Firm Turnover and the Rate of Macro Economic Growth: Simulating the Macroeconomic Effects of Schumpeterian Creative Destruction

- Article

- Figures and data

- Jump to

Abstract

Investment project selection and firm turnover are integrated in a market self-coordinated macro model (Eliasson, 1976b; Eliasson, 1991a; Eliasson, 1991b; Eliasson, 1995). We simulate a Schumpeterian Creative Destruction process driven by endogenous entrepreneurial entry causing reorganization or exit of firms that acquire and release resources in markets under different institutional conditions. While too fast structural change may make endogenous prices unreliable as conveyors of information, increasing the rate of economic mistakes and slowing econmic growth, an optimal balance between the rate of firm turnover and long run sustainable growth is demonstrated to exist. Optimal growth depends on the balance between entries and exits, the performance and size of new firms compared to incumbents, and on variation in the same characteristics. There is also the general problem associated with selection based, initial state dependent non linear micro based models that the incidence of even minor mistaken investment decisions may cumulate with time into major macro consequences ("deterministic chaos"). We conjecture that the negative tilting (as some "high speed" market entry simulations close up with the 75 year horizon) of the macroeconomic trajectories depends on the incidence of Type II econmic mistakes, or winners getting lost along the way.

1. Introduction

During the last few decades increasing attention has been paid in economic and econometric modeling to the role of investment project selection and firm turnover in economic growth. References are sometimes made to Joseph Schumpeter’s notion of Creative Destruction, for instance in Audretsch (1999); Aghion and Howitt (1992); Aghion (1998); Audretsch (1995b); Dasgupta and Stiglitz (1981); Jovanovic (1982); Jovanovic and Lach (1989); Wagner (1999); Winter (1964); Winter (1986). This literature is currently being integrated with so called new growth theory, see for instance and Pakes and Ericson (1998). Caves (1998) is an early summary of the literature.

One reason for this reorientation of research on economic growth may be a renewed interest in Schumpeter (1911) in whichJoseph Schumpeter’s theory of economic development, identifies the introduction and use of new ideas (innovations) – in entering as well as in established firms – as a major source of economic prosperity. Much of this Schumpeterian recognition is however only nominal, in that modellers struggle to fit entrepreneurial entry into neoclassical equilibrium models that we consider incompatible with the existence of reasonably defined entrepreneurs. Schumpeter (1911) himself regarded the entrepreneur a disturber of a Walrasian equilibrium. While the MOSES model, that we simulate in this study, can be seen as a general dynamic game of monopolistic competition kept in constant motion by endogenous entrepreneurial entry competition (Eliasson, 1985), the influential survey article by Franco Modigliani (1958) on new oligopoly theory had had little to say on empetitive entry as a price determining factor, and probably limited the interest in entry among economists for years. When that interest at last arrived, even empirical modellers, unfortunately have considered it mandatory to shoehorn entrepreneurial entry into incompatible equilibrium straitjackets.

Exit, is the companion of entry in Schumpeterian Creative destruction. It plays the necessary role of sorting out entrants that the market test has rejected and, in general, to set resources free for expanding firms. Exits of failed businesses therefore become a natural transactions cost for economic development , and an imp0rtant element in Schumpeterian creative destruction (Table 1). In this process of creative destruction (the term first appeared in Schumpeter, 1942) one could, therefore, argue that a faster turnover of firms should reflect a more intense market search for new business opportunities and a reallocation of resources away from firms that have been unsuccessful in identifying and commercializing new business opportunities, to firms that are successful, or more to the point, been unable to cope with competition. Hence, we should expect a positive correlation between the turnover of firms and growth. Empirical support for this is, for instance, provided by Haltiwanger et al. (2004) and Fogel et al. (2006). However, as the market selection dynamics of the MOSES model will demonstrate below, underlying this proposition is a positive market determined relationship between entrepreneurial entry and exits such that increasing returns to continued search (pushed by entrepreneurial competition) for investment opportunities occurs and successful winners dominate over exiting losers (Eliasson, 2003; ; Eliasson, 1995). While experiments on the MOSES model had already demonstrated that the organization of markets, and notably market flexibility, was instrumental in creating the positive relationship to firm turnover (Eliasson and Taymaz, 2000), this paper conjectures that this positive relationship is nonlinear, and will eventually bend down as an increasing rate of structural change, reflected among other things in fast changes in the population of firms, lowers the reliability of market price signaling and disturbs the market self-coordination functions.

The four mechanisms of schumpeterian creative destruction and economic growth.

| 1 | Innovative entry enforces (through competition) |

| 2 | Reorganization |

| 3 | Rationalization or |

| 4 | Exit (bankruptcy and/or shut down) |

-

Source: Eliasson (1996). Note: This is a stylized version on how growth occurs in the micro-to-macro model. We find the term creative destruction appropriate. It first appeared in Schumpeter (1942), but Schumpeter (1911) is a better reference for the dynamics we are discussing.

Neoclassical equilibrium economics has difficulties with the concept of systemic (non random) investment mistakes from which agents can learn to improve next period plans. Firms in MOSES form price expectations in the three markets of the m0del (product, labour and financial) and integrate them in their investment, production and recruitment plans (Eliasson, 1976b). Price expectations , however, normally come out more or less wrong; an instance of Stockholm School ex ante-ex post economics. After market confrontations with other firms, most plans thus come out more or less in error. Two types of mistakes are constanly made. Most commonly mistakes take too long to be identified and corrected (Type I mistakes). Most serious, however, are that winners may be lost, often for good (Type II mistakes, see (Eliasson and Eliasson, 1996). Type II mistakes are difficult to observe, but their existence can be determined by running counterfactual experiments on the MOSES model (see further below).

To our knowledge little attention has been paid to the feedback effects on production structures, of mistaken price expectations and on firm turnover. One would expect that a constantly ongoing interaction between interdependent price and quantity structures will eventually affect the reliability of prices as information carriers negatively and create a disorderly market behavior that is detrimental to growth (Eliasson et al., 1983; see also Brown et al., 2006). We hypothesize that the positive growth effects of increased firm turnover dominate up to a limit, then to turn negative as the rate of entry and structural change increases, competition intensifies and the rate of firm turnover tilts towards a dominance of mistaken plans due to a disturbed price signaling in markets, and an increased rate of business failure. Destruction begins to dominate over positive creation.

