Modelling Financial Derivatives Markets in a Firm Based Evolutionary Macro Model (MOSES)-On the market integration of computing, communications, and financial services

- Article

- Figures and data

-

Jump to

- Abstract

- 1. Introduction

- 2. Economic dynamics – the experimentally organized economy

- 3. The MOSES model economy

- 4. Theoretical product development for emerging financial markets- modern financial economics as an intellectual new product innovation

- 5. Games and outside participants

- 6. Making markets more complete- how modern C&C technology influences financial markets and the economy at large

- 7. MOSES simulation results on options and derivatives

- 8. Implications for policy

- Footnotes

- Appendix A

- References

- Article and author information

Abstract

The evolutionary firm based model MOSES of an Experimentally Organized Economy (EOE) is introduced and then outfitted with increasingly more sophisticated financial markets that take us from a stylized industrial banking system (standard in the model), to a (capital) market oriented monetary system, and then on to a securitized financing system where options and market derivatives play a role in allocating financial resources. We study the consequences for long term economic growth of introducing different financial market regimes.

The markets of the financial system and those of the real economy are integrated within the business plans of model firms. The immense micro to macro complexity thereby created reduces the transparency of the economic environment of all actors in the model, including Government as a policy maker, to a fraction of what is needed for informed decisions. The policy maker thereby loses its presumed information advantage of economy wide overview and becomes one bounded rational actor among all other ignorant actors. Because of the strong leverage on the entire economy of its actions the competence and information demands on Government, when conducting policy, however, becomes far more exacting than what is required of any other actor.

When Government engages in ambitious policy making its interventions in markets affect the behavior of all other actors. The entire market regime is therefore affected to the extent that the Central Government often cannot possibly be in control of what it is doing, especially when it comes to the long run consequences of its actions, and therefore often would do better by taking it easy (Eliasson and Taymaz, 1992). We find that financial markets matter for long term economic development and that seemingly insignificant respecifications of the financial market regime can cause considerable differences in long term GNP growth outcomes, amounting to as much as a difference of 1.5 percentage points per annum and a per capita GNP, that is up to 2.5 times larger on the 60 year horizon than in the worst scenario.

The capital market regime is found to outperform the industrial banking system. When introducing a crudely modeled securitized system (call options), the only one our computer system could handle, financial market transactions were, however, speeded up to the extent that resource allocations worsened. Mixing the capital market regime with the simple securitized system generally lowered long run economic growth. Adding options not only increased the speed of arbitrage, destabilizing fundamentals, but also made expectations unreliable and raised the exit rate, notably by making manufacturing firms lose money on their financial investment portfolios. The results on options cannot however be generalized beyond the very specific experimental designs implemented, but they indicate that speeded up market arbitrage, which is what financial derivatives are all about, has mixed economy wide consequences, that may be long term negative in an economy that is not otherwise diversified and robust. While the simulation analysis of the markets for derivates in the MOSES model is still too primitive to allow any empirical generalizations, the results so far should be taken seriously as indicative of possible surprise dynamics that makes it even more important to conduct more inquiries of this kind.

A final methodological note. The excessive demands on computer capacity of the options experiments have prevented us from testing the results for robustness (as for instance in Eliasson and Taymaz, 2000) by running a whole spectrum of experiments with small changes each time in the four different blocs where stochastic specifications are used. The non-linear specifications of the model often generate large differences in very long run outcomes when the stochastic seeds are changed marginally. Hence, the results to be reported should be regarded as explorative, suggesting new credible hypotheses, rather than empirically calibrated results, and also telling what kind of future analyses the new expanded model is capable of.

1. Introduction

The financial system influences the real economy and economic growth through intermediating the market allocation of resources. The interest setting process is central to that allocation. The financial system, however, is also an intermediary in the reallocation of wealth and real resources over markets. Changes in financing conditions thus affect the allocation of investments and production structures across the firm population and all relative prices. The consequent increase in dynamic complexity reduces transparency of the economic environment of all actors in the model, including Government as a policy maker. To be noted is that the separability between the financial and real systems often assumed in financial modelling does not hold under these new circumstances of micro- to – macro modelling. Uninformed production firms that dabble in financial markets may thus cause a distortion in asset price structures that lead to miss allocations of real resources and less macro economic growth. Policy makers that erroneously believe that they are well informed are at particularly large economy wide risk.

Another interesting situation arises when distorted asset prices make firms acquire shares, or entire firms at bargain prices focusing on short term capital gains only, and neglecting their manufacturing operations. In that sense this paper addresses the fundamental problem of the efficiency of the markets for strategic acquisitions (Eliasson and Eliasson, 2000; Eliasson, 2000a). The efficient functioning of financial markets and their supporting institutions, hence, is a particular concern. Since the policy maker is such an institution rather than a commercial market agent, an interesting market conundrum may be expected.

The last couple of decades has seen a radical change in the technology of global and local financial market intermediation brought about by the emergence of the fifth generation of computing, or the integration of computing and communications (C&C) technologies. The Internet is currently the carrier of that development (Eliasson, 1995a, Eliasson, 1996a; Eliasson, 1999a; Eliasson, 1999b) defining the potential for radical reorganization of both real and financial global production organization. What is new in the analysis to follow is the explicit and dynamic integration of financial and real market transactions in the business plans of firms. Allen and Gale (1994) estimated that new financial instruments intermediating a more informed and efficient allocation of (financial) risks have lowered the cost of financing and increased the stock market value of US manufacturing firms significantly, given the real (physical) allocation of resources. The last ceteris paribus clause is critical for interpreting their results. We explicitly account for the influence on rational financial and real market agents in determining (a) the allocation of real resources, and (b) economic growth. Hence the allocation of real resources is not given but will be endogenously affected by the introduction of new financial instruments in the simulation experiments to follow. We expect the economy wide systemic effects of that "simultaneity" to be considerably larger than calculated in the static analysis of Allen & Gale. We will also demonstrate how different assessments of risk (or rather uncertainty) based on historical data affect portfolio performance in what we will call an Experimentally Organized Economy (EOE). For this we use the dynamic micro (firm) based macro model of the Swedish Economy MOSES that approximates an EOE.

The MOSES model has two credit market regimes; one (1) exogenous interest rate, and (2) one banking system regime where local supplies and demands for funds determine how the local interest rate of the bank deviates from an exogenous international interest rate, given endogenous cross border financial flows. Under the commercial banking regime (2) firms can borrow at the same domestic interest rate offered by the bank. The model can alternatively (3) feature individual firm interest rates that depend on the firm’s credit risk defined by its endogenously determined debt/equity ratio. In this paper we study what increasingly more sophisticated horizontal financial intermediation does to the economy. One may say that we will upgrade the financial system of the MOSES economy from an (Rybsczynski, 1993):

industrial or universal bank-oriented system, as originally modelled in Eliasson (1976b), in which firms' investment financing was mainly based on retained earnings, to a;

capital market-oriented financial system

...where capital markets, notably the stock market, and the interest rate play central roles, and then on to a

securitized system.

of the US type with sophisticated markets for risks, where options and derivatives play significant roles. We discuss a fourth step in the level of sophistication including also a;

venture capital based financial system

...where industrially competent venture capitalists provide early financial support for entrepreneurs (Eliasson, 1997; Eliasson and Eliasson, 1996; Eliasson and Eliasson, 2000; Eliasson and Eliasson, 2000). For the venture capital analysis a sophisticated endogenous R&D (innovation) based productivity change module has been developed in a separate context (Ballot and Taymaz, 1998).1 We plan tentatively to introduce a venture capital application in that module that endogenizes the selection of winning projects from R&D investments as venture capitalists learn through their investment experience to upgrade the industrial competence needed to make informed selections. Preliminary studies on the role of insiders as information providers to the market (Eliasson, 1990a; Antonov and Trofimov, 1992) conclude the essay.

