A Micro-Macro Interactive Simulation Model of the Swedish Economy

- Article

- Figures and data

-

Jump to

- Abstract

- 1. A microsimulation model of a national economy

- 2. Firm expectations and targets

- 3. Investment-financing - the long-range planning decision (sophisticated version, not yet in model code)

- 4. Production planning and labour demand

- 5. Labour market search

- 6. Exports, inventories, and intermediate goods (firm level)

- 7. Household consumption

- 8. Product market price determination, import competition and inventory adjustment

- Footnotes

- Appendix A

- Appendix B

- Appendix C

- Appendix D

- Appendix E

- References

- Article and author information

Abstract

Work on this micro based macro model of the Swedish Economy began in late 1974 as a joint project between the Federation of Swedish Industries, IBM Sweden and the University of Uppsala. This is an edited version of several instruction manuals I wrote for the coding and later programming of that model. It was published in December 1976 as "A micro - macro Interactive Simulation Model of the Swedish Economy" by the Federation and IBM in two parallel editions. A technical pseudo code to facilitate the final coding of the model in APL, authored jointly by myself, Mats Heiman and Gösta Olavi, was appended to that publication. This republication of the 1976 document, has been slightly trimmed, and lack the Foreword by the President of the Federation, Author’s Remarks, and the Pseudocode. The Pseudocode is however available from the Journal online as (Eliasson et al., 1976). It details the specifications and highlights the modular design of the model and should be helpful for anybody who might want to reproduce a version of the model.

Originally this model, called MOSES, for Model Of the Swedish Economic System, was designed to facilitate understanding and quantifying the role of markets and production firms in economy wide economic development. Of particular interest were the consequences of markets being disturbed by inflation. The modelling approach was bottom up, drawing extensively on empirical research in business economics, not least on my own study on business economic planning practices (Eliasson, 1976a). The model has a general design in that it integrates a standard Keynesian demand driven macro model with a Leontief type input output sector structure. The manufacturing subindustries, furthermore, are populated with boundedly rational (“ignorant”) firms (Simon, 1955; Simon 1959). These firms make up the core market governed supply machinery of the model, and integrate product, labor, and financial market considerations within their business plans. Firms compete in the markets of the model. Their plans and decisions are guided by Stockholm School ex ante price expectations and learning from feed backs of ex post outcome experiences. Schumpeterian entrepreneurs enter markets unexpectedly and compel incumbents to perform. Market competition thus self-coordinates the entire model economy under an upper technology constraint embodied in new investments of firms. The government may intervene in markets, but there are no artificial external equilibrium constraints imposed. I had no ambition to build a micro foundation of existing macro theory, neither has the model been designed to provide forecasts to support policy. The ambition has been to understand what government can do to the economy as one of many monopoly actors with boundedly rational insights.

The ambition was empirical, to begin with to reproduce and understand the long term and cyclical market dynamics of a Sweden like industrial economy. To that end a separate annual Planning Survey to Swedish manufacturing firms, tailored to the needs of the model, was started at the Federation. That survey will eventually provide statistics also to test the model’s capacity to generate distributional characteristics of the Swedish economy.

1. A microsimulation model of a national economy

This model is of the microsimulation kind in the sense of Bennett and Bergmann (1975); Bennett and Bergmann (1976); Bergmann (1973); Bergmann (1974); Orcutt (1960); Orcutt (1961); Orcutt et al. (1976) and Orcutt (1961). There is a difference, however, in that focus is on the dynamics of agents interacting both across markets and sequentially over time (dynamics), and that the micro units are heterogeneous production firms, rather than individuals and households that dominate the micro simulation literature. My main ambition is to explore the role of markets in macro-economic development. Hence, firms’ behavior is governed by their expectations about prices. In formulating the model, I have drawn significantly on the Stockholm School ex ante anticipations and ex post plan outcome feed backs that I experimented with in my doctorate thesis (Eliasson, 1967; Eliasson, 1969). In modelling firm planning I have drawn directly on my interview study (Eliasson, 1976a) of planning practices in European, Japanese and US manufacturing firms, that concludes (in chapter XI) with a proposed model of the firm. My ambition has been to parameterize the firm model as close as possible to the planning and decision parameters that firms’ top management recognizes, irrespective of how that design tallies with received microeconomic theory. The philosophy behind the model is that we need to understand how micro agents (firms, households etc.) interact in markets to understand economy wide behavior. I have no ambition to clarify the micro foundations of existing macro theory.

For many types of analysis, the conventional macro model does not allow the detail of representation we need, and especially not for representing agent and market behavior. Therefore, it becomes tempting to disaggregate into subsectors, and sub-sectors of sub-sectors. Quite soon we have a one thousand equation model that we have difficulties making intellectual sense of. Micro behavioral characteristics have been aggregated away, so has also been the competitive market machinery that governs the dynamic allocation of resources in the economy across decision units and over time. Neither do we know what the parameters stand for because of estimation problems like collinearity, feed backs within periods etc., and our subsectors quite arbitrarily cut right through the decision units.

In principle, however, there is no difference between macro modelling and micro to macro modelling. All entities in economics are macro in some sense. In practice there is a difference, however, since the ambition of this project is to take the analysis down to the level of a firm defined by its financial accounts that makes decisions in markets, and to study (1) the micro basis for inflation and (2) the interaction of firms so defined across markets and over time and how these market interactions affect inflation, profitability, the allocation of resources and economic growth. To model the role of markets in economy wide behavior mathematical simulation, or micro simulation is the only theoretical and empirical method available. While it allows realistic specification, parameter estimation becomes increasingly difficult. Since firms’ behavior, their interactions in markets, and how markets aggregate it all up to macro is beyond macro modelling, these estimation problems simply must be dealt with. Conventional statistical estimation methods will probably have to be abandoned and some other kind of calibration and inference method resorted to. I will address these problems as they come. Above all, empirically relevant specification comes first and should not be compromised to facilitate parameter estimation.

Dynamics is the difficult and most important problem. To deal explicitly with period-to-period market interactions over time a dynamic micro-based economy wide approach is necessary to capture the market allocation of resources across micro units and over time. This means that we will be addressing the perennial theme of how the business cycle interacts and affects long term economic growth, and Stockholm School ex ante plan ex post realization feed backs (this time at the micro firm level) will be the appropriate design for that.

To build a model of endogenous economic growth short term behavior in markets will not only be governing and affect the long term, but the entire model economy will be dynamically self-coordinated by the actors in the markets, a problem that equilibrium price taking, market clearing models have not been capable of addressing (Lindbeck, 1963). If we have built a model that can handle the interaction between the short and the long terms to our satisfaction it will be capable of handling several other dynamic problems as well, and as model work has progressed, we have begun to talk about understanding the evolution of a capitalistic market economy.

In order not to be overwhelmed by technical problems we have struck some convenient compromises of specification that do not - I believe - reduce the explanatory potential of the model, or limit further expansion of the model, or subject us to extreme estimation difficulties. The model has a modular structure based on my experience from the design of business planning systems (Eliasson, 1976a) that will facilitate future developments of the model. For the time being we have constructed a conventional, and in no way complex economy wide model within which a micro (firm) specified manufacturing industry operates. This approach allows us to keep our special features: namely a micro specification of the behavior of three integrated markets: The labor market, several product markets and a financial system, a bank. And these three markets, as we will see, will be integrated from period to period within the business plans of individual firms.

We must also keep in mind that the prime ambition with this modelling project is to have a richly specified model structure capable of responding to a spectrum of interesting what if questions. The purpose is analysis and understanding, not forecasting.

This first section will contain a non-formal overview of the model . There will be an account of the estimation or calibrating principles involved and a few words on the empirical philosophy or the method: Does it differ from conventional econometric method?

This first section is self-contained for those who are only interested in what the model is all about, without understanding how it functions. The following sections were originally designed as instructions for coding the model, with associated comments for possible external users .

The model has a modular structure in the sense that module interfaces are well defined and often in the form of market interfaces. Some modules can be closed, and others added without necessarily recalibrating the entire model. The firm model is a typical module, each with a well-defined market interface.

1.1. Model overview

Table 1 shows the main modules of the model and their connection with the external world. There are in practice only four sets of exogenous variables:

Foreign (export) prices,

The foreign market interest rate,

The labor force, and

The rate of change in productivity of new investments globally available,1

Model modules

| Business system (manufacturing firm model) |

|---|

| Operations planning (short term) |

| Production system |

| Inventory system |

| Expectations |

| Profit targeting |

| (Cash management) |

| Investment-Financing (long term) |

| Investment plan |

| Long term borrowing |

| Household consumption (macro) |

| Buying/consuming |

| Saving |

| Service sector (macro) |

| Government sector (macro) |

| Employment |

| Taxes/transfers |

| Economic policy |

| Note: So far only Government employment has been entered into model, and government production is assumed to be proportional to government employment . |

| Other production sectors (six sectors from input/output table) |

| Foreign connections |

| Prices - exogenous |

| Exchange rate exogenous |

| Interest rate - exogenous |

| Export volume- endogenous for each firm |

| Import volume- endogenous (macro) |

| Trade assets and debts (endogenous by firm) |

| Markets |

| Labor market |

| Product market |

| Financial market (a bank) |

| Exogenous variables |

| Foreign prices: one for each of the four sub markets of manufacturing |

| Foreign Interest rate: |

| Technology: The rate of change in labor productivity of new investment vintages. |

| The labor force. |

One can therefore say that this model economy (of Sweden) has been placed in a global (market) price system (product prices, rate of interest) and (as we will see) a global pool of new technology that firms access through their endogenous investments. The model economy is therefore populated by heterogeneous firms forming expectations about market prices that all operate sequentially under an upper exogenous technology constraint, all market prices, except the foreign ones, being endogenously conditioned by feedback experience from the realization from period (quarter) to period of uncountable confrontations of inconsistent plans in the markets of the model.