The complexity and the long term nature of the non linear relationships involved make it practically impossible to capture these effects by standard econometric methods and for two reasons. First, time series panel data of sufficient length to reveal the non-linear property are not available. Second, the time span we now consider will include so many interactive influences that the model complexity needed to capture them, and keep them apart, will take us beyond the current capacity of econometric methods. It may also be the case that the negative macro consequences begin to show sufficiently early for agents, including policy makers, to take notice and react to counter these effects. More likely however is that negative consequences take so long to show statistically that their origin cannot be identified, and that corrective measures are both too late and wrong (Eliasson and Taymaz, 1992). To establish the possible theoretical existence of such a long term downside of Schumpeterian Creative Destruction only simulation analysis will do. And MOSES type micro to macro models is the only way of getting some quantitative control of the policy situation. Hence, this analysis becomes a theoretical inquiry into the possible existence of such a negative effect in a controlled experiment. In such a controlled experiment (Eliasson, 1991a; Eliasson et al., 2004), we expect a situation of chaotic behavior to emerge. Under normal circumstances agents make mistakes and respond to mistakes but the markets of the economic system at large will possess sufficient self-regulating capacities to restore order. Above a certain rate of turnover, however, we propose that this market self-regulation will begin to malfunction.

In this paper growth is simulated on the firm based macro model MOSES under different institutional conditions. Growth in this model occurs through the experimental selection of innovations in dynamically competitive markets populated by heterogeneous business actors that make up plans that are rarely correct even in expectation. New firms that enter markets raise competition and force reorganization and rationalization, or exit on incumbent firms. Depending on a number of circumstances this Schumpeterian Creative Destruction (Table 1) in what we call an Experimentally Organized Economy (EOE) may be dominated by positive creation or negative destruction. The internal balance between equilibrating and disturbing forces is determined endogenously in the product, labor and financial markets that are integrated through the internal, profit oriented decisions of individual firms.

The main purpose of this paper is to demonstrate the existence of such a balancing point within this firm based macro model economy based on empirically reasonable assumptions.1

Testing for the presence of the long-term negative influence we precede in two steps. First, we present the model of the Experimentally Organized Economy in which business mistakes become part of transactions costs. Second, we simulate the model in repeated experiments to establish the existence of a nonlinear long-term relationship between the rate (and balance) of firm turnover and macroeconomic growth that (the proposition) eventually turns negative as the rate of entry is increased, and the rate of structural change occasioned creates market disorder.

2. The Dynamics of Resource Allocation in the Experimentally Organized Economy

2.1. Schumpeterian Creative Destruction

A model approximation of the theory of the EOE, the Swedish micro-to-macro model called MOSES is used to demonstrate the existence of the negative growth effect due to disturbed market price signaling when the rate of structural change passes above a certain critical level. This is achieved through artificially raising new entry, intensifying competition and increasing the rate of exits, or intensifying the Schumpeterian Creative Destruction process. For our purposes the model economy we study has three fundamental properties.

The huge and complex opportunities space assumed implies the potential for very large productivity improvement through the reallocation of resources. Much of that reorganization occurs as firms explore the opportunities space, or enter markets in pursuit of profits, raising competition and forcing low performers to exit (Eliasson, 1991a; Eliasson, 1991b; Johansson, 2001; Eliasson and Taymaz, 2000; Eliasson, 1995).

Firms integrate their individual price expectations in product, labour and financial markets in their business plans, subject to individual, historically conditi0ned long term profit targets. These business plans are then confronted in the three markets.

The faster resources are being reallocated through entry and exit, however, and the faster the organization of production changes, the more unreliable price signaling in markets in reflecting future profit opportunities, causing in turn an increase in costly mistaken business decisions and eventually tilting growth trajectories negatively

There are increasing negative returns to increased search (“learning”) in the short term as agents attempt to explore the investment opportunities space faster to reach higher productivity levels. These negative returns to too fast learning occur because changing structures endogenously affect price setting in the markets and the faster so, the faster structural change. The market coordination mechanisms of the model economy (price signaling in markets) are disturbed, price signals becoming increasingly unreliable and causing an increased rate of mistaken decisions.

We postulate that growth will increase to begin with, as the rate of entry increases but eventually begin to decline. If almost all firms are changed through entry and exit each period, an extreme case, growth should be slower than in the zero turnover case. Somewhere between no turnover and extremely fast turnover we expect to be able to determine a long term growth maximizing rate, and we conjecture that the organization of markets that governs the allocation of resources to actors will play a critical role in determining that balance. While the hypothesis of generally positive effects of firm entry (turnover) on long term growth can be tested both econometrically and throgh simulation experiements on the MOSES model, to determine the existence of a negative tilting of that growth trajectory beyond a certain rate of positive turnover only micro macro simulation experiments will do.

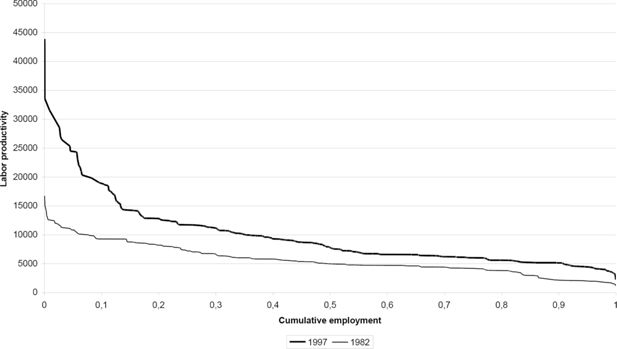

The existence of a positive relationship between entry and long term macroeconomic growth has been established econometrically on data generated by repeated simulation experiments on the MOSES micro-to-macro model of the Swedish economy (Eliasson and Taymaz, 2000). Incentives for entrepreneurial entry have been gradually raised and the simulated long-run effects on total output recorded.2 We now expect to be able to demonstrate that the long term positive entry growth relationship is non linear, and that a negative influence on long-run growth will eventually appear as the rate of entry is raised, and occur faster, (1) the faster firm turnover, (2) the more unbalanced the entry and exit process, and (3) the more diversity of production structures is reduced (flattening of Salter curves in Figure 1), for instance because of increased market concentration. Again, since entrepreneurial entry is the main supporter of structural diversity (Eliasson, 1984; Eliasson, 1991b), to establish general relationships between vigorous entrepreneurial entry, market competition, exit and long term growth, indeed becomes a task fraught with analytical complexity.

To carry out the necessary experiments to accomplish this task we have used the latest version of the MOSES model of the EOE, with endogenous R&D based generation of innovations and genetic learning of firms from one another (Ballot and Taymaz, 1998; Ballot and Taymaz, 1999). Experiments are run (by quarter) for 75 years. Micro relationships have been partly determined econometrically. The model is based on a separate firm survey carried out by the Federation of Swedish industries since 1975 (Albrecht et al., 1992). This survey is used to establish initial conditions for the simulation experiments. The remaining parameters in the model have been calibrated against the historic long-term development of a number of variables of the Swedish economy, using an early method of structural estimation developed as part of the micro–to–macro modeling project (Taymaz, 1991b).3

2.2. On Non-Duality and Unreliable Price Signaling

In static equilibrium duality prevails. Prices map exactly into quantities and quantities map exactly into prices. Out of equilibrium “behavior” can only be analyzed on the static general equilibrium model for infinitesimal departures from that same equilibrium to which the system always returns (converges) i.e., to the original (same) equilibrium, or almost there (“practical stability”, La Salle and Lefschetz, 1961). This rubber-band fixed-point based equilibrium analysis recognizes neither time, and transactions costs, nor the possibility that the economic system, because of its departure from static equilibrium may go “elsewhere”.4 Hence, to analyze the model economy´s self-coordinating capacitities after having seen its markets price signaling endogenously disturbed the capacities of the heterogeneous agents of different sizes with price setting autonomy that populate its markets become the focus of interest, and in particular their "cognitive expectations and decision systems".