In this paper we therefore introduce increasingly more sophisticated markets into the model in steps:2

A stock market in which private persons (Households) and specialized investment firms manage financial portfolios. We are particularly interested in the consequences at the macro level of a more “efficient” distribution of risks on industrially competent hands than the commercial banking system can offer.

A market where firms can invest in stocks as an alternative to investments in production capital and manage a financial portfolio. Will this possibility improve or worsen long run industrial performance?

A market in which firms’ individual interest rates depend on market valued financial risks, rather than replacement valued debt/ equity ratios.

A market for trading in financial derivatives (we only model call options). What does it mean for macro economic performance if risks can be more efficiently allocated to the most industrially competent takers?

R&D investments, entrepreneurial investment decisions and venture capitalists.

Insiders as more informed actors in financial markets (see Trofimov, 1995).

Steps 1 through 4 have been fully implemented, and simulation studies conducted.

Steps 5 through 6 have only been included through simple applications.

In the stock market firms’ risks are evaluated and prices on their net worth determined. The market values of firms’ net worth enters their debt equity ratios and therefore influence their individual borrowing rates.

The financial portfolio management function features investment companies that invest individually in stocks and derivatives.

Markets for derivatives, or options, have been around for ages, but are currently manifested in the form of a huge and fast growing trade in complex algorithms that represent estimated values of securities. The latter development is very recent and entirely dependent on the new integrated computer and communications (C&C) technologies associated with the sudden commercialization of the Internet since the mid 1990s. The commercial potential for profitable financial intermediation created by modern C&C technologies is probably enormous. It remains to be seen what that may mean for economy wide performance.

The simulation analyses to be reported on here are complicated in two ways. First, we are studying immensely intricate interactions between actors in the financial and the real production systems of the economy, and the latter "physical" system is not the transparent and well known (to economists) fixed structures of the general equilibrium, or Walras-Arrow- Debreu (WAD) model. Instead the rugged terrain of physical production structures is constantly changing because of the market selection activities going on, a notable exaple of that being the endogenous entering and exiting of firms. This defines market life in what we call a model of the Experimentally Organized Economy (EOE) in which new technology creation, and business decisions are viewed as economic experiments to be tested in markets, and market selection dominates economy wide behavior. In this model the standard separability assumption of financial economics has been done away with by integrating financial, product and labor markets price expectations in the management systems of individual competing firms. Hence, we have to tell a brief story of the EOE through its model approximation MOSES. Second, the derivatives market is characterized by strong innovative product development and diversity. Practical problems, notably computing capacity, however, prevent the representation of all that diversity in the model, even though it would have been perfectly possible in principle. Note that the entire derivatives market consists of a computerized network of trading in mathematical algorithms with ad hoc human interaction. Even though the actual simulation runs for this paper are based on a fairly primitive model of trade in the stock and options markets (see Taymaz, 1999) the interpretations of the experiments have to be preceded by a broad-brush presentation of the derivatives market to place what we have done quantitatively in a relevant theoretical context.

2. Economic dynamics – the experimentally organized economy

Economic dynamics is synonymous with concurrent and endogenous institutional and organizational change and the employment of a dominant tacit competence capital in production (Eliasson, 1990a, Eliasson, 1996a; Eliasson, 1996b). To capture that in theory we briefly introduce the notion of a Knowledge Based Information Economy (Eliasson, 1990b) to clarify the assumptions of the Experimentally Organized Economy (EOE, Eliasson, 1987, Eliasson, 1991a), and that our analysis is predicated on a state space, or a business opportunities space, that is enormous and only fractionally (and differently) known to each agent in the market. This establishes an enormous potential for productivity advance at higher levels of aggregation through recombining factors of production and reallocating resources (see Carlsson, 1991; Eliasson, 1998b; Eliasson and Taymaz, 2000 for empirical evidence). It also introduces an economic environment which to each actor is largely unknown when viewed from any point in state space. Since each actor views its local environment through its own interpretation filter it is apt to be both grossly ignorant, and significantly misinformed about circumstances that may jeopardize its very survival as a market agent. The investment process of each actor is therefore likely to be a path strewn with more or less serious business mistakes and occasional winners. Hence, the way markets of the Experimentally Organized Economy (EOE) are organized for efficient experimental selection becomes the important determinant of long term economy wide evolution. We deal with the problem of efficient selection in the EOE in terms of Competence Bloc Theory (Eliasson, 2000b; Eliasson and Eliasson, 1996; Eliasson and Eliasson, 2000).

Organizational change occasioned by innovative financial markets engineered by new C&C technology is thus a main theme of this paper. Because institutional and organizational change determines how new technology is introduced in the economy, we need a market and agent based model capable of representing that dynamic. The theory of the EOE and the MOSES model offer that.

2.1. The theory of the Experimentally Organized Economy (EOE)

The theory of the EOE is presented as the antithesis of the Walras – Arrow – Debreu (WAD) model. The notion of a knowledge based information economy provides some necessary prior modifications of the WAD model, notably about the state space. Competence bloc theory explains the market selection of projects within the vast state space, or business opportunities space of the EOE.3

In the EOE

free competitive entry (Item 1 in Table 1) into, and exploration of the opportunities space, keep incumbent agents under competitive pressure to perform. Incumbent firms respond by reorganizing and/or rationalizing (Items 2 and 3) upgrading their productivities. They are all under constant threat of being competed down along a Salter (1960) performance curve, or out of business (item 4). Because of competition and selection aggregate productivity performance increases.

choices of market and technology determine the fate of the individual agent, which often fails. But choices must be prematurely made to avoid ultimate failure and exit, and hence cannot be avoided. Business mistakes become a normal cost for economic development.

The four mechanisms of schumpeterian creative destruction and economic growth

| 1. Entrepreneurial competition (entry) enforces |

| 2. Reorganization of incumbent agents and/or |

| 3. Rationalization, or |

| 4. Death (exit) |

-

Source: Eliasson (1993) and Eliasson (1996a).

A break down of economic systems effects

| 1. Rationalization of information processing given the manufacturing and distribution structure (“doing the same thing but faster”) |

| 2. Reorganizing information and communications flows, given manufacturing and distribution structures (e.g. through ”speeding up inventory turnover”) |

| 3. Optimizing manufacturing and distribution flows over a given structure |

| 4. Reorganizing physical flows to exploit information and communications technology (dynamic systems effects) |

| 5. Simultaneous reorganization of physical and information and communications flows (Integrated production) |

-

Source: (Eliasson, 1996c).