The four micro defined markets of the model operate by quarter and generate a set of future quarterly values on the exogenous variables. They are Raw materials and basic goods (RAW), Intermediary products (IMED), Durable (Investment) goods (DUR) and non-durable consumption goods (NDUR). To scale the model up to Swedish National Accounts (NA) level the remaining seven production sectors, including government production, agriculture, mining, construction, transportation, electricity generation and other services are represented in macro by their input output sectors.

To begin with, and for technical computer capacity reasons, the standard time horizon we have in mind is around five years, or one business cycle. The model runs sequentially by quarter, or a normal production planning period in manufacturing (Eliasson, 1976a). I will come back to the horizon problem below. However, even if our attention is restricted to a 5-year time span, much of the calibration work requires that we check model behavior over a much longer period (see section 3).

The best way to proceed from here is to go through the central modules of the model one by one.

1.1.1. Business sector – short run production planning

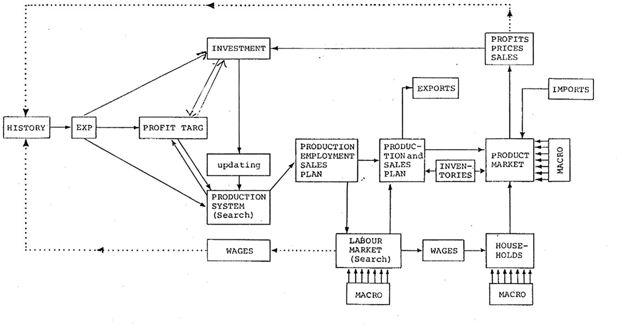

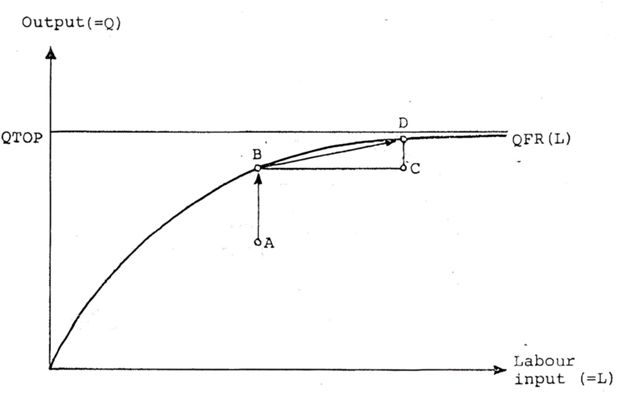

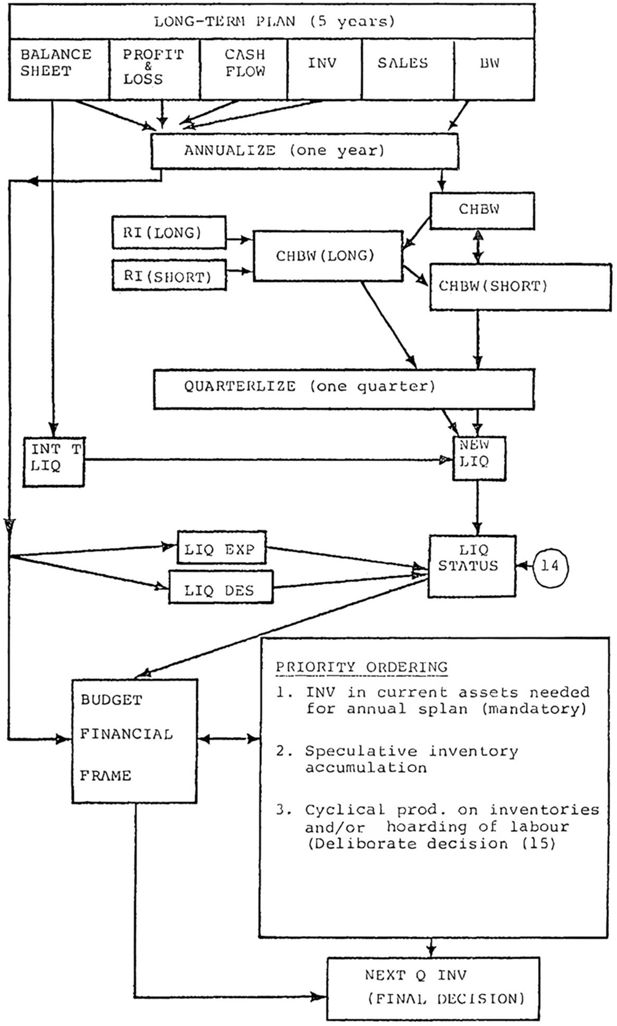

Figure 1 is a flow-chart overview of the short-term decision system of one firm. Figure 2 gives details of the production system.

The Micro Macro model has been designed on the interview experience documented in Eliasson (1976a) and reflects management planning and plan revision practices in sufficient detail to make decision parameters recognizable to top level management. Plans and decisions are based on statistical information collected from firms’ own statistical accounts in a special annual survey (The Planning Survey) conducted from 1974 by the Federation of Swedish Industries (see Virin, 1976). In Figure 1 an experimental run begins from an initial state of data collected among other places from that Planning Survey. At the left-hand side the model firm begins planning from a vector of firm {P, W, M, S} historic (5 year annual) product price, wage, profit margin, sales and capacity utilization etc data.2 The questions in the Planning survey have been formulated on the format of the model, and are compatible with the internal statistical systems of firms (Eliasson, 1976a). The historic initial state vector is converted into firm expectations in the EXP module. Here quadratic adaptive smoothing formulae are used, complemented with an error correction component and a risk aversion factor (see Section 2.3). In model simulations a complete set of new initial state data is endogenously computed from quarter to quarter. A calibrated model can therefore be run on given (known) exogenous data up to the present time and then be reloaded with new planning survey data and thus set up for new “empirical experiments”.3

The profit margin variable is translated into a profit margin target in the TARG block (Section 2.1). Profit margin targeting is modelled on the Maintain and Improve Profits (MIP) principle found in Eliasson (1976a) to be standard practice in business planning. It can be demonstrated to approximate an ex-ante wealth (net worth) maximizing principle that is revised every quarter (see reference and below). Here we also use a conventional smoothing formula. The length of historic time considered is longer than in the EXP sector.

Growth expectations feed into the investment module to generate long-term plans as explained below. Long-term expectations are also modified to apply to the next year and are fed into the production system.

