Modeling Work Incentives in Microsimulation Models

Cite this article

as: A. Klevmarken; 2022; Modeling Work Incentives in Microsimulation Models; International Journal of Microsimulation; 15(1); 97-106.

doi: 10.34196/ijm.00253

Figures

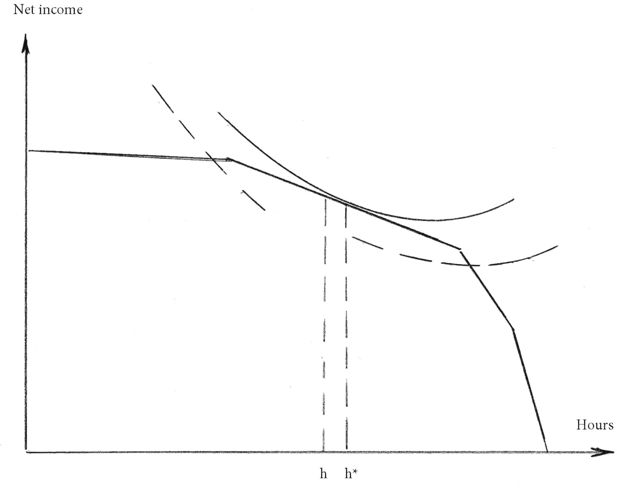

Figure 1

Budget sets for two households by husband’s and wife’s workhours. Source: Klevmarken et al. (1995) Figure 2.7.

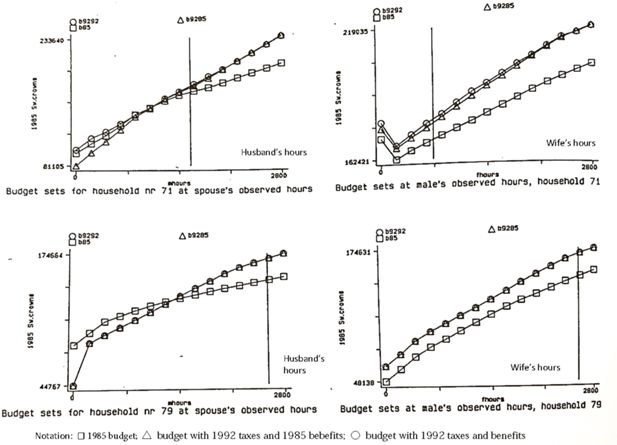

Figure 2

Median Budget sets for single women 1985 with 1985 taxes and benefits and with 1992 taxes and 1985 benifits respectively. Source: Klevmarken et al. (1995) Figure 2.8.

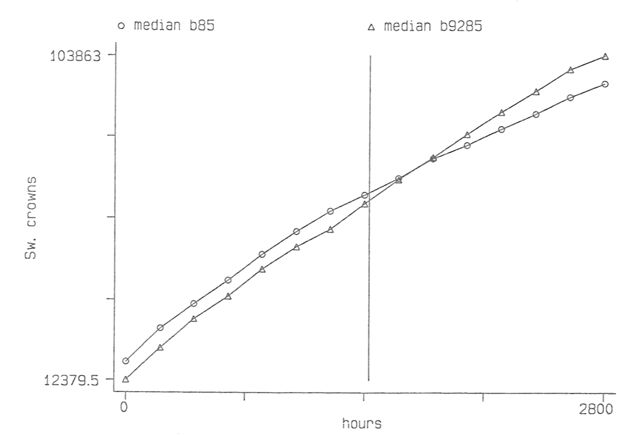

Figure 3

Quartile changes in disposable income by workhours for single women caused by the taxchanges 1985-92. Source: Klevmarken et al. (1995) Figure 2.11.