Having said that we have also introduced the four fundamental growth generating mechanism in the EOE that are coded into the MOSES model, or what we call the four elements of Schumpeterian Creative Destruction of Table 1. They are universal (Eliasson, 1996a), since all four categories can be defined and observed at all levels of aggregation, even within the firm.4

2.2. A generalized Salter curve analysis of innovation enforced by fear of competition

Using the concept of a Salter curve to describe the dynamics of the EOE we can (1) decompose economic growth into the four investment categories of Tables 1 and 2 illustrate the huge synergistic productivity improvements that can be achieved at all levels of aggregation through "organizational change" as illustrated in Table 2. This amounts to classifying firms into growing, contracting, and exiting agents, together shifting the Salter curves in Figure 1 out- and upwards. The main point made is that the large effects of C&C technology are systemic through reorganization of both information processing and physical production (item 5) and that the realization of these systemic effects requires considerable management organizational competence within the firm. At higher levels of reorganization among firms as in Table 1 this, as we have already concluded, becomes a matter of how markets and competition work.5

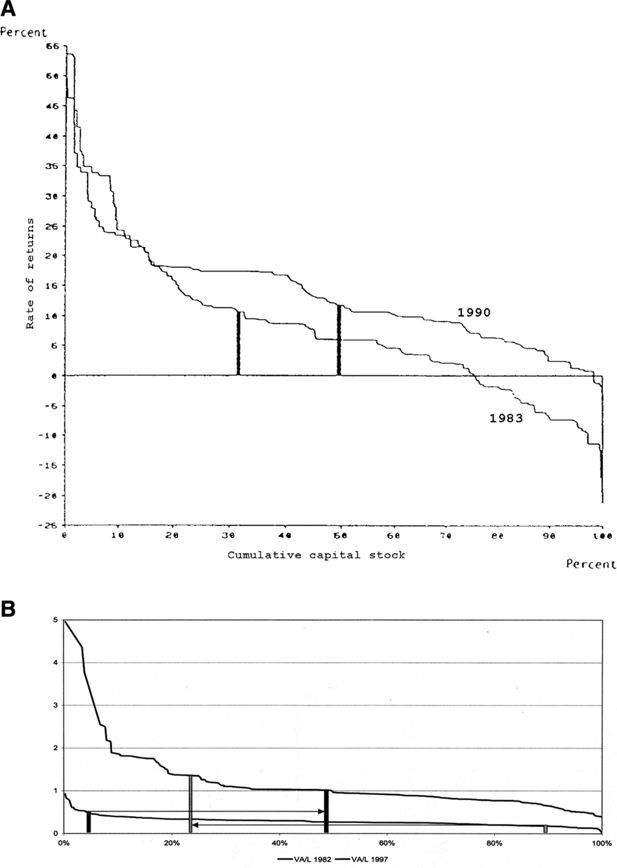

A) A Salter Ranking of Rates of Return to Capital in Swedish Manufacturing 1983 and 1990. Note: The figure ranks nominal rates of return over the nominal market interest rate across Swedish manufacturing firms 1983 and 1990. The vertical columns show the position of the same firm each year. The width of the column measures the size of the capital of the firm in percent of that for all manufacturing. Its rate of return has increased between 1983 and 1990, but it has lost in ranking. Its relative size has increased between 1983 and 1990. Source: Eliasson (1991a) and Albrecht et al. (1992): Moses Database.

The initial state description of the MOSES model economy consists of several performance distributions (Salter curves) over firms. The labor productivity and profitability distributions in Figure 1 of real initial data sets for the years 1983 and 1990 illustrate. The horizontal axis measures performance (labor productivity in Figure 1B) in descending order to the right, each step or column representing one firm, its size being expressed in percent (of total capital stock) of the entire population of firms.

In the ranking of Figure 1 each firm is challenged by superior firms to its left, with a greater capacity to outbid itself in both product and labor markets and perhaps also in financial markets to obtain funds to invest and become more profitable. This firm therefore has to (Eliasson, 1996a) take innovative counter action to prevent being overtaken by competition. But the superior firm to the left also knows that firms on its right may be preparing strategic counter action, to leap frog its performance disadvantage by risky innovation and consequently also has to take action to offset that risk. In an open market economy each firm along the Salter ranking finds itself in such a more or less precarious competitive situation. And this is not all.

In the wings of the market theatre eager challengers wait for an opportunity to enter the scene, and if allowed ("free entry") will do it any time. Entrepreneurial entrants are not only optimistic and eager to enter the market fray. Even though on the average less productive than incumbents the group often includes some super performers. So free entry is a real threat to incumbents (Eliasson, 1991b). In principle therefore all agents in an open economy find themselves more or less under competitive threat to innovate themselves out of a perceived precarious position. This "innovation pushed by fear" is sufficient to keep the Schumpeterian creative destruction process of Table 1 in perpetual motion (Eliasson, 1995b), and it is modelled as an endogenous competitive process by the entry algorithms of the MOSES model. But the economy wide outcome of that process depends on the character of the innovation response, incentives in markets and the efficiency of project selection and scale up in markets.

2.3. Competence bloc theory governs the efficiency of project selection

With competitive market selection of business experiments being the main vehicle for economic growth, the main concern of policy makers concerned with growth should be how these markets are organized for dynamically efficient selection. This means making sure that the minimum of market agents being in place to minimize the negative economic incidence of (1) keeping losers on the books for too long (Economic mistake Type I) and of (2) terminating winners prematurely (Economic mistake Type II). What is needed as a minimum for such dynamically efficient project selection is explained by competence bloc theory (Eliasson and Eliasson, 1996; Eliasson, 2000b). (Before we go on it must be understood that the agents of the competence bloc can in principle be found in both the market and internally within the business hierarchy of a large firm. Since we do not yet model project selection within the firm in the context of the MOSES model that observation need not concern us here).

The competence bloc is not yet introduced in the MOSES model. Hence it will not make sense to present it in full here. For that the reader is referred to the references above. Suffice it to mention that completeness of the competence bloc is one criterion for efficient selection. The completeness of the competence bloc defines the incentives for innovation and entrepreneurship and for new entry in particular. New entry in turn initiates competition, that forces incumbent agents to innovate (previous section) and enforces the Schumpeterian creative destruction of Table 1, and the selection that drives economic growth. For incentives to be credible, institutions that reduce the uncertainty surrounding the (property) rights to the expected present value of investments today as valued in financial markets must be in place (Eliasson, 1998a).

3. The MOSES model economy

The MOSES model economy approximates the theory of the Experimentally Organized Economy (EOE. Eliasson, 1987; Eliasson, 1991a) which exhibits dynamic properties of a kind that are not to be found in mainstream general equilibrium modelling. Surprisingly, neither have we found much of the typical non- linear selection based, and initial state dependent economy wide cumulation phenomena that go under the name of "deterministic chaos" (Day, 1983) in the growing but fragmented evolutionary modelling literature.6 The principal differences concern the economy wide cumulative consequences originating in different outcomes of market agent selection and the consequent market self-coordination of the entire MOSES model economy. One basic assumption is particularly important; the size and complexity of the state space, or the business opportunities space,7 which is "sufficiently enormous" to make all actors ignorant about circumstances that may threaten their very survival, and prone to commit systematic economic mistakes.8 As a consequence, production structures in the MOSES model are in a constant flux. Endogenous investment of firms and an endogenous population of firms through entry and exit explains most of this. Endogenous production structures remove all static equilibrium properties from the MOSES model, reduce the information content of (endogenous) market prices and (because of their heterogeneity and "non atomic size") give agents considerable price setting autonomy. In that sense MOSES becomes an economy wide model of general monopolistic competition (Eliasson, 1985). Given our previous discussion and our interest in growth modelling we can also call MOSES a generalized economy wide Salter (1960) analysis of economic growth.

For the economy wide financial market analyses to follow the following type of market agents in MOSES will be of particular interest:

– The (production) firms

– The actors in financial markets

– Intermediaries between the financial and the real production system

Financial assets are defined by pricing algorithms, and thereby also assigned a property right. They therefore also become tradable (Eliasson, 2000a). This specification is not so difficult for physical goods and services, but to define future profits from investments today as accessible property requires new legal foundations that have only recently been developed (Eliasson, 1993). The present value formula is a value approximation to that abstraction defined under the equilibrium assumptions of the WAD model (Eliasson, 2000a).9 Trade in that abstraction requires support by a register of units (certificates) that regulates access to and the rights to the profit flow. The stock certificate is one such abstraction. It took a long time for the legal rules of the stock market to be established and for trade in those certificates to be possible.