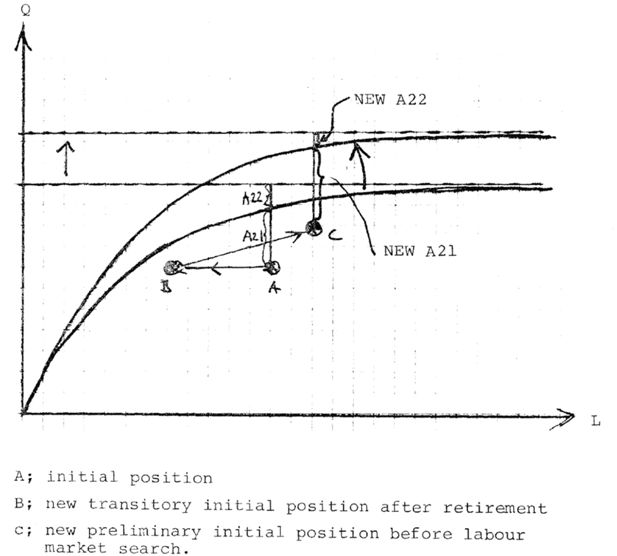

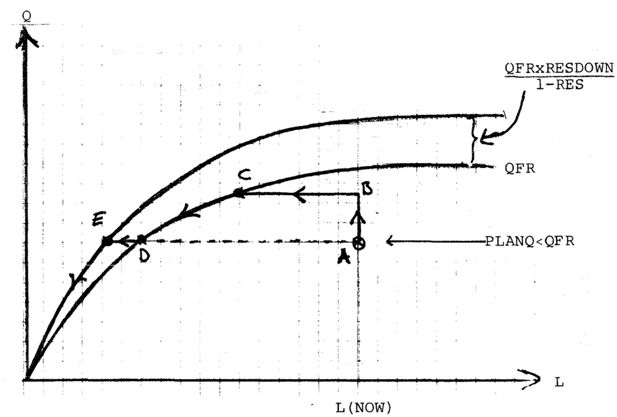

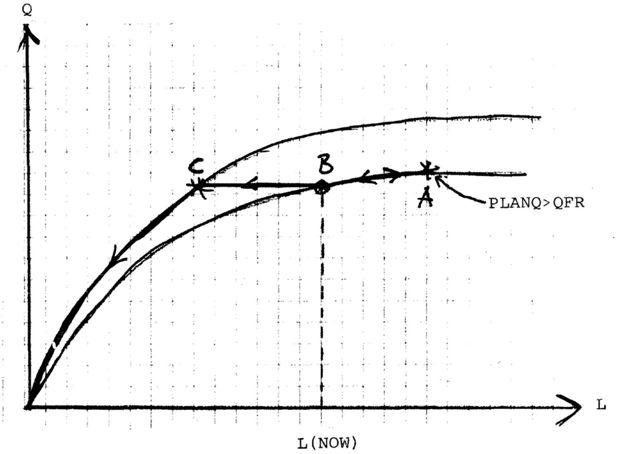

Each period (quarter) each firm is identified by a production possibility frontier (QFR(L)) defined as a function of labor input as in Figure 2 and a location below that curve.4 The distance between A and B measures the increase in output Q that the firm can achieve during the current period with no extra labor input as indicated by the L coordinate in A. In practice a vertical move between A and B cannot be costless. For the time being we abstract from that.

Suffice it to note that in those experimental runs where we have investigated this aspect there seems to be a general tendency among firms to be operating in the A, B range, which is constantly shifted outwards by investment.

The distance CD measures (for the same period) the extra increase that the firm is capable of, with the application of extra labor, but staying within a commercially viable operating range. Approximate data on A, B, C and D are collected in the annual Planning Survey for 1976 by the Federation of Swedish Industries (Virin, 1976).

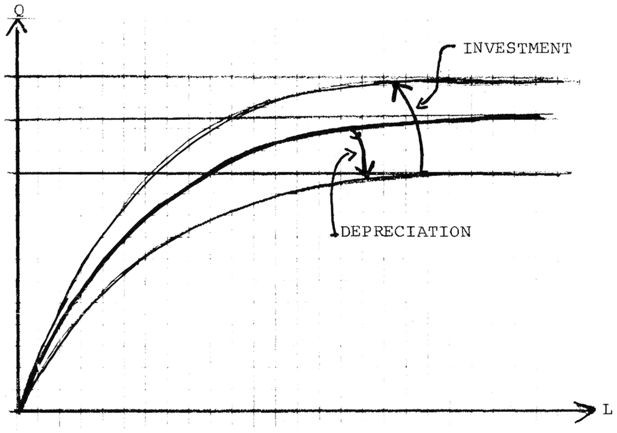

The production function QFR(L) in Figure 2 is of the putty-clay type and can be directly estimated on the data collected in the Planning Survey. New investment, characterized by a higher labor productivity than investment from the period before is completely “embodied” with the average technical performance rates of earlier investments through a change in the coefficients of QFR(L).

The first sales growth expectation of a model firm from the EXP module starts a trial move from A in the direction indicated by EXP (S). After each step price and wage expectations are entered and checks against profit margin targets made. As soon as the firm M-target is satisfied, search stops and the necessary change in the labor force is calculated. If it means a decrease, workers are laid off. If an increase, the model firm enters the labor market to search for new workers (see section 4). After this search has been terminated the firm can calculate its output for the period. The wage level has been determined and is fed back to update the historic vector (dotted lines in Figure 1). The firm now checks its ex ante data against finished goods stocks to determine how much to supply in the market. A certain fraction, determined by the last period’s relative domestic and foreign prices is delivered to export markets. The final distribution between sales and inventories for each market and the price level are determined in a confrontation with inputs and household demand (middle right end of Figure 1 and lower end of Figure 3) to be described section 8.3. Final price, profit and sales data have now been determined and are fed back into the historic vector of each firm (dotted lines).

1.1.2. Labor market

The labor market process is represented in micro in considerable detail. At this level, however, requirements on relevant specification are still higher. Hence, the version now to be described should be considered provisional and experiments conducted so far have taught us that model behavior is too sensitive to variations in the random search sequences that (in combination with a small number of firms) determine how, and in which order among the firms one firm recruits.

Labor is homogeneous in the present version of the model. The productivity of one worker is determined by the machine capital of the firm that employs him, a specification that is appropriate for large parts of manufacturing, which means that labor productivity both varies a lot across the firm population and is updated for each firm each quarter (see below).

The first step each period is an adjustment of “natural” decreases in the labor force of each industry and firm unit through retirement. This adjustment is applied proportionally throughout. Then the unemployment pool is filled with new entrants to the labor market. After that the service and Government sectors enter the labor market in that order. They offer last period’s average wage increase in the manufacturing industry and get whatever is available from the pool of unemployed. This sounds a bit arbitrary, and it is. We have had to enter this specification provisionally to allow for the fact that wage and salary levels differ significantly between subindustries even though labor is homogeneous. The assumption that the export oriented manufacturing is the wage leading industry is conventional in macro modelling. It is of course not quite true at the micro level. With no explicit separation of wage levels (because of skills etc.) and little knowledge as to how the government, service and industry sectors interact in the labor market, this macro simplification will have to do for the time being.

After the service and government sectors have done their recruiting, firms enter one by one in the order by which they need to increase their labor force. They scan other firms, including the pool of unemployed. The probability of hitting a particular location of labor supply is proportional to its size (labor force and the number of unemployed compared to total labor force).

The firm offers a fraction of the expected wage increase. From the pool of unemployed people are forthcoming at the wage offered if it exceeds the unemployment benefit. If a firm is raided (for workers) by a firm with a wage offer that is sufficiently above its own, the raider gets the people it wants up to a maximum proportion of the raided firm’s labor force. The raided firm then adjusts its wage level upwards with the difference observed and revises its production, employment, and investment plans for the new data.

If a firm raids another firm with a higher wage level, it does not get any new workers but has to upgrade its offering wage level and revise its production plan for the next trial. After search is over, firms with relatively low wages, that have learned about the market wage levels around them, have had to upgrade their own wage level by a fraction of the differences observed.

Firms can be allowed any predetermined number of trials each quarter. Obviously, the size of wage adjustment coefficients and the number of trials (intensity of search) each period determines the degree of wage differentiation that can be maintained in the labor market under the homogeneity assumption. We will experiment with various impediments to this adjustment process. We can note already now that overall macro behavior of the model is very sensitive to the time reaction parameters of the labor market.