When entrants are characterized by large variations in performance, and not necessarily being better than incumbents on average, new (and young) firms tend to perish at a faster rate than old incumbents. This property of the model is compatible with empirical evidence reported in literature, and in Johansson (2005).

When some entrants are very much better and very large, and variance in performance low, incumbent firms will soon begin to perish in large numbers from competition. With time the new and superior firms will begin to dominate (Eliasson, 1991b). However, new entry may not be sufficient to maintasin a healthy diversity of structures and performance distributions accross the firm population will flatten and be dominated by a long tail of low performers (Eliasson, 1984; Eliasson, 1991a; Eliasson, 1991b).( Such a structure is vulnerable to unexpected competition, that may leave a permanent (non reversible) structural break and suddenly turn fast growth into low growth phase (Eliasson, 1983). Such triggering phenomena at the macro level, however, are rarely "observed", and can only be “understood” through model simulations. In fact, earlier model experiments have uncovered a conflict between static and dynamic efficiency in the sense that considerable diversity of characteristics at the firm level appears to be a necessary requirement for stable and sustained macro economic development. This does not only mean diversity in the sense of different, but also diversity in the sense of more or less efficient firms (the existence of slack) and constant change at the micro firm level. Steady state like macroeconomic growth thus has to be supported by constant and “substantial Brownian motion at lower levels” (Eliasson, 1984), and vice versa: If that micro economic dynamics is blocked, e.g. exit prevented by policy, negative long-run macro economic effects will eventually begin to show. This is part of the micro to macro dynamics we study in this paper.

Testing for the presence of a long-term negative influence we proceed in two steps. We take note of certain “stylized facts” from the empirical literature on firm turnover to make sure that the inputs into the simulation model and its intermediary output are compatible with those “facts” (next section). We then go on to present the alternative model of the Experimentally Organized Economy in which business mistakes become part of transactions costs and use it to establish the existence of a negative long-term relationship between the rate (and balance) of firm turnover and macroeconomic growth through simulation experiments.

3. Stylized Facts about Firm Turnover and Growth

Entry, and even more so exit of firms caused by mistaken decisions, for long was an avoided issue in economic theorizing. Because of the mathematical difficulties of allowing for autonomous micro behavior in neoclassical equilibrium models´such phenomena were neglected, and even mistakenly regarded as irrelevant. As an empirical phenomenon entry and exit, however, exist, and some economists observed early that economic growth might be affected. Some empirically oriented economists (Acs and Audretsch, 1989; Baldwin and Gorecki, 1987; Baldwin and Gorecki, 1989; Baden-Fuller, 1990; Du Rietz, 1975; Hause and Du Rietz, 1984; Highfield and Smiley, 1987) defied the theoretical problems and launched the needed ad hoc empirical inquiries to learn about the magnitudes involved in firm turnover. Econometric models estimated were also loosely related to mainstream economic theory, and a closer analysis would demonstrate that they normally conflicted with the assumptions of the mainstream equilibrium model. For this reason interest among economists in the growing research on entrepreneurship and new firm formation has not been overwhelming. For a long time conventional wisdom was (e.g., Eriksson, 1984) that “industry growth comes mainly from existing firms”. Since the MOSES model was solidly based on observation in Eliasson (1976a) it was simply impossible to neglect the empirical facts of entry and exit, and an entrepreneurial entry slot was quietly sneaked in, despite advice to the contrary, in Eliasson (1978a). In simulation analyses, Eliasson (1991b) and Eliasson and Taymaz (2000) also demonstrated (1) that entry induced by "above equilibrium profitability" , and (2) exiting firms that had run out of equity, significantly affected long-run growth, but in complex ways of market interactions. The long time needed for significant effects of new entry to appear at the macro level had been demonstrated already by Du Rietz (1975). Johansson (2001), furthermore, showed that new and small firms accounted for all growth in employment in the Swedish IT industry between 1993 and 1998, while the large firms as a group significantly reduced their employment. Entry also “became seen as one of the main mechanisms by which long-run equilibrium” is restored (Audretsch and Mata, 1995). There are however theoretical problems associated with trying to understand the economy wide economics of firm entry, or for that matter entrepreneurship, in terms of neoclassical orthodoxy. Already Schumpeter liked to refer to his entrepreneur as a disturber of Walrasian equilibrium. Kirzner (1973) , on his side, proposed that the entrepreneur should be seen as the restorer of equilibrium states. On that the MOSES modeller has to object that if market transactions costs associated with non stochastic business failure is a normal cost of economic development and an important explanatory factor in economy wide market self- coordination, the walrasian equilibrium central to neoclassical orthdoxy will not be compatible with the existence of reasonably defined entrepreneurs and endogenous exit, and should be kept out of models fearturing Schumpeterian entrepreneurial competition and the entry and competitive exit of firms. This theoretical complication arises when Stockholm School ex ante-ex post considerations are allowed into the market micro to macro machinery (Eliasson, 1983; Eliasson, 1984; Eliasson, 1991a; Eliasson, 1992; Eliasson, 2003).

The stylized facts also are that rates of entry and exit develop parallel, but vary between economies (Caves, 1998; Geroski, 1995; Siegfried and Evans, 1994). Furthermore, there is econometric evidence of rates of entry being dependent on rates of return in the firm and/or in the market entered, but the evidence varies between studies. The reason for the absence of such relationships in some studies might be that entrants are generally overoptimistic and believe their technology to be superior to that of their incumbent competitors in the market and be independent of the situation at large in the market. In reality then, entry depends on expected profitability on the part of the entrant, which is difficult to measure. Highfield and Smiley (1987), however, believe that the lack of empirical support of this neoclassical relationship in other studies (for instance in the much quoted early Orr, 1974) depends on a “ lack of sophistication in modeling entrepreneurs´ expectations about future profit rates”. It is also hard to believe that there should be no relationship between the aggregate profitability situation in a market and the rate of entry in the same market. Stylized facts, in fact, are that entry increases and exit decreases with profitability and growth in the local markets (Siegfried and Evans, 1994).5