Complexity increases many times over when we introduce trade in future transfers of ownerships stocks (options), but the principles are the same. In the regular stock market prices are affected when managers rebalance their portfolios to minimize risks and maximize expected returns. The pricing of options is therefore affected by actual trades in stocks, but stock prices are also influenced by trades in options. How traders meet becomes a complicated story. For the time being we use a simple random pairing device to make traders in both markets meet.10 For more detail see Taymaz (1999).

3.1. An evolutionary model of the experimentally organized economy – a brief presentation of MOSES11

The main micro agent of the MOSES model is the firm, and endogenous entering and exiting firms keep the markets of the model economy "alive". The firm population is therefore endogenous through market selection, and firms come in different sizes and structures and with different profit seeking agendas. Aggregation is explicit over dynamic markets governed by competing agents with autonomous price setting capacity, up to the level of a national economy. Behavior is mainly deterministic. Selection makes the MOSES model highly non linear and initial state dependent, exhibiting therefore now and then typical "chaotic" characteristics. The statistical resolution of the model is set at the firm or division level and the endogenization of growth should be seen as dependent upon market selection among those entities as they are kept in competitive motion bin the Schumpeterian creative destruction process of Table 1.

3.1.1. Specification – overview

The MOSES model when seen from a "high altitude" comes out as a Leontief – Keynesian 11- sector model where manufacturing has been divided up in four markets (product, labor and financial) in which firms, compete for customers, workers and financial resources. MOSES agents face convex production sets,12 that are however constantly shifted outwards because of entrepreneurial entry, investment and competition among firms as illustrated with the Salter curve analysis above. New best practice global technology is brought in by firms’ endogenous investments. Growth thus becomes endogenized under an exogenous global technology constraint.

The individual firm is modelled on the format of a business planning and decision system as observed in the interview study. Case studies have thus been the source of tailoring the individual firm model Eliasson (1976a). The model runs on a data base of 150 real firms, data on which has been collected in an annual special survey (The Planning Survey, Albrecht et al., 1992) by the Federation of Swedish Industries, that defines the initial state of model simulations. There are about 75 additional “synthetic” firms introduced the initial year to make up the difference between the market aggregate of the Planning Survey firms and the corresponding aggregate from National (accounts) statistics. To achieve stock and flow consistency between these statistical sources, based on different taxonomic principles, constitutes a major statistical effort (as described for 1982 in Albrecht et al., 1992).

Case studies have been constantly carried out to improve specifications of firm behavior and market processes. Researchers at the Industrial Institute for Economic and Social Research ( IUI) in Stockholm, where the full model was put together and calibrated, and Swedish public committees were often interested in gauging the macroeconomic consequences of micro circumstances studied in special inquiries. MOSES could therefore often be upgraded on the budgets of other projects. One example was the joint IUI and Academy of Engineering Sciences (IVA) project of the state of technology of Swedish manufacturing industry, which provided historic data on the best practice technologies for the four MOSES subindustries (Carlsson et al., 1979; Carlsson, 1991). Another imprtant example was the economy wide MOSES based cost benefit evaluation of the Swedish industrial support program for crisis industries in the 1970s/1980s (Carlsson, 1983). The Government Agency for Civilian Catastrophe Preparedness (ÖCB) paid for the inclusion of a new and fifth IT industry13 in the MOSES model (Eliasson and Johansson, 1999). Last, and not least, this project on financial markets14 is being funded be the Swedish Transport and Communications Board as part of a larger inquiry of the role of C&C technology in Swedish economic development.

3.1.2. The firm model

The firm is modelled in MOSES on the format of a business planning system as observed in the interview study Eliasson (1976a), which concludes in chapter XI with a sketch of a theory of the firm. Firms are governed by profit targeting algorithms that make them climb ex ante perceived profit hills. This targeting approximates ex ante long term profit or wealth maximization. Since these profit hills constantly change because of all the competitive profit hill climbing going on firms constantly fail to attain their profit targets and must revise their expectations and plans from period (quarter) to period.

The MOSES model is comprehensive and economy wide in the sense that all relevant Keynesian demand and mistaken firm expectations feed backs are at work. We have recently devoted considerable attention to representing the allocation of resources over financial markets, and to how these mechanism are influenced by C&C technologies (Eliasson, 1995a; Eliasson and Wihlborg, 1998; Eliasson and Taymaz, 2000). This means that the model has to be completely stock flow consistent at the firm level and through all accounts up to macro over time. The model furthermore features endogenous price and quantity determination in markets but that inconsistencies between individual firm plans mean that markets never clear.

3.1.3. Schumpeterian creative destruction

For the empirical presentation to follow, it must be understood that economic growth in the model is endogenous and occurs through the four investment mechanisms of the Schumpeterian creative destruction process, which is moved by entrepreneurial entry competition as shown in Table 1. Depending on circumstances, firms both expand and contract operations in response to competitive challenges. One can also say that growth occurs through competitive selection (Eliasson, 1996b). It therefore becomes necessary to explain how (1) selection is governed , how (2) incentives to enter markets and commercialize new technology are created, and (3) how such entrepreneurial competition forces incumbents to innovate to leap frog expected competition and/or to avoid being competed down the Salter curves in Figure 1, or even out of the market (exit). The first aspect is accounted for by competence bloc theory (Eliasson and Eliasson, 1996). The second and third, that are critical for entrepreneurial entry, have been discussed under section 2.2 above.

The MOSES model is fundamentally deterministic, and market governed selection makes it highly non linear and initial state dependent. It hence generates output that appears "random" and now and then exhibits phases of chaotic behavior ("deterministic chaos") that is mathematically related to stochastic number generation (Carleson, 1991). For practical purposes, however, four market mechanism in MOSES have had to be (temporarily) made partly stochastic. They are:

Direction of search for workers in the labor market, or as this mechanism can also be interpreted: Information about workers being willing to change jobs is made stochastically available to recruiting firms (Eliasson, 1976b).

The degree of success of R&D investment outcomes, thus allocating winners and losers on individual firms (Carlsson, 1997).15

The rate of entry each period is a stochastic function of the excess returns to capital over the interest rate registered in the market. New firm characteristics are drawings from an empirical distribution (see further below).

A particularly important decision variable is expected excess profitability over the current long-term interest rate. Firms' borrowing and investment spending decisions are dependent on expercted excess profits so defined. Realized excess profits govern firms production planning, recruiting and willingness to offer wage increases (see Eliasson, 1976b).16 The rate of firm entry is dependent on the same profit variable among incumbent firms in each market. The labor and capital productivities of new investments in firms are drawn from an exogenous (global) pool of best practice technologies. Individual firm R&D investments (after Ballot and Taymaz, 1998) raise the probability of the firm of scoring a winning technology with superior productivity characteristics compared to those in the exogenous pool (Item 2 in the list above).17 The new productivity vintages are then integrated with the existing capital equipment of the firm (see Eliasson, 1991a). The productivity characteristics of new entrants are drawings from a similar empirical distribution (Item 4 above), only that the spread is much wider. For practical measurement reasons the MOSES model runs on well-defined observation units (firms or divisions) that either enter or exit or grow or shrink through their endogenous production, rercruiting and investment decisions. In the economy wide perspective of the micro to macro model reorganization (Item 2 in Table 1), hence, can be interpreted as both limited to internal firm reorganization and reorganization among firms through selection. So far, we have not had the time to generalize the firm model to accounting also for internal reorganizations even though it would have been good to have such a feature in this context of financial market analysis, for instance to understand the economy wide importance of having or not having viable markets for mergers and acquisitions (M&A). See further Eliasson (1998b, Eliasson (2000a) and Eliasson and Eliasson (2000).18

Firms in the MOSES model interpret their market environments through adaptive smoothing algorithms in which projections are upgraded because of past mistakes ("learning") and corrected for risk aversion (Eliasson, 1976b; Eliasson, 1980; Eliasson, 1991a). The entire MOSES model economy "learns" from selection by way of the Schumpeterian creative destruction and selection process of Table 1 (Eliasson, 1992a; Eliasson, 1992b; Eliasson, 1996b).