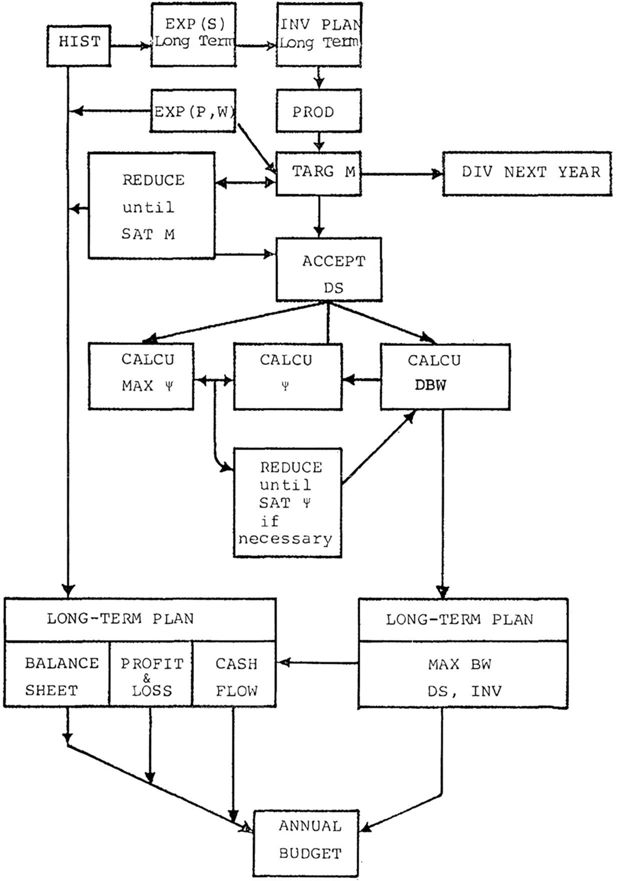

1.1.3. Business sector: Long-term investment financing (One firm)

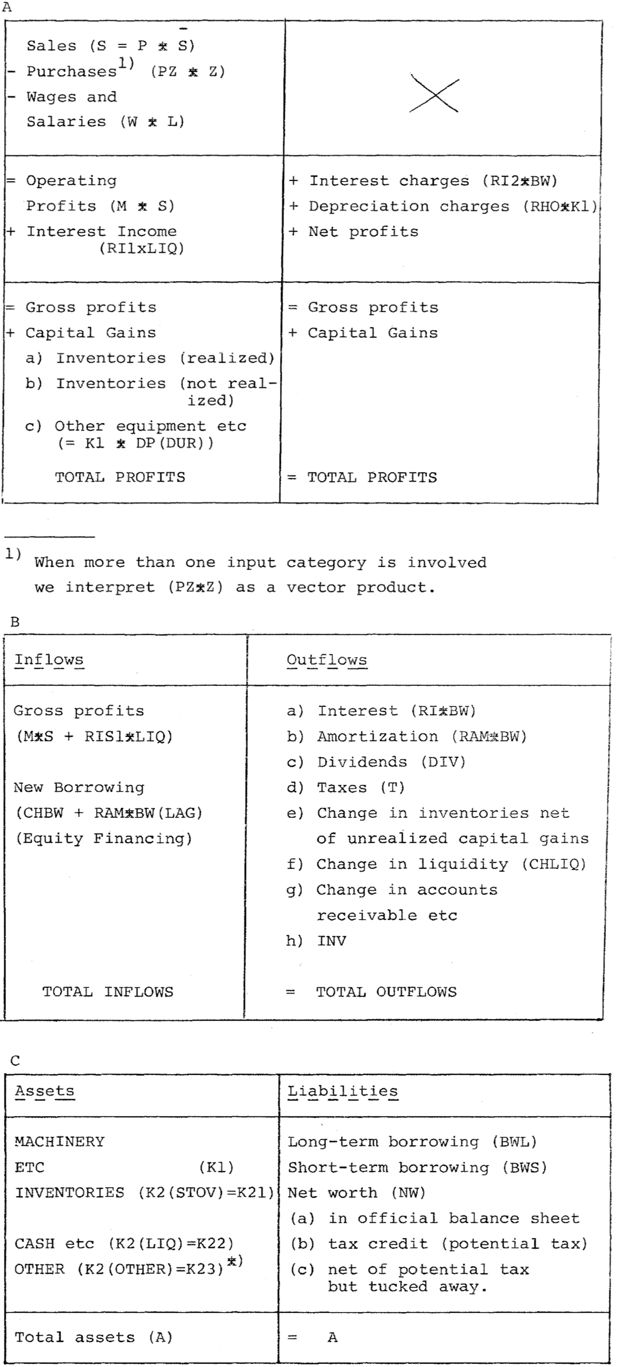

Operations planning described in the previous section and long-term investment financing decisions now to be presented are organizationally separated. The two planning decision sequences are integrated in the current (quarterly) financial plan, where the firm interacts with the short-term money market (“the bank”). This organization of decision making corresponds nicely with actual practice in large firms (Eliasson, 1976b). Throughout modelling work great care has been taken to make sure that no “leakage” occurs, and that all stock and flow accounts at micro (firm) and macro levels are consistently maintained from period to period. For the time being we use a simple investment decision routine (that is now in the program). The sophisticated, real-life imitation in the main text has not yet been codified in the program. It is exhibited in Figures 4 and 5 .

As in short-term planning a vector of historic Price, Wage, Profit margin and Sales (P, W, M, S) data generates a future long run EXP(P,W,S) vector and a long-run TARG(M) vector. The idea is that long-run expectations catch some long-run trend, that will guide investment decisions. Short-term expectations are formulated as a deviation from that trend.

Long-term EXP(S) initiates a calculation scheme that gives a preliminary investment plan. This preliminary investment plan is fed through the production system, described earlier, and combined with EXP(P) and EXP(W). There is a check whether the sales, investment plan combinations meet profit margin targets. If not, sales and investments are reduced until SAT(M) (see Figure 3). The convexity of the production system assures that corrections are downward. The long-run plan, furthermore, is based on long-run normal operating (capacity utilization) rates. Once this provisional plan has been reached, the firm has expectational control of future (5 year) profit performance. Then dividends (DIV) are decided for the next year. Dividends are fed into household disposable income.

The next step is to check the financing consequences of the provisional growth plan. A maximum gearing (leverage) ratio or the ratio between debt and net worth (ɸ = BW/NW) is currently calculated as described in Appendix C. The idea is that the ratio between the expected excess cash inflow and firm net worth determines the risk associated with new borrowing and will determine how the firm’s interest rate deviates from the local Swedish interest rate. Excess cash inflow is calculated within a typical budget framework. The maximum gearing ratio (MAX ɸ) is then assumed to be a function of the expected nominal return to total assets less the rate of risk taking and the nominal rate of interest. The expected gearing ratio (EXP ɸ) and rate of borrowing associated with each growth (S, INV) plan can then be calculated.

The provisional (S, INV) plan arrived at earlier is now checked against MAX ɸ, and modified downwards until below MAX ɸ. The convexity of the production system again means that a lower growth plan means higher M ex ante. We now have all the data needed to build a long-term plan around the conventional budget framework; a set of future balance sheets, a 5-year profit and loss statement and a 5-year cash-flow chart.

To be noted is that no decisions have been taken so far, except those related to fixing numbers in the plan.

We have now arrived at the investment plan for the annual budget. This is shown in Figure 4. The first year of the long-term plan is separated out and modified to fit next year, e.g., with respect to the expected business cycle. The format is the same as for the long term plan, but more details enter.

It is now time for planners to assess the credit market situation. The long-term and the short-term interest rates are compared with total borrowing requirements from the long-term plan. This decides long-term borrowing for the year. Note that this is the first decision to act that has been taken so far in long-term planning. It has been based on expected market prices, and therefore represents an instance of price setting autonomy, and a departure from the price taking assumption. This means that short-term borrowing is either planned to be reduced or increased at the going short-term interest rate to make up for the estimated difference in the annual budget.

Next, the annual budget is broken down into quarters.

The initial liquidity position is compared with the new liquidity position based on the first quarter of the annual budget. These data are in turn compared with expected liquidity over the budget and long-term plan and compared with desired liquidity. From this the financial frame of the budget per quarter is derived.

Mandatory requirements on finance from working capital etc. are subtracted. After this, what is left is allocated to investment spending. The decision is now final for each quarter. This corresponds to what is called the appropriations procedure in budgeting practice (Eliasson, 1976a).

New investment brings with it global best practice technology, which defines an upper boundary on productive capacity of the firm. The way investment affects the production system is described in section 4.

Also note that budget assumptions may go wrong ex post. The buffer that takes up the needed adjustment is liquidity and/or short-term borrowing.

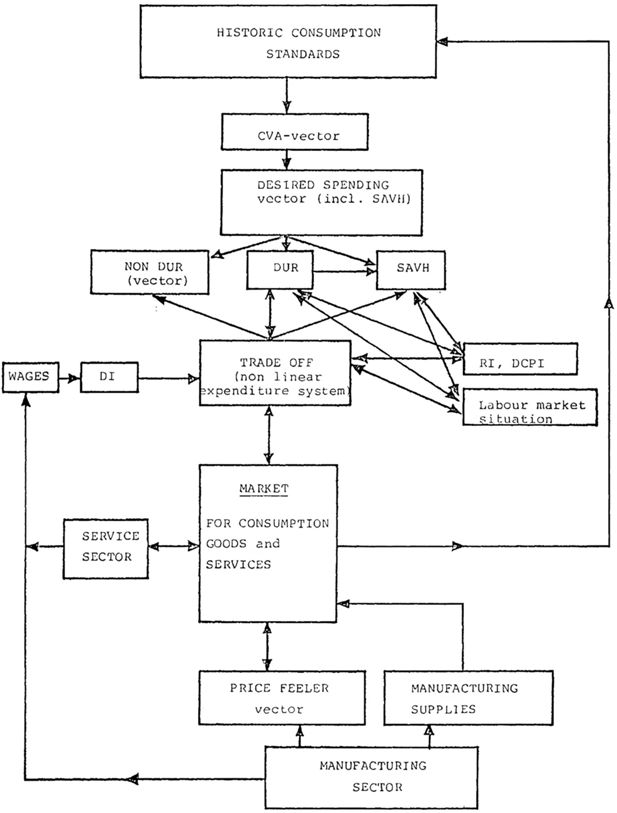

1.1.4. Household consumption

For the time being the household sector is specified in macro. We need however gather up all incomes generated in production and feed them back through the tax and transfer system and through households and the public sector as demand in a stock flow consistent manner. The household module has been prepared for an easy transformation into micro in the sense that macro behavior will be assumed to be formally identical for each micro unit (household), the only difference being the numbers we place on various behavioral parameters. The prime reason for staying at the macro level is empirical. There is practically no micro data for Sweden available on which to build a sector with heterogenous households. This is in marked contrast with the situation in the U.S., where practically all work in microsimulation has been conducted on the household sector by Orcutt and others. Besides, the author himself does not have the same kind of background experience on studying households as he has on manufacturing firms.

