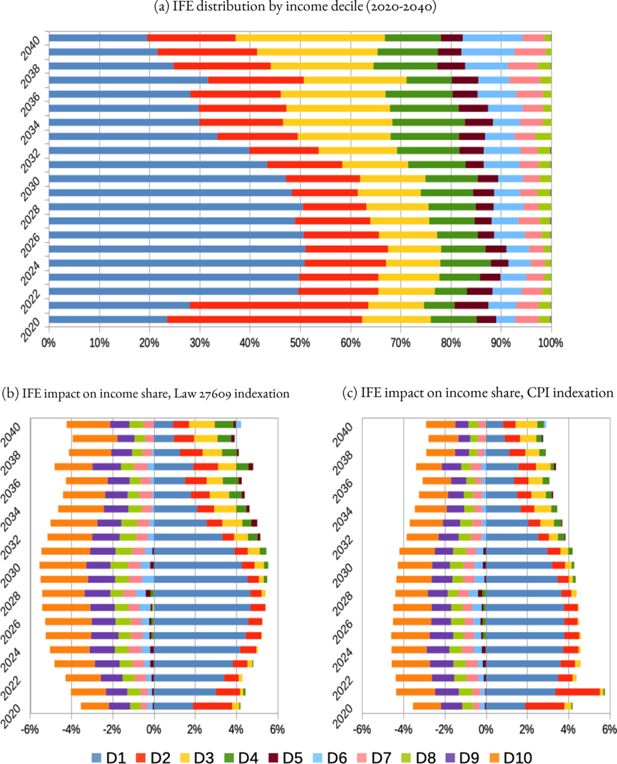

Figure 8

Distributive impact of a permanent IFE by income decile (2020-2040). Note: Households with neither labour nor IFE income are excluded from this analysis. Income deciles are however always computed with respect to total income (labour, pension, IFE, and family benefits). The income deciles are only computed in the centraleconomic scenario. Household income is equivalised following CEDLAS and The World Bank (2014), who adopted thecalibration established by Deaton and Zaidi (2002). Reading example for Figure 8c in 2021, a permanent IFE indexed on pensionmobility Law 27690 would increase the first decile income share by 3.4 percentage points, when compared to its labour incomeparticipation.

Data and code availability

The data and the code are both available, and the model is open source (developed with LIAM2). The github release for this article is https://github.com/leonardo-calcagno/MISSAR/releases/tag/v1.31, with the full code. The data and the code are also in a dedicated ZENODO repository, https://zenodo.org/record/4665857 and the DOI is 10.5281/zenodo.4665857.

Download links

A two-part list of links to download the article, or parts of the article, in various formats.