3.1.4. Households as consumers, savers, and private wealth managers

Households are modeled in macro in MOSES. As has become traditional in macro economic modelling individuals/households are thought of as identical ("representative") and infinitely small ("atomic"). Under such conditions rational utility maximizing households can be represented in macro as a Stone type expenditure system. All income paid out by producers are fed back as demand to markets after having been filtered through the Swedish tax and income transfer system (Eliasson, 1980). The representative household is modelled as a sophisticated consumer, saver, investor and borrower under a Modigliani and Brumberg (1955) life cycle and a Friedman (1957) permanent income consumption perspective. We have even been playing around with an extended household governance principle in that the household "principals" are not aiming to run the wealth at the expected life cycle horizon of each household member down to zero, but rather aim for continued growth of the real wealth of the extended household growing for ever (Eliasson, 1976b; Eliasson, 1982; Eliasson, 1985). We mention this because this study will represent wealthy households as investors in financial assets. In that capacity they will temporarily be separated from the aggregate household system as individual portfolio holders who interact with the aggregate through income and borrowing flows.

3.2. Calibration

The MOSES model is empirical in that its specification, notably the firm model has been based on careful case studies (Eliasson, 1976a), its initial state measured annually since 1975 on a separate survey (the Planning Survey) of the Federation of Swedish Industries (Albrecht et al., 1992; Taymaz, 1992b), and all being placed for chosen initial years within a stock flow consistent complete micro to macro Swedish National Accounting framework. The latter accounting system has required a major statistical effort, since public sector data have had to be reclassified on the market taxonomy firms use in their internal statistical system, from the production taxonomy of public statistics,19 ,and in initial state dependent non linear selection based models like MOSES eerrors of measurement tend to cumulate (for 1982, see Taymaz, 1992a). The manufacturers of the model have then been calibrated against Swedish macro data and distributional characteristics, for instance the Salter curves of Figure 1, first using the ad hoc method described in Eliasson and Olavi (1978), then the unique computerized calibration method developed by Taymaz (1991b). We have taken the empirical credibility of MOSES seriously. Even though we believe we have got the specification, the statistical measurements and the calibrated parameters right we talk about MOSES as representing a Sweden like industrial economy, which is sufficient for making simulation experiments empirically interesting.

All simulation experiments reported on in this paper use the parameter set calibrated against historic Swedish test variables for the period 1982 -1990.

It should be emphasized that well researched empirically relevant specification combined with detailed measurement has to a significant extent relieved us of a number of parameter estimation problems. This is one of the many advantages of the micro simulation method.

Quantitative control of economy wide dynamics has been particularly difficult. This includes calibrating parameters such that an empirically reasonable endogenous growth cycle emerges. About a dozen parameters regulating agents’ behavior across markets and over time, notably those relating to the Stockholm School ex ante plan ex post outcome feedbacks, are critical for economy wide systems dynamics. These are also the market mechanims that make the MOSES model depart fundamentally from general equilibrium type models of Walras-Arrow-Debreu (WAD) descent.

3.3. Generalizing from cases to macro

The MOSES model endogenizes aggregation over dynamic markets under non- price taking conditions and is market self-coordinated without a need for an exogenous Walrasian auctioneer. It is therefore the ideal tool for analyzing the economy wide long-term consequences of events occurring at the micro level, such as market interactions between firms, or organizational changes within firms and divisions. The model has also been used frequently to generalize from case studies to macro, under the assumption that its parameters reasonably well represent the dynamic market aggregation of consequences up to macro. Dynamic cost benefit analyses of major investment programs would be one example, for instance technical spillovers from the Swedish fighter aircraft Gripen (Eliasson, 1995a). The synergistic economy wide productivity effects of the introduction of generic new technologies, such as C&C technologies and the Internet is another case, as are the consequences of C&C technology for both new product development in, and for raising the allocational capacities of financial markets that we will study in the following section of this paper (Eliasson and Johansson, 1999; Eliasson and Wihlborg, 1998). Only a model of general monopolistic competition, like MOSES, can be used for such purposes.20

4. Theoretical product development for emerging financial markets- modern financial economics as an intellectual new product innovation

Few industries are truly science founded. IT industry is not. Biotech industry is. It has been based directly on Watson & Crick’s discovery of the genetic code, and three path establishing methodological break throughs based on it around 1975, one of them receiving the Nobel Prize (Eliasson and Eliasson, 2000). The perhaps most science founded industry however, with by far more profound economy wide consequences is the new market for financial derivatives. These markets are based on a sequence of developments in mathematical economics, all based on the Walras-Arrow-Debreu (WAD) platform, beginning in the 1950s, all surviving originators having been awarded the ("Nobel") Prize in economics.21 This offers a unique possibility to study the consequences of introducing new market information devices and financial products optimized for a WAD type static equilibrium economy in the radically different market environment of the MOSES model economy. Since these mathematical product abstractions have in fact been traded in the markets of real economies, notably in the US, there is some empirical evidence to compare with MOSES simulation results.

4.1. New innovative products developed in the ivory towers

Well through the 1950s financial economics was almost all a matter of empirically based rules of thumb in firm decision making. In this subfield of business administration theory business practice encoded as rules of thumb dominated over systematic and consistent analysis. This field was suddenly broken up by the successive entry of new, innovative intellectual tools of analysis based on the WAD tradition and optimized for that same economic environment, a disruption of the entire field of business administration that has gradually moved financial analysis away from business administration practices into the abstractions of economic theory.

It began as an engineering product development by (Markowitz, 1952) who formulated the theory of portfolio choice , a path breaking new financial product that since then has radically changed ways of thinking among financial asset managers. Next, Franco Modigliani and Merton Miller (1958) demonstrated theoretically that large parts of the flora of rules of thumb would be made irrelevant if it could be assumed that financial risks could be separated from other financial considerations and traded in separate markets for risks. This theoretical "insight" generated a mounting controversy in academe and in the financial community. Above all the famous Fisher separability proposition was questioned. It stated that decisions in real product markets and financial markets could be kept separate. Already here those new abstractions clashed with the economics of MOSES firms in that price expectations in product, labour and financial markets are integrated in the business plans of individual firms, plans that are then from period to period tested against each other "for consistency" in markets, revised and then tested again. Another point of criticism was that financial transactions costs in the new theory were assumed to be zero. None of this is true in the MOSES economy, so we have an interesting "empirical" problem to address below in that (1) financial and real markets are explicitly integrated by management in the business plans of MOSES firms, and (2) that business mistakes of types I and II (see Section 2.3) become market transactions costs with fundamental economy wide consequences.