Another stylized fact is that the average performance of entrants is lower than that of incumbents but that the variation in performance in the entry sample is very much larger (Granstrand, 1986; Caves, 1998). This suggests that newly established firms have a higher exit rate than older incumbents, a property empirically supported by Audretsch and Mahmood (1994); Audretsch and Mahmood (1995) and Caves (1998) survey of empirical literature. This property and the specification of innovation supply and firm entry are also very similar to Jovanovic (1982) model of passive learning of firms, i.e. firms learn of their own capacities by being subjected to the reality of markets. For some, trained in standard micro production analysis, this may seem counter intuitive, since for them old and obsolete plants should exit first. On this Honjo (2000) finds that new firms have greater difficulties surviving than old firms, notably in markets with high entry rates and (therefore) intense competition. Audretsch (1995a) observes that survival rates (over a decade) are lower in highly innovative than non-innovative markets, but entrants that have survived exhibit higher growth rates than other firms. This is also the result of Johansson (2001). Also Baldwin (1995) found that firms that survive exhibit fast growth rates. The higher exit rate of new firms than of incumbents has long been a property of the MOSES model and for exactly the reasons given above (Eliasson, 2000).

Generally speaking, the short-term effects of entry on aggregate output appear not to be large, and slow in coming (for a survey see Eliasson, 1991b). The important long- term effects of new entry are indirect and systemic and are even slower in coming. To quantify them you need a full scale dynamic, micro based model of the entire economy.

4. The Entry and Exit Processes

Firm turnover involves innovative entry, learning and imitation, enforced reorganization and competitive exit, together making up the Schumpeterian Creative destruction process of Table 1. This process, which is endogenous and the explicit driver of the micro macro simulation model MOSES, may or may not generate macroeconomic growth, depending on economic circumstances endogenous in the model.

4.1. Economic Growth through Competitive Selection

One could say that the four mechanisms of Schumpeterian Creative Destruction in Table 1 updates a set of performance characteristics represented each period through the rankings of as many Salter curves (see Figure 1). Under positive circumstances (incentives, competition, competence) the Salter curves are shifted outwards. Economic growth occurs. This positive outcome is, however, not guaranteed. Circumstances might be negative and destruction dominate, changing the shape of the Salter curves. Stagnation might follow instead.

Firms are guided in their investment decisions by the expected return to capital over and above the market interest rate. The key selection problem of economic growth however is that winning innovations are identified and not lost, and succesfully carried on to industrial scale production and distribution. Market selection is a complex and resource using process, lost winners representing a large social cost in terms of lost output. Competence bloc theory presents the critical actors involved in technology selection, commercialization of innovations and scale up. Otimal market selection performance occurrs when the long term macroeconomic incidence of two kinds of economic mistakes are minimized; keeping losing projects on the books for too long (Type I mistakes) and losing winners (Type II mistakes), type II mistakes being the by far most important. While close to impossible to observe directly, the existence of type II mistakes can however be demonstrated through simulation experiments on the MOSES model, as can also the entire optimization process by designing and testing different market organizations (Eliasson and Eliasson, 1996; Eliasson, 2001; Eliasson, 2003).

Short-term production decisions and recruiting are guided by a criterion called Maintain or Improve Profits (MIP). Firms constantly climb expected profit hills that change from period to period because of innovation and the ongoing climbing traffic, and keep modifying their supply plans and recalculating their expected profits as market prices change endogenously and as they learn from experience (Eliasson, 1976a; Eliasson, 1977; Eliasson, 1991a ). The more expectational mistakes the firms make the more cautious they become. However, the more disturbed market pricing, the larger the incidence of business mistakes, and the more likely that winners will be lost (Type II mistakes), the cummulated consequences of which may be very large and only emerge with a long lag. Type II mistakes that we expect occur in MOSES simulations, will bias long term growth in the entry experiments negatively.

4.2. The Concepts of Entry and Exit

The concepts of entry and exit are well defined in the MOSES model as “whole” firms that enter or leave. Also factors of productions used in exiting firms (labor and machines) are recycled over the market to other firms. In general, we want to relate entry to the Schumpeterian (Schumpeter, 1911) concept of entrepreneurial entry as it apperas in the Creative Destruction Process in Table 1.In reality, however, entry and exit take on more diverse forms. Jenner (1966) wanted to see the launching of a new product as a new entrant, and firms may acquire parts of other firms, or spin-off parts of itself as new entrants. Strategic acquisitions and divestures have become an increasingly important phenomenon in industrial dynamics. Similarly, the shutting down of a factory as well as the termination of a product line in a big firm should count as exit. This is perfectly compatible with our theory as expressed in Table 1, but such a fine statistical resolution takes us beyond availability of data, even though a few empirical studies have looked at corporate spin-offs (e.g., Du Rietz, 1975; Du Rietz, 1980). The same phenomenon on the exit side is more difficult to define and observe statistically. A complete reorganization of a firm with many subsidiaries, including divestures and new acquisitions should count as a complex entry and exit process, and may to some extent appear in statistics as the disappearance of old, and the opening up of new firm identification numbers. Part of this activity will be possible to test for statistically in econometric models. The MOSES model, as it is currently designed is prepared to deal with the desired realism for complex both theoretical and empirical analysis. Avalability of data , however, sets the ultimate limits to the empirical study on how reorganization of micro structures affect macro (Item 2 in Table 1), and the practical way to proceed, to our mind, would be to develop statistical methods to feed the MOSES model with case study data.

4.3. Entry

In this analysis we use the following entry rate specification.

where s (.) is a stochastic function, α is the exogenous entry parameter, and π the average rate of return in the appropriate market.

Firm performance is measured by labor and capital productivity (called TEC and INVEFF respectively in the model) and by the rate of return. To specify the characteristics of new firms we use the stylized fact mentioned that average labor productivity of a sample of new firms is lower than the same average of incumbent firms, but the spread very much wider.

In the first experiment below we have set the size of the average firm entrant (large entrants) at 15 percent of the average incumbent measured by labor employed. The new data becoming available suggests that this is somewhat large for Sweden with its very large firms. The average size of an entrant in engineering industry should rather be somewhere between 5 and 10 percent.

To test for the effects of the entry rate on long-run macroeconomic growth the value of the exogenous entry parameter, α, has been increased gradually. The size of new firms in terms of the number of employees is drawn randomly from a uniform distribution the average size of which is smaller than the average size of incumbents. The boundaries of the distribution vary between m percent (lower limit) and n percent (upper limit) of the average size of the incumbent firms.6

The technological characteristics of the new firms are also determined randomly, using genetic algorithms (see further Ballot and Taymaz, 1998). There are 100 technologies that firms can learn about, recombine and use. These technologies are indexed from 1 to 100 by ascending technological level. The probability that the ith firm will enter with technology j is defined as follows:

where Tave is the average technological level for all firms in the market and pj the proportion of incumbent firms using technology j. In other words, new firms tend to enter with technologies that are close to the market average and adopted by many firms. However, it is still probable that a new firm may enter with the best technology, i.e. technology 100. Therefore, entry encourages diversity that is likely to include better technologies. On the other hand, increasing returns to adoption generated by imitation force firms to cluster around the same technology, and reduce diversity. The entry process, therefore, raises the rate of technological change by creating diversity, but it also causes reallocation of resources towards, in some cases, low-tech new firms (Ballot and Taymaz, 1998). The performance characteristics of a new firm entrant can thus be referred to as a drawing from an empirical distribution.