The consumption function is a Stone (1954) type linear expenditure system with some non-linear features added. Basically, the household is seen as a combined consumer, saver and investor governed by a Friedman (1957) type permanent income consumption propensity under a Modigliani – Modigliani and Brumberg (1955) life cycle plan. One technical novelty is that saving is treated as a future consumption (spending) category in that households aim to keep a desired financial wealth that is proportional to disposable income. Even though that doesn’t come out explicitly in macro, and may sound odd for a household, households will then have to aim for having a positive wealth balance at the expected “end of its life” for precautionary reasons. There is also a direct short-term interaction (swapping) between saving and spending on household durables, entered as a function of the rate of interest, inflation, and unemployment changes (see Section 7).

The household spending decision is described in Figure 3. Each period a vector of historic consumption data is transformed into a vector of addicted spending levels which in turn are translated into desired spending by nonlinear transformations. Desired spending is decomposed into several kinds of nondurable consumption (including services), durables and “saving”.

In another end of the model the manufacturing, service and Government sectors generate income that after being taxed feeds back into households as disposable income.

There finally remains a residual (positive or negative) between desired spending and disposable income. This residual is allocated on different spending categories by way of marginal elasticities that differ from those that divided up total desired spending.

This is the way product market dynamics takes place. Firms send out price signals and announce their supplies at those prices. Households signal back what they will buy at these prices and there follows a predetermined number of artificial market confrontations before any trading takes place. The last price signal vector then becomes the ex post price for the period (quarter), and firms split their available output between domestic sales, exports and inventories on the basis of this price. When firms decide on preliminary supply volumes to offer in the market, they each check back at their finished goods inventory positions. The guiding principle is to maintain the price level that has entered the production planning-supply decision and to try to move inventories towards “optimum” levels within a predetermined min-max range (see Section 8).

1.2. Supply and demand market non clearing dynamics

Interesting economy wide dynamics arises when ex ante incompatible supplies of heterogeneous firms and demands are confronted in the three markets of the model, during periods and between periods (quarters), and firms constantly must revise their plans because of mistaken expectations. This dynamic relates to the ex ante ex post dichotomy of Stockholm School economists that I used to “explain” revisions of investment plans by firms in my doctorate thesis (Eliasson, 1967; Eliasson, 1969). The non clearing market dynamics that arises at the micro level is no transparent analytical story, and it should not be made up as such. We have learned about its economy wide importance through simulation practice when trying to calibrate the model. Only in the very short run, we have understood, is it acceptable to abstract from market price quantity inconsistencies that keep markets from clearing. They are everywhere present but tend not to go away and often cumulate into major economy wide change. As you experiment with the micro to macro model you learn how to identify the origin of consequent economy wide changes, that as a rule have been found to have empirically reasonable explanations, thus our emphasis on empirically relevant specification, high quality data and proper parameter calibration. Familiarity with some details of the model is however needed to understand the nature of this complex market interaction dynamics, so I will come back to it in Section 8 when the whole model has been presented in sufficient detail. One example could however be mentioned already here, since it can be analytically predicted, and may be important, but was discovered when preparing for some experiments aimed at establishing the market relationships between technological change on the one hand, a micro level phenomenon, and macroeconomic growth and employment on the other. Since firms are constantly operating way under their potential (section 1.1.1. and Figure 2), and with equipment that is far below the best practice productivity standard that comes with new investment, as our statistical data show, the question constantly popped up; Why not force firms to raise output, or shed redundant workers to raise profits. As the model has been designed it all depends on how markets that relate technology and employment to economic output function. So, the natural way to enforce that outcome in a model with explicit markets and empirically well documented firm behavioral characteristics, is not to change firm behavior, but to raise market competition. What happens, for instance, if some managers in the most profitable firms try to capture the potential profit opportunities of available new technology by raising investments and their rate of recruitment of additional workers. This not only increases their growth, but raises competition with other firms for limited resources, and forces other firms to react in order not to be forced out of the market. If all firms try to outcompete each other through investing and recruiting workers from each other, prices on inputs, and notably wages, will be bid up and stop the process long before all workers have been hired by the most productive firms, and the most productive firm has substituted the globally best technology (through investment) for its existing production equipment. So that “neoclassical optimum” is unreachable in the short run because of steeply increasing costs trying to reach it. But since remaining incumbents have now upgraded their technology (productivity) performance, and even more productive new technology will become available through new investment, the next period will offer even higher levels of technology for everybody to learn from and access through new investment. The “optimum neoclassical “state of the economy will therefore still be as unreachable as before, not only because of the steeply (endogenous) cost increases experienced in trying to reach it “immediately” , but also because (endogenous) structural change has altered its location . In neoclassical terms, trying to exploit the technological opportunities too fast, model firms run up against steeply diminishing returns, but the explanation is not neoclassical and a property of the production function, but depends on steeply rising market transactions costs in trying to get there too fast. Over the longer-term investments and the introduction of new technology in all firms caused by increased competition will however represent a collective body of new technology for firms to learn from that gradually lifts the short term constraint. In models without markets, such as traditional neoclassical macro sector models, for instance the Johansen (1960) sector model “of economic growth”, that lacks markets, that explanation is lost. It makes sense in future simulation experiments to keep our eyes open for these effects, since our micro based macro model will not only generate new economic phenomena, perhaps not thought of before, but also allow new and economically more relevant explanations.

1.3. Estimation method

Even though based on a micro foundation this model addresses typical macro-economic systems problems, related to inflation, the allocation of resources and the determinants of economic growth.

The advantages of the micro to macro approach are many. We can move specification down to typical decision units (the firms) instead of having to deal with relationships between statistical artifacts at aggregate levels when it comes to observation and measurement. We can draw upon the wealth of high quality statistical micro information that exists in firms. We don’t have to make obviously false ceteris paribus assumptions associated with partial models. We introduce measurable concepts that are well known and easily understood, several of them being decision parameters that firm managers recognize and know how to use. Above all, we have designed a consistent “measuring grid”, a taxonomy, by which micro statistics are organized consistently within the framework of the national accounts. This reorganization of a consistent micro to macro database featuring both stocks and flows has already been found worth the modelling effort, by making the model useful for statistical organizing purposes.

With the higher ambition to eventually use the model for empirical studies on the Swedish economy, this approach presents us with one large obstacle. Realism in specification in combination with explicit modelling of dynamic market selection means selection based economic growth and an initial state dependent and highly nonlinear model. This necessitates that we at least for the time being give up on well known, standard econometric estimation techniques, as far as several sections of the model go. In a way, however this is a common experience with practically all large-scale macro models, only that initial state dependent nonlinear models based on selection make the problems much more difficult. There is however one decisive advantage with microsimulation modelling. All models are based on a priori specifications that condition estimated parameters, as well as the interpretation of empirical results. A well-researched prior specification of the model, as in our case, therefore, enters as exogenous and reliable information and should, in that respect, make estimated parameters more reliable, even though more difficult to obtain. When the estimated parameters cannot be stochastically interpreted, we talk about calibration, and we must decide for ourselves on the relative importance of relevant specification and reliable parameter estimates when interpreting the simulation results.

Our model is primarily designed to address problems related to the behavior of the macro economy. This means that its use should in principle be up to the same requirements as those of conventional macro models. This might, however, erroneously be taken to mean that requirements on relevance in micro specification are less demanding in macro modelling than in our micro to macro model. Quite the opposite. The main ambition of our entire modelling project is to understand how an economy can be self-coordinated by agents competing in markets, all taking place under an upper technology constraint (see below). Hence, firm behavior in markets will have to be explicitly represented and modelled, and in future hopefully also households and individuals. Macro models have nothing to say about this. Only if those micro specified market selection phenomena can be demonstrated to have a negligible influence on the behavior of the economy at large could one be satisfied with simple macro relationships. But before you hasten prematurely to such an assumption you must study the relevance of that simplification, at least theoretically. And that can be done by studying the mathematical properties of our model through simulation analysis. Early trial simulation experiments also suggest that it is not acceptable to neglect the role of markets and selection in macroeconomic behavior. Micro and markets seem to matter significantly for macro. Our modelling ambition therefore appears to make sense, and macroeconomics perhaps be in for a future problem of irrelevance.

All economic models are partial in some ways, and the art of economic analysis is to choose a partial model where all relevant aspects of the problem to be solved have been incorporated a priori. The modular specification of our micro to macro model, and the sequential relationships between modules mean that perhaps in future we might be able to device methods to estimate modules, or clusters of modules separately, and then assemble them into a whole, and that we don`t have to get the full possible micro specification right in the first implemented version of the model. The design of the model can be continuously improved as we learn more from its general theoretical properties and get more test data. Such is at least the modelling strategy. As we confront the model with new empirical data it becomes important that we find a method to discard incorrect alternatives only, without running the risk of throwing out correct alternatives. This also means that the modelling effort has been defined as a never-ending experimental process that is continually improved - or abandoned - as it is confronted with new test information. By this reformulation we have made a virtue out of the estimation difficulties.