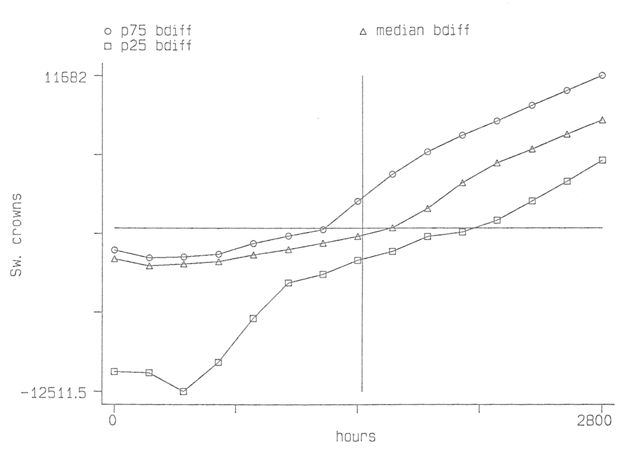

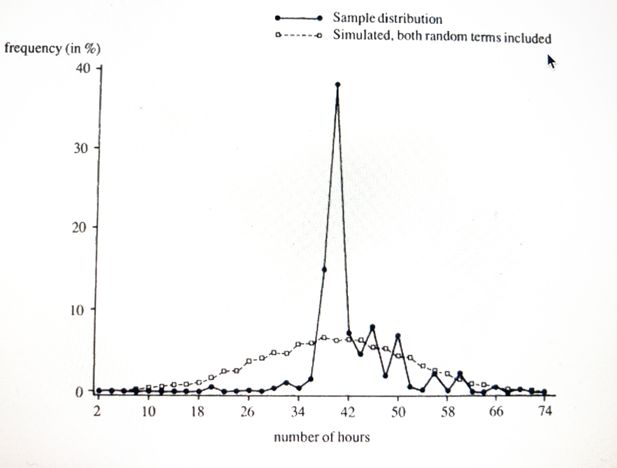

Figure 5

Distribution of working hours, males. Simulated values from a Hausman model. Source: van Soest et al. (1990).

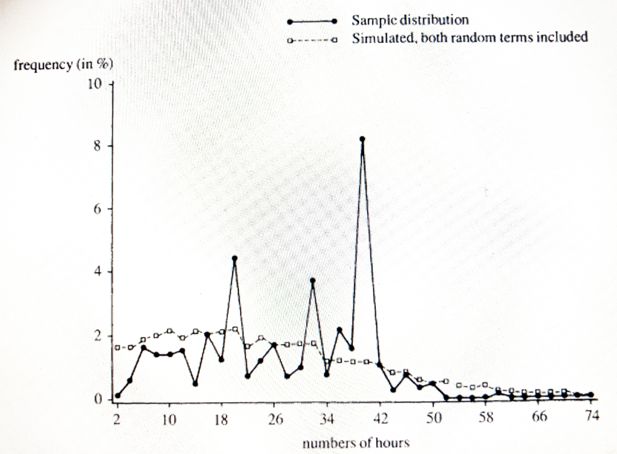

Figure 6

Distribution of working hours per week, females. Simulated vales from a Hausman model. Source: van Soest et al. (1990).

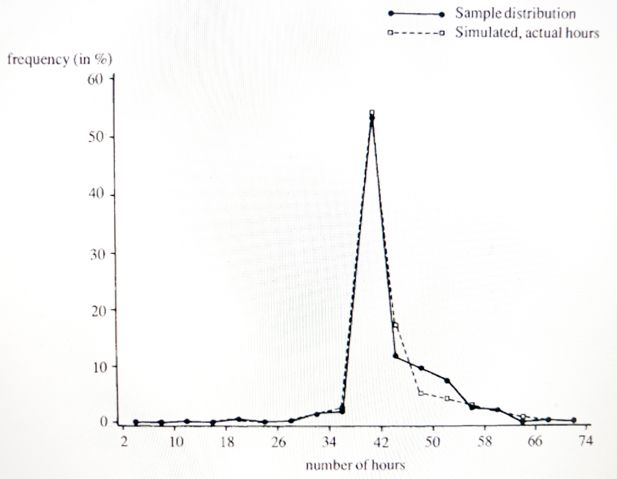

Figure 7

Distribution of working hours per week, males. Simulated hours from a model including offered hours. Source: van Soest et al. (1990), Figure 2.

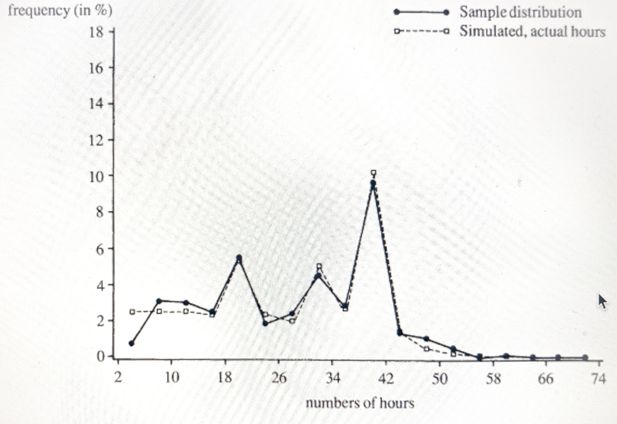

Figure 8

Distribution of working hours per week, females. Simulated values from a model including offered hours. Source: van Soest et al. (1990).

Tables

Table 1

Estimated wage rate and income elasticities from a Hausman model in MICROHUS.

| Elasticities* | Singles | Males | Females |

|---|---|---|---|

| Wage rate | 0.1433 | -0.0132 | -0.0057 |

| Income | -0.5813 | -0.1813 | -0.1493 |

| Compensated | 0.6011 | 0.1296 | 0.1119 |

-

*

Note: The last two columns include estimates for married and cohabiting couples.

Data and code availability

Please contact the authors for information on data and code availability.

Download links

A two-part list of links to download the article, or parts of the article, in various formats.