4.4. The Positive Role of Firm Deaths (Exits)

Exits are easier to specify. They are fully endogenized and occur when firms have been experiencing a bad profit development for considerable time. The model allows for a continuum of exit behavior between fast exit when a firm has had a recorded profitability below targets for a number of years, when the firm runs into liquidity problems and difficulties of rising debt exposure and, at the other end, and at the latest (slow exit) when net worth has vanished (Eliasson, 1976b). This means that the exit rate might be positively correlated with the general profitability in the market because increased entry of superior firms increases competition and forces exit. This would be one reason for the observed (e.g., Siegfried and Evans, 1994) correlation between entry and exit of firms.

The positive macroeconomic effects of a faster exit however demand a separate explanation. How come the disappearance of firms adds to output? This paradoxical effect depends on the complete multimarket interactions of the MOSES model making both production structures and the allocation of resources endogenous. The resources released by exiting firms are reallocated to growing firms, and the more so the more productive the receiving firms and the less productive the disappearing firms, and the more efficient markets are in reasllocating freed resources, not least workers. This dynamic of market resource reallocation is difficult to demonstrate econometrically, and in particular on the short time series panel data available. It has been demonstrated to be a property of the MOSES model by Eliasson (2000). The clear result of that study was that a long-term, positive outcome of entry required a significant exit rate and a fast reallocation of labor over the market. Furthermore, as we will soon see, the experimental design that generated the negative long-run effects of fast entry was a slowing of the exit process.

Exit, hence, is an integral part of the firm entry and reorganization processes that together define Schumpeterian creative destruction. Exit is necessary to release resources for non-inflationary new firm formation and growth. Exit is a natural consequence of the business mistakes that occur constantly in the model of the experimentally organized economy. Stable long-term macroeconomic growth in the MOSES model, however, is demonstrated to require that entry and exit frequencies balance off over time.

5. Results from Simulations

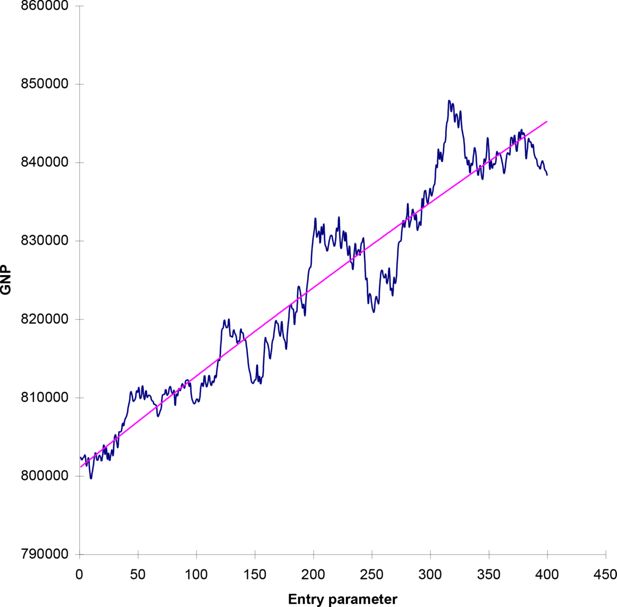

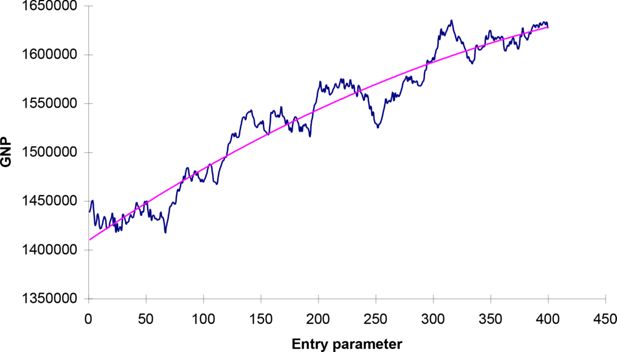

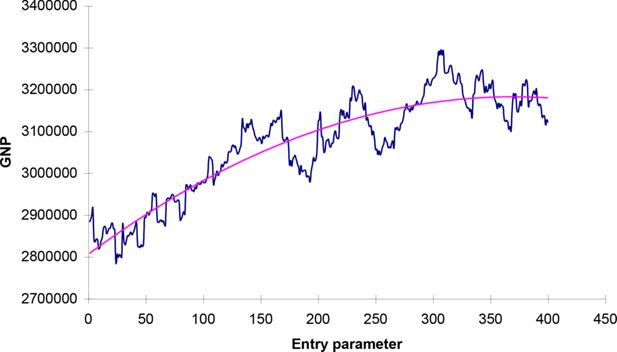

Each experiment has been rerun by gradually increasing the entry parameters exogenously. Figure 2, Figure 3, Figure 4, Figure 5 show the average value of GNP in the experiments, and the trend line shows the regression “curve” estimated by regressing the GNP level on a quadratic function of the entry parameter.

(A) GNP Levels at Year 75 for Different Entry Rate Specifications.(B) Manufacturing Output Levels at Year 75 for Different Entry Rate Specifications.