The estimation problem has, however, to be faced squarely when it comes to quantification. A forecast had better be quantitatively right, and even though Friedman (1953) argued that the model was OK if its forecasts were correct, this cannot be taken seriously if you want to understand what you are doing. And a model that has generated correct forecasts for some time might be entirely wrong the next time, and if that matters for your decision, you had better understand that ahead of time. Beliefs are also a private problem. Beliefs certainly enter all decisions. When it comes to convincing outsiders, they must believe in what you advise. Empirical credibility becomes an issue, as for instance in economy wide cost benefit analyses of politically sensitive decisions to be taken, for which the model we are now putting together should be a superb tool (Winkler, 1967). What happens to the economy if you do this? Following a generally agreed on estimation or calibration protocol will therefore be a credibility issue in the longer term, however well specified the model.

Right now, the empirical issue however is how to calibrate the parameters of the model to be able to meaningfully study the theoretical properties of a complex model that resembles a Sweden like advanced industrial economy. And that is difficult enough. Several combinations of parameters should be expected to generate model output that resembles the numbers generated by the Swedish economy. Statistical testing of well-defined parameter combinations against historic data from the Swedish economy should be the method to discriminate between them. Fortunately, perhaps, our experience has not been of that kind. We have rather found it difficult to find one good alternative. Hence, we must turn our problem formulation around again. For those specifications that we are, so to speak, satisfied with in terms of their ability to trace economic development well, we must devise techniques to check that we have not happened to come upon a specification that is incorrect. And if we happen to find several specification alternatives among which we are unable to discriminate, we simply need more empirical data to choose. Thus, for instance, inflation is currently a great policy concern. We have also found that inflation tends to feed through model firms' expectations, and not only affect their production, recruitment and investments, and their willingness to raise wages, but also tend to get stuck in, and even overrshoot in future periods' expectations. To understand this economy wide market dynamics better and to help calibrate the model an econmetric study has been carried out at my Federation department Genberg (1975). Implications are that the macroeconomic risks of inflation do not only run through wages, as suggested by partial macro models, but also, and perhaps more importantly for the longer term, distort investment decisions and the allocation of resources. Search techniques to fit simulation models automatically to test data have been developed for simple cases (see Powell, 1964; Powell, 1965). To begin with we are working with a similar hands on manual calibration procedure (see 1.3.3 below), but hoping to come up with a more sphisticated computer based method in the future. In science, as in decision making, it is often far more important to see clearly what one doesn't know, than to be able to account for one’s knowledge. Hence the importance of getting the specification of the model right. This is also the way we go about estimating the parameters of the model.

Since the short and the long terms cannot be kept apart, as is commonly assumed to be possible in comparative static analysis, a different and more difficult comparative dynamics problem must be addressed. We have found through experimentation, however, that some sets of parameters have a unique influence on long-run trends, others on cyclical behavior around these trends and others again operate both in the long and the short run. We have used this experience to devise a two-stage parameter calibration procedure.

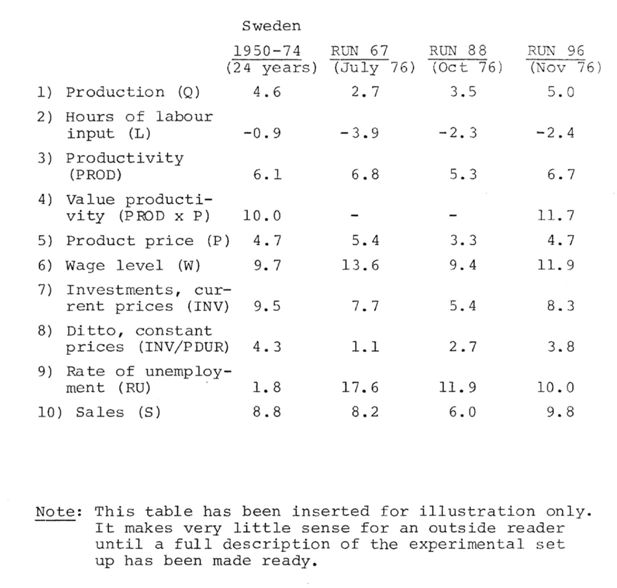

The first step is to calibrate the model so that it traces a chosen set of long-term trends of the Swedish economy, disregarding altogether the cyclical aspect. Figure 6 gives the reference trends and tracing performance of some recent experimental runs.

The second stage involves tracing the cyclical behavior of the same variables satisfactorily.

The two-stage procedure, calibrating short term and long-term parameters separately that we have found workable, also tallies well with how to causally interprete the endogenous growth cycle generated (Wold, 1969), and thus with our two original problems. The diffusion through the economy of inflation is of a cyclical nature, while the relationship between inflation, profits and growth are a long-term concern. Since inflation causes disorder in market pricing and affect price predictability negatively the short- and longer-term concerns are however compounded over time in intricate ways. Since studying the economy wide consequences of this complex market dynamics was the reason for starting this modelling project to begin with, the consequent empirical problems simply have to be dealt with. It is also well recognized that such complicated relationships cannot be represented in macro models. Lags between cause and effect are long, involving intricate short-term feedbacks between actors in markets and over time integrating experience, expectations, plans and realizations. This means that macro aggregates are a blend of firms in different stages of development that conceal the dynamics we are interested in.

Again, the first calibration stage, mentioned above, (satisfactory trend tracing) is all we need to handle our second problem.

1.3.1. A priori assumptions

mpirical information enters the model in seven ways:

The causal ordering of decision and activity sequences (see e.g., Figure 1) has been modeled on what we know from the interviews of Eliasson (1976a).

Structural parameters, for instance defining the relation between maximum possible inventories and sales, or trade credit extensions associated with a given value of sales.

Time reaction parameters that regulate the market dynamics of the model economy, for instance those regulating how historic experiences are transformed into expectations and plans and how fast decision makers (firms) respond to expectations that do not come true. The role of expectational mistakes in shaping future decisions becomes an issue.

Initial state data, such as firms’ capacity utilization and capital stock data collected in the annual Planning Survey of the Federation of Swedish Industries (see Virin, 1976), and corresponding stock and flow macro data from public NA statistics. All initial state data are endogenously updated from period (quarter) to period during simulations. This means that the simulation can be stopped any period, and a new initial state is available for the simulation to continue.

Start-up historic input vector, for instance, for instance a profit margin history to generate next period profit target. Also available each year from Planning Survey.

Macro parameters (for instance in consumption expenditure system, from Klevmarken and Dahlman, 1971).

Exogenous data inputs: export prices, foreign interest rate, productivities of global best practice investments, and labor force.

We consider the specification under §1 to be of critical importance as it represents a measurement taxonomy that maps one- to - one into firms own market oriented statistical measurement (information) systems. The ambition here has been to bring statistical categories as close as possible to what business decision makers look at (as studied in Eliasson, 1976a), rather than what policy makers look at. This has caused some problems of consistency when (under §4) the initial state data are aggregated up to the Swedish National Accounts level where the statistical taxonomy is production rather than market oriented (See below). The causal ordering of decision sequences under §1, furthermore, has allowed us to replace several time reaction parameters (in macro models) with directly observed decision and selection sequences in firms. Thus, for instance, firms exit at the latest when they have legally run out of equity, or earlier when their returns to equity have been running below the interest rate for many years, if, in the latter case, the firm has a management parameter that instructs it to do so. Remaining asset values are then sold in the investment goods market, or (for inventories) in product markets, loans repaid and remaining positive equity values added to household disposable income.

For the time being we focus on calibrating the time response parameters under (3) that regulate how markets affect economy wide behavior and on which we have practically no external knowledge to draw on except trying out various sets of combinations to see to what extent the model reproduces historical trends and cycles of the Swedish economy.

1.3.2. Data base needed

Two sets of data are needed for that; one set to operate the model and another to assess performance; (1) macro statistics from the Swedish national accounts (NA) that will uncritically be said to represent the Swedish economy, and (2) the panel of firm data that will become available with time from the annual Planning Survey.

The second set is specific to our model. We need a micro firm data base of at least 5 years (historic annual panel data) and a set of positional data for the initial year to get the model started. And we need a forecast or an assumption (or historic data if we trace history) for the exogeneous data for the simulation period. We would also like to be able to start simulations at a date of our choice, which means that the micro data base should, preferably, stretch far back in time. In practice this means that except for the last few years, we will not have all the data we need.

Model building, model calibration and data collection must take place simultaneously. Thus, much of the data we need for testing the model will not be available until most of the calibration work has been done. This is how we “solve” this dilemma.

Until now we have experimented with the model on historic, five-year input vectors for the years 1970-74 for each firm. Fortunately, 1974 is the peak of an inflationary profit boom in the business sector. A simulation run then begins under conditions that are like those prevailing during the year when our historic national accounts test data begin, namely 1950 (the Korean boom).

In the beginning calibration was mainly concerned with setting the model up to become operational, and we were satisfied with creating a synthetic micro database. For the time being macro subindustry data for 1970-74 (four subindustries) have simply been chopped up into 50 firms applying a random technique that preserves the averages of each subindustry. Based on this start-up information, we have performed a series of preliminary calibration experiments according to a procedure to be described below. Occasionally we have included one or several real firms in a simulation run to see what happens to them.