The next round in financial product development occurred when William Sharpe (Sharpe, 1964) introduced the Capital Asset Pricing (CAP) model and demonstrated how risks could be systematically and rationally (under the WAD assumptions) priced and then traded in separate markets. The CAP formulae established tradability and constituted a theoretical underpinning of the rapid development of new markets in risks that in fact soon took place. In the CAP algorithm estimated beta values indicate the individual contributions of shares to the risk exposure of the entire portfolio, and therefore also prices.

The next phase in financial product development soon arrived with the algorithms for options pricing developed by Black and Scholes (1973), which made the markets for financial derivatives a practical reality. In a couple of decades the B-S/M options pricing formula had made such markets a dominant reality, not only refashioning national and global financial systems, but also the global economy, and in passing presenting national policy makers with a much more restricted agenda of political choices than before.

The Black-Scholes/Merton algorithms tell how an option should be valued for each given level of risk. Hence the derivatives market can be used to reduce financial risks through reallocating risks over markets to those traders who are most competent to understand the risks.

Before we go on it should be recalled that the MOSES model, much as academic finance before its scientific revolution in the 1950s, was built bottom up on observations of business practices and rules of thumb decision making, as studied in Eliasson (1976a), and then conded in Eliasson (1976b). It still remains that way. To be noted also is that when those observed practices are integrated this whole economy wide market model comes out not only incompatible with the fundamentals of neocclassical or neo walrasian equilibrium orthodoxy (Eliasson, 1985; Eliasson, 1991a; Eliasson, 1991b; Eliasson, 1992a), but the rules of thumb and information proxies used in business practice, suddenly appear very much rationally founded when viewed as they should as ex asnte expectationally founded - the Stockholm School connection. Once ex ante plans are confronted in markets and ex post sorted out he world of economics appears quite different. Since the fundamentals of modern financial economics occupy a very special corner of the MOSES economic system, it would in fact the very interesrting, now that this new monetary/ financial part has been integrated within the model, to test the reliability of the new decision rules introduced, for instance the Capital Asset Pricing Model (CAPM) of Sharpe 1964, in the artificial economic world of the MOSES economy.

One could finally say, using Rybsczynski’s (1993) categorization mentioned above that introducing (in this paper) portfolio choice moved the financial system of the MOSES model from a bank- oriented system to a (capital) market oriented system. Introducing the CAP and B-S/M options pricing formula introduced the securitized financial system.

4.2. Introducing an innovative financial services industry in the MOSES model

Financial products are introduced in the MOSES model economy in seven steps:

Step I: A market valuation of net worth of individual firms, efficient market type and the possibility for (only) households and specialized investment firms to hold portfolios

Step II: Portfolio holders also include manufacturing firms that can:

– repurchase own stock (in own firm)

– buy shares in other firms

These investors can buy stock, sell stock, pay back debt or invest , and deposit money in the bank at the offered interest rate.

Step III: A market valuation of debt equity ratios that determine individual firm interest rates

Step IV: Firm financing through stock issues

Step V: Options and derivatives

Step VI: Wealthy individuals can become industrially experienced venture capitalists.22

Venture capitalists can build industrial experience from learning from their own experience of investing, and thus acquire a unique understanding of innovative projects that lowers their risk. This will be done through introducing a competence block module (Eliasson and Eliasson, 1996; Eliasson, 2000b) in the MOSES model. By formulating pricing algorithms for the financial products we establish tradability in those products.

Step VII: Insiders and outsiders in the stock market.23

Insiders will be defined as both particularly well informed individuals, who happen to (1) know before the market about an imminent occurrence that will affect the price of the stock, and (2) who have the industrial competence to understand the commercial opportunities associated with particular technologies. The second type of industrial competence is what make venture capitalists competent. Modelling that competence draws on the genetic learning mechanisms introduced in MOSES by Ballot and Taymaz (1998). In fact, learning and diffusion of knowledge through venture capital and insider activity will create in MOSES the type of positive externalities that are associated with new growth theory. An interesting question that we will come back to later is whether more efficient financial markets, because of new financial products, will reinforce these positive externalities, or not.

4.3. Introducing the efficient stock market

We introduce a simple stock market in MOSES and superimpose investment companies that manage their portfolios and then engage in derivatives trading in stock options, or algorithms representing their perceived future value.

The value of the firm to the owners of its equity has earlier been represented by its replacement value, or total assets replacement valued minus nominal debt, as described in Eliasson (1992b), Eliasson (2000a). We now allow for market valuations of that equity using different market pricing formula as follows:

Insiders use internal profit projections in firms to derive the present value of future expected profits.

where Rⁿ is the current or expected nominal rate of return on replacement valued net worth and δᵢ the insider’s discount rate (see Eliasson, 1996a).

Outsiders use dividend projections to determine the firms value according to the standard dividend valuation formula:

We make outsiders rather simple minded and expect them to believe in a rational expectations (efficient market) type valuation formula:24

which is (by Gordon’s formula) the sum of all discounted future dividends, assuming static WAD type expectations. δ₂ is the outsider’s discount rate. DDIV stands for the rate of change in dividends (DIV). The outsiders have more difficulties assessing the dividend income stream than insiders. Hence, in general

Differences between insider and outsider valuations occur because of (1) uncertainties relating to the fundamentals behind dividend policies, and (2) different risk premia in the discount factor.

We specify an initial distribution of shares over portfolio holders who act individually in the stock market. They however mix with the aggregate when it comes to consumption spending. Initially we create shares with an arbitrary nominal value of 1000 SEK. (The number of shares then becomes the initial value of net worth divided by that nominal value).

Firms can issue new shares to finance expansion. The firm does so (1) when its investment plan must be reduced because its borrowing has driven up its interest rate, but (2) its effective rate of return on its shares (ER) is still larger than its borrowing rate i:

The effective rate of return is defined as:

ΔMV/MV + DIV/MV is the rate of growth in the market value (MV) of the firm (see below) plus is the rate of dividend payout of that market value or DIV/MV. If (Equation 4) holds the market is willing to pay a positive premium to the incumbent shareholders.

Holders of stock are of four kinds:

Outsiders; Wealthy people invest in non-liquid holdings in stock rather than deposit them in the bank. Outsiders are solely concerned with dividends. They rarely change the composition of their portfolio through speculative purchases and sales.

Professionals/speculators analyze external firm data. The pure speculator only looks at stock prices (Taymaz, 1999). Professional speculators may however use a variety of analytical devices. They may obtain information on profits and the balance sheet, but with a delay compared to the insider. They compare firm profits and firm dividends and consider dividends as predictors of future profits. The better the historic fits the more confidence they place on the projections. Unexplained variations enter the discount factor as a risk premium.

Most actors in MOSES financial markets are hybrids of outsiders and professional speculators. They convert dividends into stock prices using (Equation 2) and (Equation 3) and compute weighted averages, the weights telling how speculative they are.

Professional speculators will be specified to be (sometimes) superior investors compared to insiders because of their superior understanding of the macro economy.

Insiders know everything about their own firm (all that is in the MOSES data base). They act as professional outsiders when they buy shares in other firms.

Firms act as professional outsiders when they buy stock in other firms, and as insiders when they buy back their own stock. This means that firms only figure in MOSES as arm’s length investors in other firms, and do not acquire firms strategically.