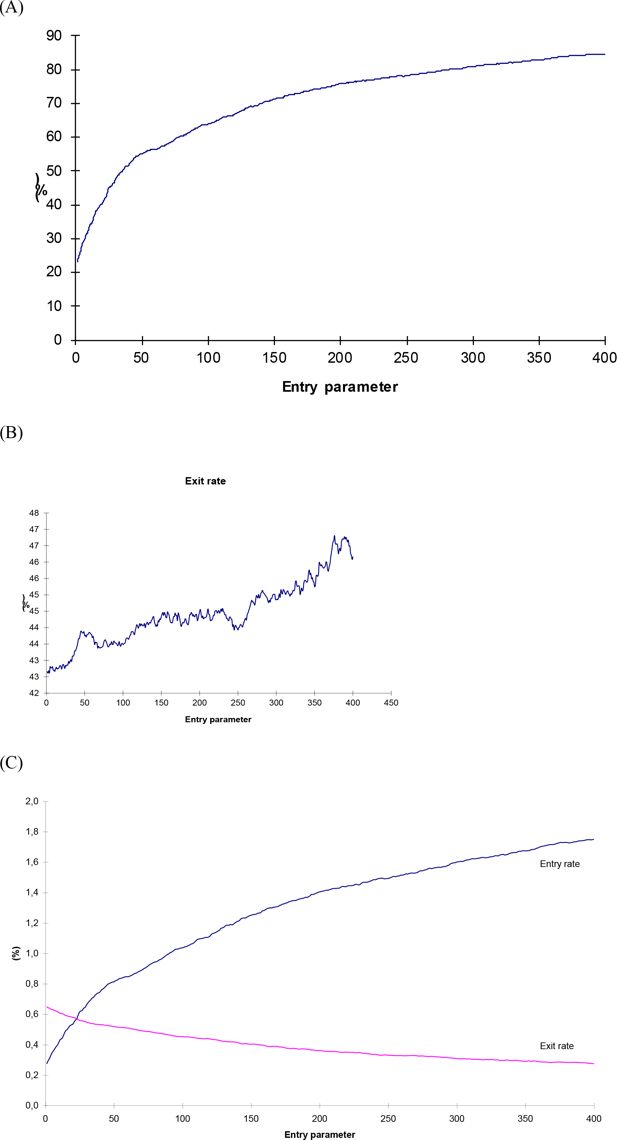

Figure 6A shows the entry rate. The entry rate is defined as the proportion of net entrants at the end of the simulation (year 75). As may be expected, the entry rate increases almost monotonically by the value of the entry parameter to reach some 80 percent. Figure 6B shows the effects of the entry parameter on the exit rate that is defined as the ratio between the number of exits and the number of firms at the beginning of the simulation (there were 225 firms at year 0). As expected, the entry rate also increases the exit rate because of the increased competition in the markets.7

(A) Number of net (surviving) entrants in percent of 75 end-year populations of firms for different entry specifications. (B) Number of exits during 75-year simulations in percent of initial number of firms. (C) Number of entrants and exits per year in percent of stock of firms (number) for different entry specifications.

The parameters in the entry function are moved such that the entry rate is steadily increased. The exit rate is completely endogenized, but faster and slower exit can be specified in terms of the criteria model firm management applies to close down a firm.

The endogenized balance between entry and exit is shown in Figure 6. The exit rate in Figure 6C decreases compared to Figure 6B because the firm population increases faster than the number of exits. To demonstrate the change over from the approximately linear to the non-linear macroeconomic response to firm turnover we present four sets of figures showing the GNP levels after 15, 35, 55 and 75 years respectively (Figures 2–5). For 75 years also manufacturing output is shown (Figure 5B).

Up to 15 years the levels of GNP increase proportionally with the rates of entry and exit (Figure 2). Decreasing returns to further entry begin to show as a small down bending of the trend curve after 35 years, which becomes pronounced after 55 years and very striking at 75 years both for GNP and manufacturing output. The downward bending at year 75 also comes at a lower turnover rate than at years 35 and 55.

For our purposes it is sufficient to establish the existence of this non-linear negative effect under the dynamic market assumptions of the simulation. The negative effects however take a long time coming, but the final surge may become very strong. This is also what we had conjectured onn the basis of prervious experience from the MOSES model on the cumulative incidence of Type II expectational mistakes, or on the market disorder created by speeding up market transactions excessively

It is not meaningful at this stage to draw any further quantitative conclusions. For obvious reasons the number of firms populating the model is only a tiny fraction of the number of firms of the real Swedish economy. The scales of the entry, exit and entry parameters in Figure 6 do not say anything about the rate at which firms are turned over per period or year. We can observe from Figures 6A, B that there is a parallel increase in the entry and exit rates, also as expected. The long-term growth to the 75-year horizon peaks at an entry parameter between 100 and 150. At that turnover level some 60 percent of the end population of firms is new. Many new entrants have exited during the 75-year period.8

On the exit side (Figure 6B) long-term (75 years) output peaks when exits number some 43-44 percent of the initial (year 0) population of 225 firms. While both the number of entrants and exits increases, the number of entrants is much larger than the number of exits. On the entry side, the “optimal” number in the model simulation amounts to some 1.1 percent of the stock of firms per year, which is slightly above the average of just below 1 percent in the 1970s and 1980s in Swedish manufacturing (Andersson et al., 1993).9 We have no corresponding exit data and apparently the exit rate simulated is much lower (Figure 6C). We can only say that if the scale would be calibrated to the level of the real economy the proportion of firms replaced through Schumpeterian creative destruction each period would be very large as you go to the right in Figure 6. There is, however, the possibility, indicated earlier, that the strong negative bend on the growth curve at very high rates of entry after 50 years depends on a too low exit rate (unbalanced turnover) and would go away if we speed up the rate of exits by making management more profit conscious. Hence, the extreme bending down in Figure 5A and B is unlikely to occur in reality because such high entry rates rarely occur for such long periods. But the effect is there to show. To capture it in a time series analysis on entry, exit and growth rates, generated by the model over a 75 year period, a very different model than the standard linear regression model would, however, be needed.

6. Concluding Policy Discussion

Literature increasingly reports strong econometric support for a positive linear relationship between entry and growth and also on a positive influence on production growth of a balanced entry and exit process. Firm turnover, however, involves a reallocation of resources and structural change. Above some limit the rate of structural change will begin to affect the reliability of price signaling in markets negatively, and raise the incidence of mistaken business decisions.Winners may get lost (Type II mistakes). To test for a long- run, non-linear negative influence of a very fast and (perhaps) unbalanced firm turnover process very long time series data that are not available are needed. Simulation has been the only way of establishing the possible theoretical existence of this phenomenon. It may even be so that the firm turnover rate needed to generate disturbances in the price system has to be so extreme that it “cannot occur” under normal circumstances in reality. If so, the negative relationship will not be observable. The micro-to-macro model of the Swedish economy has been found to embody the expected non-linear characteristics and for the reasons hypothesized. The output growth curve began to bend down after about half a century at entry rates that were far above recorded entry rates during the past 20 years. In that sense the model economy can be characterized as robust in response to price disturbances.