The next step, not yet embarked upon, will be to prolong the micro database back in time, using essentially the same synthetizing technique but also enlarging the number of firms. There are two reasons for this. We must check the stability properties of the model economy when we vary start-up data by moving back and forth over historic time. In addition, we need better and more precise historic test data to evaluate model macro performance. The changeover to this database will take place at a time when a new, extended version of the model is planned to be ready. We expect that several parameters of the system will have to be recalibrated after this changeover before the model has found its way back to a good trend tracking performance of the quality already achieved under much more primitive conditions.

The final stage is to feed the model with a set of real firms and to apply the same synthetizing technique on the residual that remains between the subindustry total and the aggregate of the real firms in each market. We are thinking in terms of eventually having the 200 largest Swedish firms in the model. When and whether we will reach that ambition, or higher, depends not only on the amount of work associated with arranging a proper database, but also on the exact nature of internal memory limitations on computer capacity. For various reasons this stage will be reached late in the project. We are currently experimenting with a sample of 50 firms.

1.3.3. Calibration

Calibration must be defined in at least two dimensions. We need a set of criteria for a good “statistical fit”.

In econometric terms this corresponds to choosing the level of significance and to some extent the estimation method. Second, we need a procedure of selection that guides us towards a specification alternative that satisfies our criteria and (NB) that is not a spurious one. These two steps are summarized in Tables 2 and 3.

Step wise master criteria for statistical fit.

| A. | Certain macro industry trends approximately right (Within 1/2 percent) over a 20 year period (see trend chart Figure 6). |

| B. | Same trends for the four sub industries. |

| Same criteria for 5-year period. | |

| C. | Micro. Compatible with “stylized facts”. No obvious “misbehavior”. |

| D. | Identify (time reaction) parameters that work uniquely (or roughly so) on cyclical behavior around trends. |

Calibration procedure (trend fitting)

| 1. Find first reference case. Assess its performance in terms of A in Table 3. |

| 2a). Perform sensitivity analysis with a view to finding new specifications that improve performance in terms of A. |

| 2b). Ditto with a view to investigating the numerical properties of the model within a normal operating range (analysis). Check and correct if properties can be regarded as unrealistic. |

| 2c). For each new reference case, repeat the whole analysis of 2 b) systematically. The purpose is to ensure, each time, that the new reference case is a better specification and not a statistical coincidence and that the properties of the system revealed by the sensitivity analysis above, and judged to be desirable, are presented in the new reference case. |

| 2d). Subject model to strong shocks. Check for “misbehavior”. (For instance, fast explosive or strong contractive economy wide behavior that have been generated by external shocks that may be considered extreme. If so, ponder the possibility that the model may generate empirically reasonable surprises that have not yet been observed. |

| 3. Define new and better references case. Repeat from 2. |

-

*

Find first reference case. Assess its performance in terms of A in Table 2.

The annual Planning Survey of the Federation of Swedish Industries has been designed to provide the panel data needed on individual firms to make calibration of micro distributional characteristics possible. We have, however, no ambitions to predict individual firm outcomes.

In general, we are not interested in using the model for routine forecasting of the business cycle forecasting type. On the other hand, we consider it possible in the future to ask questions to the model of what happens to the macro model economy if a major micro intervention in markets is enacted. This is of course also a forecast, and such model-based cost benefit studies should be contemplated when a satisfactory parameter estimation technique has been developed. Also, very interesting and meaningful in the future should be to study how specially designed individual firm models behave under different environmental circumstances that the model will be capable of generating.

We may say that the model we have designed is a combined medium-term growth and cyclical model that only requires that it tracks Swedish macro trends well over the medium-term, say five years, and exhibits a typical business cycle, but not necessarily a historic Swedish business cycle. With these “empirical” criteria we may not have moved far beyond a theoretical inquiry into understanding the interaction of inflation and growth. Since this interaction occurs (in the model) through the intermediation from period (quarter) to period of explicitly modeled markets we don’t have to be overly unassuming about having addressed an important and neglected empirical problem.

Towards the end of the project we also hope to be close to the following model performance; a specification that traces five year macro trends in Sweden according to A (in Table 2) well, irrespective of where in the period 1955–1970 we begin the simulations (provided we have the necessary start-up data), and that also reproduces a typical business cycle in all the variables in A, given exogenous variables, including policy parameters and start-up data.

This introduction has outlined the ideas of the modeling project. Next follows a formal documentation of the model specifications, to be converted into pseudo computer code, and finally into a computer language, APL.5 For an empirical understanding a more detailed account of the calibration method is needed, as well as a full description of the experimental runs. The material for that is not yet ready.

2. Firm expectations and targets

I specify the system of routine management of existing operations of a manufacturing firm. The primary source of information is my own interview study of business economic planning (Eliasson, 1976a) that concludes in Chapter XI with a sketch of a firm model. I begin here with specifying the algorithms that determine how expectations and targets are formed based on experience, external information, and on how profit targets are determined. It is basically a "looking in the mirror" adaptive approach to the future of a boundedly rational firm in the sense of Simon (1955) and Simon (1959), complemented with the possibility to use external information, for instance learning from other firms, or from external forecasts. It should also be possible to use this external slot to investigate the systemic consequences of noise input into the economy of the kind done before by Frisch (1933). The difference between our model and the other two is that disturbances in our case are transmitted into the economy by way of price changes in product, labour and financial markets, that are integrated from quarter to quarter in the formation of expectations and business plans of individual firms, not as an external knock on a mechanical system of difference equations.

As far as I know, no one has yet modeled endogenous change in existing economic structures caused by market competition and price change, or the introduction of new activities in the form of Schumpeterian entrepreneurs. The reason of course is the almost complete lack of generalized empirical knowledge about these matters, but also the limitations of expression imposed by the standard math commonly used in economic analysis. Hence the use of mathematical simulation or micro simulation in this modelling project is a methodological innovation that has expanded the range of theoretical expression, very much in the spirit of Koopmans (1957), who concluded that the modern computer might “well restore the numerical example to a position of honor among tools of analysis in regard to problems too difficult for more general solution”. We will see how much methodological controversy must be overcome to bring that understanding into economic theory (. Interdisciplinary travel seems to have given rise more to personal problems than to praise of those who have tried. Third, economy wide models I have seen have no interface to accommodate an empirically meaningful entrepreneur. We will however try, and it can be done with the market-based model specification of this model.

We distinguish between long-term expectations, on the one hand that feed into long-term plans, notably investment-growth plans, and affect the long-term financing decisions as described in the next section. On the other hand, we have short-term operating expectations that affect production and sales decisions.

Expectations focus on market prices, wages, sales and to some extent interest rates.

Firms’ targets focus on profits only, more specifically on profit margin targets determined in each firm to correspond to a rate of return target. I found the targeting procedure, that I call Maintain or Improve Profits (MIP) targeting, to be widely practiced in the US, European and Japanese firms interviewed in Eliasson (1976a). Long- and short-term targets are in principle the same, except for the time horizon, only that short-term targets may be temporarily violated under a longer-term target constraint.6

Time has three dimensions:

The long term focuses on a trend and implies a continuation beyond the long-term horizon (H).

The short term, which for us is synonymous with the (annual) budget horizon, and allows for business cycle considerations.

Updating of targets and expectations each period is based on the current feedback of targeting and expectational experience.

Targets are set once a year in the annual planning sequence.

2.1. Profit targeting (TARG-module)

In this section we introduce a set of decision criteria for the firm. They are based on a dominant objective function that condenses the preference structure of Corporate Headquarters (CHQ) of a (large) firm. We begin by identifying this function in operational terms, and proceed to particularize a set of decision rules (restrictions).

2.1.1. Objective profit function

Profits are the dominant goal variable of CHQ that guides downstream decisions in a large firm as reflected in their internal economic planning procedures (Eliasson, 1976a), implying that all other variables are subordinated the profit objective.

Such plans recognize how the certainty of information fades with future time, and hence must be complemented with routines to flexibly cope with errors. This flexibility is achieved with period-to-period revisions of anticipations and plans. There are quarterly revisions of operational budget decisions (for instance recruiting), and annual revisions of long-run, sometimes irreversible commitments (investments).

Since this is the first place where symbolic language enters, a few points on notation should be mentioned.

The APL language that we use for programming only takes ordinary letters. Systematic use of only such letters makes reading very slow. To keep good correspondence with the pseudo code and this explanatory text and to make these chapters readable at reasonable speed we often use Greek letters here, but spell them out in the pseudo code. (Hence α becomes ALFA in the pseudo code). Also note that we often use the Algol notation: = that stands for “make equal to”.

Indexes etc. are always kept on level with other symbols. Only when necessary to avoid confusion, brackets are inserted to separate symbols.

CH in front of a variable always represents the time difference or differential. Hence CHP(DUR) means ∆P(DUR)≈ (dP(DUR)/dt).

A D in front of a symbol, or a set of symbols means relative change. Hence, DNW or D(NW) means CHNW/NW.

Functions are also, and conventionally, indicated by brackets as QFR(L) that defines the production (of Q) possibility frontier (QFR) as a function of L. It will always be obvious from the text or the context when we are indicating a function.