Insiders (in other firms) and professional outsiders evaluate the dividend behavior of each firm over the past in terms of observed profitability and dividend behavior. The better the fits, the more confident they are in their dividend evaluation algorithms as proxies for profits and future stock prices. Deviations enter as an extra risk premium in their discount factor. But the professionals may also worry about the ability of managers/insiders to assess the external profit situation of their own firm. They therefore consult outside experts for predictions. Here we can use the method of Antonov and Trofimov (1993), who introduced outside experts/consultants in the MOSES economy to help firms understand what was going on in the model economy. Their two "statistical bureaus" each used their favorite theory (a Keynesian and a neoclassical model) to predict. In their two central planning scenarios firm management had to build their plan on the predictions of one of the two. In a third free market scenario they were allowed to rely on any of the two or any correlation they happened to believe in. The point is that the outsider and insider evaluations of stocks or stock options can be based on a variety of principles.

Both insiders and outsiders need price and market (sales) forecasts. Insiders feed them into their own firm model as expectations, and normally use the forecasts of their own firm. Therefore, insiders may also be wrong, since outsiders (because of superior competence or chance) may have a better understanding of the macro economy.

Outsiders use a simple model to predict firm profit margins, for instance:

Where P and W are firm prices and wages respectively and D are operators that stands for relative change in the same variables. Hence, they can compute the nominal rate of return Rⁿ in (1), using externally available balance sheet data and the definition:

assuming S/K to be roughly constant.

M stands for the gross profit margin of sales (S) and ρ is the depreciation rate on capital K. The firm value can then be computed using (Equation 1).

Professionals and insiders are bold speculators. They buy and sell according to their analyses but revise their assessments every quarter to buy and sell again according to their revised assessments. This is in principle quite like computerized trading already being practiced in the market. To get leverage on such speculative activity we introduce term contracts and options.

Every professional trader should in principle be willing to offer term contracts and options based on their expectations. If expectations among traders are very varied, they should have a stabilizing influence on market pricing. If they are first very differentiated and then suddenly shift uniformly in one direction (which can easily be engineered in the model) very interesting macro behavior will erupt.

To increase the leverage even further professional traders may be allowed to borrow. They borrow as firms do, and pay an interest rate that depends positively on the correlation between the debt market value ratio of their portfolios. If market values drop suddenly and interest rates shoot up on highly leveraged portfolios interesting market behavior should be released.

Now what can we do with this?

With highly leveraged professional traders in both spot and futures markets uniform changes in expectations should cause significant reallocations of funds between firms, traders and the bank of the MOSES model if local interest rates shoot up and firms’ borrowing capacity is affected. Since the banking system can create money, credit available for investment will also be affected.

The portfolio investment possibility of individual firms introduces one additional potentially important allocator of resources through the entry and exit process. A firm’s net worth is defined as:

Where K₁ stands for hardware production capital, K₂ is the portfolio of financial assets, and K₃ current trading assets including inventories of inputs and own products. Now let

where ST is investments in shares that are allowed up to a share ẫ of the portfolio of financial assets, then

When a firm expects a better return on investing in other firms’ shares than in its own production ST investments increase and appear in the balance sheet at current market values. Since the firm may make investment mistakes in its financial portfolio it becomes perfectly possible that a highly leveraged (high D/NW) firm with large investments in ST, after a stock market slump may find itself in a bankruptcy situation with a NW ≤ 0. This situation may thus be entirely unrelated to its own manufacturing performance. A previously well managed manufacturing firm with a good profit record may therefore be forced to shut down because of purely financial mistakes.

Stockholders hold portfolios of shares that they compose according to the relative risk-free returns on deposits in the bank.

Cash proceeds from stock sales can be used to buy more shares in other firms, to deposit in the bank or be added to household disposable income. Professional outsiders and firms can borrow to buy more shares. Professional outsiders/borrowers pay an interest that is positively related to their debt equity ratios. We could in fact define a "capitalist class" that holds wealth and lives on capital income. That capitalist class would then coincide with the insider or venture capital definitions (see above).

4.4. Tradability and trading

Tradability in financial asset markets depends on the possibility of linking a property right to the asset (an institutional legal problem, Eliasson, 1993; Eliasson, 2000a) and on formulating an efficient pricing algorithm. This is what the Markowitz – Modigliani – Miller – Sharpe innovative financial product developments have accomplished, and even more so the Black and Scholes (1973) and Merton (1973) options pricing model. Trading, however, must also be identified as individual transactions between a portfolio holder and shares in one firm to determine individual stock prices. Also, the forming of expectations must be explained. Sellers and buyers of individual shares find (through selective search) each other in different ways. Contrary to the product and labor markets in MOSES, where actual bargaining takes place, when it comes to financial assets demand and supply agents find each other stochastically and clinch rational deals. This is explained in Taymaz (1999).

Firms, households, and private wealthy investors choose between investing in their portfolio or depositing in the bank according to expected after-tax and risk relative returns.

4.5. Introducing derivatives and options

Derivatives are modeled as contracts based on agreements about future trading in the stocks as defined above. There are three kinds of derivatives:

Forward/ Future (term contracts)

Options

Swaps (a series of term contracts)

In principle all financial contracts, including shares, can be seen as options. For the time being we will, however, introduce them in the traditional way. The MOSES model recognizes the following contracts.

Term contracts

Professional outsiders and firms (as professional outsiders) are allowed to take forward positions in stocks. With a forward contract the investor offers to buy or sell at a preset price at some future date. This is a commitment. The futures contract differs from the forward contract in that you offer to deliver a financial asset at a preset price at a specific date. If you want to get out of your commitment you must sell the contract in the market.

Options

An option is the same as a term contract, only that you don’t have to buy or sell. You have purchased an option to buy or sell at a preset price at a specific date.

Swaps

A swap means that the financial transaction takes place by way of a third party.

Originally swaps were created to bypass currency regulations. A US firm had dollars and wanted SEK in Sweden. A Swedish firm had SEK but wanted dollars in the US. The Swedish firm was not allowed to buy dollars. Then the Swedish firm arranged through a bank to buy the dollars of the American firm and to pay the American firm in SEK in Sweden. When authorities used regulation to prevent Swedish firms from transferring money out of the country, regulations could be bypassed because of swapping. No direct transfer of currencies occurred. Swapping meant that the outcome for the parties was anyhow the same. Regulators had created a "semi barter" market, forcing parties to resort to more costly transactions forms (swaps).

Swap transactions have of course been possible all the time, only that modern C&C technologies have made the matching of potential trading and swapping partners more efficient and more complete. Today you may not even need a bank to arrange the transfer.

Standard financial transactions in the Swedish currency market aimed at facilitating access and making the market more complete can take place in a similar fashion. We are talking about firms with different access to the capital market because of credit controls, a bad credit rating or simply incompetent financial institutions. A bank may not want to lend to a small firm that it does not understand, or to a firm with a bad credit record. Another firm which understands the firm in need of cash and has a good credit rating may then borrow from the bank and extend a credit to the firm that needs it. Through increasing access this intermediary firm has made the market more complete through a swap. Obviously new C&C technologies will soon subject an incompetent, legally tied down and over bureaucratized commercial banking system to devastating competition if it does not shape up. Microsimulation method is ideal for studying the economy wide consequences of such institutional competition in financial markets. The venture capital market is one example where banks for legal and organizational reasons are great underperformers (Eliasson, 1997).

Swaps can be used to convert bank lending into venture capital. To do that MOSES requires that inter firm borrowing is explicitly modelled which is currently not possible. We may however limit swaps to professional outsiders which would then appear in the market as more competent competitors to the bank in providing venture capital.

Term contracts make it possible to model pluralism or singularity and everything in between. We can generate a bewildered and perhaps stabilizing expectational future, or a single valued future "compressed immediately into today" that may be heavily destabilizing in a dynamic model economy such as MOSES.