Long-term sustained, fast and stable growth in macro economic output is a desired ambition of industrial policy. We can say that the simulation experiments reported on directly perform the transformation of Table 1 into macro change, firms being guided in their investment and production decisions by price expectations and a profitability criterion called Maintain or Improve Profits (MIP. See (Eliasson, 1976b) as they compete for income in product markets and for resources in capital and labour markets. Growth occurs if winning projects/firms are opting for investment and growth and losers are contracting or shutting down. This ideal market dynamic may not always be the outcome, however. Long – term investment decisions in MOSES firms are guided by the expected return to capital over the market interest rate. The MIP criterion accepts that firms are temporarily inferior performers by that rate of return criterion, but force them to constantly improve their performance. Hence, if firms cannot meet their own short-term profit standards they may decide to contract operations rather than invest and expand. In this particular set of experiments unreliable price signaling in markets may lead both to mistaken production and investment decisions and tilt an increasing number of firms onto a lower than possible growth path. Similarly, unbalanced growth, with too few exits may raise factor prices and tilt expansive firms onto lower growth paths.10

We have demonstrated in this paper that faster growth for some time may mean significantly less growth later, at a stage when it may be impossible to restore the long-term outcome. Sustainability involves an “optimization” over a very long time span. An interesting question is if the policy maker should have a role in that optimization decision. The first problem to resolve, then, is to figure out the reasons for the long-run negative effect of fast turnover on growth. Wouldn’t the economy have developed endogenous market correction mechanisms that eliminate such long-run effects? The negative effects (and first) take a long time in coming. They cannot be discovered ahead of time by analytical methods so there is no opportunity for policy makers to act ahead with precise targeting of counter measures. Second, even if they had known what was coming, policy makers might not understand what to do and easily enact mistaken policies (Eliasson and Taymaz, 1992). Third, part of the difficulties of understanding the social and econmic costs of disturbed markets has to do with the incidence of lost winners (Type II mistakes) that may even permanently hold back economic development (see Ballot and Taymaz, 1998 on the incidence of technlogical lock-ins in the MOSES economy). Fourth, however, the low entry rates per year should be seen in relation to the total firm population. The model firm population features much less heterogeneity than the real firm population. Hence, the model economy is not as robust as the real economy and the downward bending of the curve should occur at a lower entry rate than in reality. Accounting for that one might perhaps say that the large entry rates to the right in Figure 6A, involving a very large increase in the firm population, are not sustainable for an entire economy for such a long period, only locally and then the realistic range of entry over a long period would be just above or just below the optimum, but not so far off. Then negative effects may go undiscovered for decades. In conclusion one might at least take note of the fact that this observation from model experiments is in line with Swedish experience over the last 80 years: a steady lowering of new firm formation per year from a peak around 3 percent in the 1920s to a low around 0.5 percent in the 1990s (Andersson et al., 1993). As a consequence industrial structures increasingly became dominated by a group of incumbent large firms, several of which ran into trouble during the oil crises years of the 1970:s. To prevent a large scale destruction of obsolete firms and a negative immediate employment effect the exit process of the real economy was slowed by an extreme subsidizing program. This subsidy program and alternative disbursements of public money under the same budget constraint has been reenacted on the (real) firms in the model, mostly the shipyards. Sweden at that time was the second largest shipbuilding nation of the world supplying almost 10 percent of output. Today none of these shipyards exists, The creative destruction had been artificially slowed by industrial policy interference, which was socially very costly in terms of lost output, all being estimated in an economy wide cost benefit study on MOSES Carlsson (1983). Since all receipients of industrial subsidies were represented in the data base of MOSES subsidies could be allocated on the now dead firms exactly by amount and time received. Those firms in fact only survived in the model simulation (as well as in reality) only as long as the subsidies were doled out. If the money was taken away, and redistributed equally on all firms through a lowering of the payroll tax, the crisis firms all exited and the economy soon recovered to grow on the earlier faster trajectory, albeit at a lower level. So government had been adding worse to bad by subsidizing the worst performers that were also paying the highest wages (steel and shipyards; Carlsson, 1983) in Sweedish manufacturing. The negative impact on the real Swedish economy of the extreme subsidy program began to be fully observable and understood only as late as the early 1990s. and the MOSES simulations were instrumental in making that collossal policy mistake statistically visible.

Footnotes

1.

A brief presentation of the micro-to-macro model tailored for our particular firm turnover experiments is found in Eliasson (1978a); Hanson (1989); Eliasson (2000) and Eliasson et al. (2004). A more principal presentation is found in Eliasson (1976b); Eliasson (1977); Eliasson (1978a); Eliasson (1991a); Eliasson (1992) . The macro economic effects of disturbed price signaling in markets due to inflation were studied in Eliasson (1978). In addition there are five MOSES books: Eliasson (1985); Bergholm (1989), Albrecht et al. (1989), Taymaz (1991a) and that present the model and its empirical calibration in full technical detail. A model with a deidentified data base has been put together for external use (Taymaz, 1992).

2.

Cf. Eliasson (1978) where the macro economic growth process is fairly unaffected by such disturbances caused by inflation up to a certain level, then to turn negative.

3.

Complex economic models involve a number of unobservable parameters. These parameters are either estimated statistically from reduced form models, or, in most of the cases, substituted by researchers’ best “educated guesses”. The way the parameter values are set has been one of the main reasons why these models have been ignored and even disregarded as a robust analytical tool by orthodox economists. However, we have developed a calibration algorithm to set parameter values for the MOSES model at the early stages of model development (Taymaz, 1991b). This calibration or, as we feel confident to call it, structural estimation program, based on a random hill climbing algorithm, fits the “model” to a number of sector variables, but it can also use micro-variables for calibrating parameter values. As shown by Balistreri and Hillberry (2004), estimation and calibration exercises are identical under consistent identifying assumptions. Both methods fit a model to data. Therefore, one should not consider econometric models as a superior analytical tool. In terms of fitting the data, there is no difference between econometric models and simulation models. However, simulation models allow the researcher to model underlying interaction mechanisms and, hence, achieve a robust analysis.

4.

For a discussion of this “chaotic property”, see Eliasson (1983).

5.

On this Ueda (2000) observes that output is positively correlated with profits in aggregate data, but not in sector data. This incompatibility with the neoclassical competitive equilibrium model Ueda explains by assuming that the “ sector’s incumbents have market power” and therefore lower profitability in growing markets to deter entry and protect their rents.

6.

Currently the average is 15 percent.

7.

This effect has been a property of the model through all its versions. See Eliasson (1978a).

8.

Johansson (2001) found that only 60 percent of the original number of firms in the Swedish IT industry remained after 5 years.

9.

Calibration of entry data for use in the model was based on the planning survey of the Federation of Swedish Industries that we also use in the model. Since this data set does not include very small firms and self employed entry data differ from official statistics that have later become available (Nyström, 2006).

10.

These negative effects on growth came out clearly in early model experiments on the Swedish subsidy program (Carlsson, 1983).

References

- 1

- 2

- 3

- 4

-

5

MOSES Database181–227, Documentation of the Planning Survey Data: Cross-sector and Panel, MOSES Database, IUI Research Report No.40, Stockholm: IUI, p.

-

6

Den Långa Vägen ─ Om Den Ekonomiska Politikens Begränsningar Och Möjligheter Att Föra Sverige Ur 1990-Talets KrisStockholm: IUI.