Finally note the fact that Q both stands for quarter and output. QQ means quarterly production volume. Fortunately, in most of this explanatory text it won't be necessary to distinguish between periods of various lengths.

A consistent accounting system allows us to derive the following additive objective function):

A =M∙α - The profit contribution from manufacturing operations

B = -RHO∙β - Accounting charges

C = +DP(DUR)∙β - Capital gains from asset management

D = +(RRN- RI)∙Ѱ - Profit contributions from finance and cash management

The target variable for top Corporate Head Quarter (CHQ) management:

or the real, annual creation of asset wealth.

GOAL hence stands for the rate of increase in firm net worth (NW) plus the rate of dividend payout of that net worth (=Ɵ) both deflated to real terms by a price index, in this case the rate of change in the consumer price index (DCPI). Inflation is no minor factor to consider when designing rational profit targets for a firm (see below) and in interpreting market price signals (see below under expectations).

Each component in (1) thus adds linearly to GOAL fulfilment. A stands for the contribution from operations management to overall growth in firm value, B from “accounting”, C from asset management and D from financing (the leverage factor). We have a problem with how to define asset values under C. They can be expressed in both market and accounting (replacement cost) terms, and at book values, and firms’ target criteria are not always consistent. The strict linearity of the targeting principle in (1) is often violated in one important aspect. Capital gains that appear under C and the financial leverage factor D may be mutually dependent in that firms may find it profitable to invest in non-production (“financial”) assets to enjoy financial gains under C by borrowing under D to benefit from an interest rate that is lower than the rate of return of the firm ((RRN - RI) 0). This interdependence between the C and D components in the profitability target (1) is an important organizational concern. The fact that large firms engage significantly in non-production activities also affects the data that is collected in the Planning Survey.

A proof of (1) follows in Appendix A.7 The variables are defined verbally and in operational terms as follows:

NW = Net worth defined residually as shown in Figure 7 in the next section.

Ɵ = The rate of dividend (DIV) payout of NW = DIV/NW

α = S/A

S = Sales expressed in current prices

AS = Total assets, valued at replacement costs

β = K1/A

K1 = Replacement cost of production equipment as defined in the balance sheet. It is updated as shown in Section 3.4 below.

W = Wage index

P = Product price index

CPI = Consumer price index

RHO = Rate of depreciation of production equipment (K1).8

K2=AS-Kl= Other assets (inventories, extended trade credits, cash etc.9)

Ѱ= BW/NW = the debt (BW) net worth or gearing ratio

NW = AS - BW

RI = Rate of interest

M = Gross profit margin in terms of sales (S)

RRN= [M∙S-RHO∙K1 + K1∙DP]/AS= nominal rate of return on total capital(=AS)

RRNW = [M∙S-RHO∙K1 + K1∙DP - RI∙BW]/ NW = nominal rate of return on net worth or equity.

We assume here that all stock entities are valued at current replacement costs. This means that firms’ net worth (NW) has been obtained by a consistent (residual) valuation method as shown in Figure 7C in the next Section. Since prices for investment goods and products in inventories are endogenously determined, the current replacement value of NW can be computed from period to period. Ideally, however, a firm’s NW, or equity should be valued at market prices, but this is not possible without a stock market in the model, which today is beyond our ambitions.

Equation (2) however allows us to interpret the objective of the firm to be to achieve maximum possible long term ex ante or maximum long term ex ante real value creation for share owners, even though that ex ante target has no operational meaning beyond the short run (read quarter). The real firm as well as the model firm deals with expectational uncertainty by revising its ex ante calculation from period (quarter) to quarter as unpredictable circumstances change, for instance by revising (each quarter) its P, W and RI expectations and sales, production, recruiting and investment plans. The interesting question of economy wide dynamics is to what extent ex ante short term adaptive expectations (see 2.3 below) over the longer term gear up such that firms’ performance in terms of the short run target satisfaction (Equation 2), becomes rational in the longer term.

In coding the model, great care will be taken to distinguish (Equation 1) between ex ante variables and ex post outcomes, and (Equation 2) – depending on model version- between market values and the corresponding entities taken from the books (accounting values). Since prices change endogenously in model markets, this will be found to be of no minor concern. For wages, se Section 5, and product prices Section 8.

GOAL (see Equations 1–3) can be decomposed into operationally defined components far down into the business organization to which local targets can be attached in internal planning and budgeting that are all consistent with the overall objective function (see further Eliasson, 1976a). Over the longer-term, as mentioned, maximizing ex ante GOAL can be shown to be synonymous to maximizing ex ante firm wealth each period. Since ex ante (expectations, see 2.3. Periodic updating below) rarely come out as expected ex post in the market environment of this model, this should be taken as a theoretically observation in passing.

2.1.2. An additive delegation scheme

Equations (1) and (2) offer a convenient organization /targeting scheme. Equation (1) states that the relative change in firm net worth (DNW) plus the period’s dividend payout (Ɵ) expressed in percent of the same net worth (NW) is the sum of four components.

The profit margin (M) times the ratio between sales and total assets(α), or the short term contribution from production departments (operations management).

Calculated economic depreciation (subtracted) dealt with in the accounting office.

Inflationary and capital gains from asset management. More generally, however, C can be seen as the contribution to firm value creation from managing its portfolio of assets.10 This will be a convenient accounting/control scheme if the model is later extended to allow firms to invest in financial assets in a stock market.

he leverage contribution to the firm’s wealth creation from its finance department defined as the difference between the nominal return to total assets and the (average) interest rate on debt (BW) times the debt net worth ratio (BW/NW).

For the consumer-shareowner the deflator should be the consumer price index (CPI). This is however not an appropriate deflator for the professional stock investor. He is unlikely to regard his wealth as a stored-up consumption potential, at least not with the weighting system normally used to compute CPI. Since the deflator choice has only been introduced to allow an outside assessment of business performance, we need not discuss this matter further. The decision criteria that we will introduce are all invariant vis-a-vis this choice.

Even in small businesses top management is never in full operational control of the internal firm economy. Lack of competence in how things are done, and limited information explains that. Decisions on how to run production must be delegated, and control is exercised through negotiated agreements of statistically defined targets to be achieved. This is clearly reflected in firms’ internal control routines, the budgeting process being the most well-known (Eliasson, 1976a). A theory of firm behavior, or an empirical model of a firm should of course also be explicit about how limited control of its internal affairs affects its behavior. The additive objective profit targeting function (Equation 1) is a perfect empirical algorithm on which to build such a firm delegation scheme, a device that also reflects business practice (Eliasson, 1976a).

Equation (1) tells us that four factors contribute additively to performance in terms of the objective function (1) or (2). Two of these factors are however matched by separate organizational units within firms namely:

Investment-financing (long term) = D

and

operations decision making (short term) = A

(B), or the depreciation factor, is dealt with in the accounting office. Capital gains and losses affect the financial performance of a business and distort the accounts managers use to monitor production operations. In large firms operations management and financial portfolio management are normally organizationally separated (Eliasson, 1976a). Recent experience has however made firm management aware of how inflation distorts their statistical accounts. Maybe the introduction of new inflationary accounting systems in the future will make it possible to organize a separate office for inflationary accounting to manage the contribution of capital gains under C to the overall financial performance of the firm.11

The outcomes of long-term investment financing and operational decision are mutually dependent in a way that will be modelled in detail in the next chapter. The typical feature of firm management, however, is that decisions under A and D are not simultaneous but managed separately. This is one rationale for keeping the long and the short terms separate.

The objective function (1) also gives a rational reason for the concern with profit margins in manufacturing firms (Eliasson, 1976a). If sales-asset ratios are stable over time, M is a monotonous indicator of profitability in terms of those factors that are manageable in the short term. Hence an increase in the profit margin in the short term means an increase in the return to assets. The short term is thus defined to mean the production planning period within which production plans cannot be changed. Profit margins are easy to monitor statistically compared to the unclear concept of a return to capital. For good reasons firms do not use the ambiguous concept of capital in operations planning (see further Section 4 on production planning, and Eliasson, 1976a).

If shareholders value their assets in terms of their purchasing power and their purchasing power is defined in terms of a basket of consumer goods, then their goal variable reads either:

and the real rate of return on net worth{=RRNW-DCP}, or (from 2):

The real (or CPI-deflated) growth rate in net worth, inclusive of what is currently made directly available in the form of dividends.

By breaking M down further as in (3) the separable, additive targeting function (1) can be identified with the internal organizational fabric of the business. In the economy we are for the time being (no purchase of intermediate products and no divisional separation of the firm unit assumed) considering M as composed of three factors:

Labor productivity = Q/L

Wage level = W

Product prices = P.

Prices are typically associated with sales departments while productivity is managed and determined within production departments.

While labor costs can be managed properly at the location where it is applied this is not normally so with prices or profit margins. Since prices and profit margins can be measured reliably only for the end (final) product we have found that firms use a whole range of performance indexes based on W∙L/Q , or unit labor costs, to remotely monitor profit performance at detailed levels of manufacturing production (Eliasson, 1976a).

2.1.3. Feedback MIP targeting