4.6. The Black and Scholes (1973) options pricing formula

The Black and Scholes (1973) options pricing formula (also see Bookstaber, 1987) determines the price of an option for a given risk level. It reads:

where

N(d₁) = the probability that a normally distributed random variable will be less or equal to d₁, the option delta.

P = price of stock now

EX = Exercise price of option

PV(EX) = present value of EX, calculated using the risk-free interest rate

t = number of periods to exercise date

σ = standard deviation per period of rate of return on stock. σ² is the security’s return volatility.

The B-S formula thus tells the price of a call option that eliminates profit opportunities from trading.

Suppose no risk is associated with the future security price. Then σ² will be close to 0, and both d₁ and d₂ will become large making N(d₁) and N(d₂) equal to 1. Hence, the price of the call option becomes equal to

or the current price minus the discounted future price. Whenever there is volatility in the market or uncertainty about the future value of the security (σ > 0) you take on a risk in buying an option, and therefore pay a lower price.

because the EX may not be what is expected. Since expectations about the future value of a security vary, or the competence to evaluate risks varies, a rational foundation for a market in options exists. A theoretical note is in place here. Modern financial economics has done away with Knight’s (1921) distinction between uncertainty and calculable risks. The B-S (1983) pricing algorithm assumes calculable risks, as in (7) above. Pricing becomes an insurance or lottery business. The assumption about the N() functions above is however an empirical assumption that may not hold up in reality, and probably not in the MOSES model economy, which does not have the properties of a stationary process which both the B-S algorithms , and rational expectations (RE) models (see above) require. The distinction between uncertainty and calculable risks has a meaning in MOSES. Our guess is that the N functions are quite unstable over time which should make the Black and Scholes (1973) pricing formula unreliable, a proposition that is perfectly testable through simulations on the MOSES model.

4.7. Stability of fundamentals

Volatility (σ²) can be calculated ex post. In an assumed walrasian lottery setting repeated experiments ("trades") in the options market would then produce calculable risks and predictable outcomes in expectation. If the stochastic functions underlying fundamentals are not stable, as should be expected in MOSES type non - linear environments, then stochastic predictability, being assumed in the B-S pricing formula, may not be there. Thus, using the B-S formula in the non-linear MOSES economy may be highly risky (due to uncertainty), not to say failure prone.

A confused and incomplete, but fast market process may both stabilize and destabilize market fundamentals. If correct in expectation in their perceptions of the external desired economic optimum stochastic equilibrium conditions may be attained. Otherwise, market chaos may be created when the whole army of producers march in the same, but the wrong direction, and market self – coordination fails. We have already seen what happens in the MOSES economy when market transactions are speeded up pushing the entire model economy too close to a market clearing situation that does not exist as an operating domain of the MOSES economy. Near economy wide systems collapse is then the outcome (Eliasson, 1991a). The MOSES model economy, enriched with modern financial services technology, should therefore be able to tell whether the optimum desired by policy makers is an economically desirable target to aim for.

(For instance, you may think you know best about the future. You should then act on that insight, taking a speculative risk, that you do not consider a risk because you know better. This is a commendable entrepreneurial attitude that economies need in large numbers to prosper (Eliasson, 1996a; Eliasson, 1997). The definition of an entrepreneur is that s/he believes in, or understands something no other does and dares to act on that understanding.

A professional trader may be convinced, because of his or her superior understanding of the macro economic situation, that the stock of a particular group of firms will decrease significantly in value. If this belief runs counter to current beliefs in the market, the professional trader goes short, offering to sell stock (that he does not have) at a price below the current price a year from now.

Genetic network learning (Ballot and Taymaz, 1998) in MOSES makes it possible for insiders to know more about the competitive situation of a firm than others. Speculators can search, using genetic algorithms, for correlation patterns in the MOSES economy that have been stable for some time for good or spurious reasons, and when identified, act on them).

4.8. Introducing derivatives

Derivatives are introduced in the MOSES economy in four steps.

First (Step 1) we introduce tradable stock certificates and firms and households as investors in such certificates. Second (Step 2) we make the market value of a firm’s net worth (rather than the replacement accounting value) dependent on the individual firm debt equity ratios that determine a firm’s interest rate. Third (Step 3) we model markets for stocks in which traders determine the market value of individual firm shares. For this step the information and expectations of individual traders must be specified (Taymaz, 1999).

Step 4 introduces the various options defined above, issuers and holders and the markets for such options.

Insider trade is based on superior information or knowledge. Trading insiders therefore make the market more informed. By not being allowed to trade the market will remain uninformed. With insiders trading in the market financial resources will be allocated more efficiently. The MOSES world of an Experimentally Organized Economy distinguishes between insiders happening to know about specific market determining events and insiders being particularly knowledgeable about the business. Prohibiting both insiders from trading may therefore be bad economic policy (Eliasson, 1990a). Instead of outlawing it policy makers can help making markets more complete (read informed) by instituting more speedy disclosure mechanisms, something modern C&C technology is especially suitable for, maybe revealing a trade even before it has been executed, rather than after several weeks of bureaucratic paperwork which was the case in Sweden not long ago.

5. Games and outside participants

The MOSES model constitutes an excellent pedagogical business game, which may be greatly improved when complemented by the sophisticated financial markets of this document. This is especially so because trading in many of the financial instruments just discussed already occurs in markets for computerized trading. This document can therefore be used as an instruction manual for how to set up such a business game.

5.1. Rates of return corrected for risk

The financial investor is concerned with the real rate of return on his or her portfolio, standardized for risks. The higher the estimated risk the higher the return demanded.

We measure the performance of the portfolio by the so-called Sharpe index:

S is the average excess return of the portfolio compared to the standard error of the return (= σ). R stands for the average return, and r for the average "risk free" return (say the interest rate),25 all for the same measurement period. σ can be called a measure of price volatility.

This return over a risk-free investment can be computed for any portfolio. When all investments are in risk - free bonds the Sharpe index is zero. The financial investor wants to maximize the Sharpe index over the longer term. The ex post outcome then depends on his or her ability to foresee the risks taken on. The competence to do that may raise the S even though other, but less competent investors think the risks they have taken on are much higher than they really are.

5.2. Error tracking index

It is of interest to compare the individual Sharpe index with that of a competitive portfolio, for instance that of another portfolio manager or a stock market index. Such a useful error tracking index (T) is:

where R* is the average return on the reference portfolio and σׇָ the standard deviation of the difference between the portfolio return (=R) and the reference return (=R*).

5.3. Volatility

The five inputs in the B-S/M (1973) options pricing formula (Equations 7; 8) are (a) the current price of the (underlying) security (=P), (b) the exercise price of the option (=EX), (c) time of expiration (=t) , (d) the risk free interest (discount) rate and (e) volatility. Since the first four variables can be determined, the expected volatility in the market can be estimated by introducing the market price of the option and then solving for volatility (=σ) to determine the price of the option. Since an estimate of volatility is an input in the Black-Scholes options price it is perfectly possible to define a market for trading in volatility estimates. Then call options traders can outsource the risks associated with predicting volatility in the market, and price the call option according to Equation (7), conditional on that given volatility estimate. Alternatively, s/he may carry the risk on his/her own and use past measures of volatility of the computed variance (= σ²) in actual prices over time, and some econometric model to predict σ, or simply plug in a guess.

To simplify for an outside participant to engage in the options market of the model we can request for each stock an estimate on all current stock and options prices (last period) and a past record of expected and actual volatility (= σ²). The investor can then determine what s/he is willing to pay for a given option or offer to buy options with this exercise price and time to expiration for so and so much.

5.4. Efficient data mining