-

7

Innovation, growth and survivalInternational Journal of Industrial Organization 13:441–457.https://doi.org/10.1016/0167-7187(95)00499-8

- 8

-

9

New firm survival: new results using a hazard functionThe Review of Economics and Statistics 77:97.https://doi.org/10.2307/2109995

-

10

The post-entry performance of firms: IntroductionInternational Journal of Industrial Organization 13:413–419.https://doi.org/10.1016/0167-7187(95)00497-1

- 11

-

12

Firm selection and industry evolution: the post-entry performance of new firmsJournal of Evolutionary Economics 4:243–260.https://doi.org/10.1007/BF01236371

-

13

Entry and Market Contestability: An International ComparisonProductivity Growth and the Competitive Process: The Role of Firm and Plant Turnover, Entry and Market Contestability: An International Comparison, Basil & Blackwell, Oxford.

-

14

Plant Creation versus Plant Acquisition – the Entry Process in Canadian ManufacturingInternational Journal of Industrial Organization 5:27–41.https://doi.org/10.1016/0167-7187(87)90004-X

-

15

Statistics Canada, Analytical Studies Branch, Research paper Series no.23Statistics Canada, Analytical Studies Branch, Research paper Series no.23.

- 16

-

17

Estibration: an illustration of structural estimation as calibrationSSRN Electronic Journal 14:589062.https://doi.org/10.2139/ssrn.589062

-

18

The Microeconomic Foundations of Economic Growth310–330, Human Capital, Technological Lock-In and Evolutionary Dynamics, The Microeconomic Foundations of Economic Growth, Ann Arbor, The University of Michigan Press, p.

-

19

Technological change, learning and macro-economic coordination: an evolutionary modelJournal of Artificial Societies and Social Simulation 2:2.

- 20

-

21

Economic Turbulence: Is a Volatile Economy Good for AmericaChicago: The University of Chicago Press.https://doi.org/10.7208/chicago/9780226076348.001.0001

-

22

Industrial subsidies in sweden: macro-economic effects and an international comparisonThe Journal of Industrial Economics 32:1–23.https://doi.org/10.2307/2097983

-

23

Industrial organization and new findings on the turnover and mobility of firmsJournal of Economic Literature 36:1947–1982.

-

24

Entry, innovation, exit – towards a dynamic theory of oligopolistic industrial structureEuropean Economic Review 15:137–158.https://doi.org/10.1016/0014-2921(81)90084-2

-

25

Etablering, Nedläggning Och Industriell Tillväxt i Sverige, 1959–1970Stockholm: IUI.

- 26

-

27

Business Economic Planning – Theory, Practice and ComparisonLondon: John Wiley & Sons.

-

28

A Micro-Macro Interactive Simulation Model of the Swedish EconomyA Micro-Macro Interactive Simulation Model of the Swedish Economy, Federation of Swedish Industries: Economic Research Reports, series B, Nr 15 (December). Republished in this Anthology.

-

29

Competition and market processes in a simulation model of the swedish economyAmerican Economic Review 67:277–281.

-

30

105–126, How Does Inflation Affect Growth? Experiments on the Swedish Micro-to-Macro Model, p105–126, How Does Inflation Affect Growth? Experiments on the Swedish Micro-to-Macro Model, p.

- 31

-

32

Policy Making in a Disorderly World Economy, Conference Reports 1983:1269–323, On the Optimal Rate of Structural Adjustment, Policy Making in a Disorderly World Economy, Conference Reports 1983:1, Stockholm, IUI, p.

-

33

Policy Making in a Disorderly World EconomyStockholm: IUI: Conference Reports 1983:1.

-

34

Micro heterogeneity of firms and the stability of industrial growthJournal of Economic Behavior & Organization 5:249–274.https://doi.org/10.1016/0167-2681(84)90002-7

-

35

The Firm and Financial Markets in the Swedish Micro-to-Macro Model – Theory, Model and VerificationStockholm: IUI.

-

36

Economic Evolution, Learning, and ComplexityInstitutions, entrepreneurship, economic flexibility and growth - experiments on an evolutionary micro-to-macro model, Economic Evolution, Learning, and Complexity, Heidelberg, Physica.

-

37

The Contribution of Human and Social Capital to Sustained Economic Growth and Well-Being91–115, The Role of Knowledge in Economic Growth, The Contribution of Human and Social Capital to Sustained Economic Growth and Well-Being, p.

-

38

Global economic intergration and regional attractors of competenceIndustry & Innovation 10:75–102.https://doi.org/10.1080/1366271032000068113

-

39

Simulating the new economyStructural Change and Economic Dynamics 15:289–314.https://doi.org/10.1016/j.strueco.2004.01.002

-

40

The Birth, the Life and the Death of Firms: The Role of Entrepreneurship, Creative Destruction and Conservative Institutions in a Growing and Experimentally Organized Economy305–356, Firm Turnover and the Rate of Macroeconomic Growth - Simulating the Macroeconomic Effects of Schumpeterian Creative Destruction, The Birth, the Life and the Death of Firms: The Role of Entrepreneurship, Creative Destruction and Conservative Institutions in a Growing and Experimentally Organized Economy, Stockholm, The Ratio Institute, p.

-

41

Growth, entry and exit of firmsThe Scandinavian Journal of Economics 86:52.https://doi.org/10.2307/3439403

-

42

Modeling the experimentally organized economyJournal of Economic Behavior & Organization 16:153–182.https://doi.org/10.1016/0167-2681(91)90047-2

-

43

Deregulation, innovative entry and structural diversity as a source of stable and rapid economic growthJournal of Evolutionary Economics 1:49–63.https://doi.org/10.1007/BF01202338

-

44

Entrepreneurship, Technological Innovation and Economic Growth. Studies in the Schumpeterian TraditionBusiness Competence, Organizational Learning and Economic Growth: Establishing the Smith-Schumpeter-Wicksell Connection, Entrepreneurship, Technological Innovation and Economic Growth. Studies in the Schumpeterian Tradition, Ann Arbor, The University Michigan Press.

- 45

-

46

The Economics of Technical Change - The macroeconomic consequences of business competence in an experimentally organized economyRevue d’Economie Industrielle Numero Exceptionnel:53–82.

-

47

Firm Objectives, Controls and Organization – the Use of Information and the Transfer of Knowledge within the FirmBoston/Dordrecht/London: Kluwer Academic Publishers.

-

48

The biotechnological competence blocRevue d’économie Industrielle 78:7–26.https://doi.org/10.3406/rei.1996.1641

-

49

Industrial policy, competence blocs and the role of science in economic developmentJournal of Evolutionary Economics 10:217–241.https://doi.org/10.1007/s001910050013

- 50

-

51

What do we know about entry?International Journal of Industrial Organization 13:421–440.https://doi.org/10.1016/0167-7187(95)00498-X

-

52

The Dynamics of Market Economies295–310, A Note: On Measuring and Modeling Innovative New Entry, The Dynamics of Market Economies, Stockholm, IUI, p.

-

53

Microeconomic Evidence of Creative Destruction in Industrial and Developing CountriesMicroeconomic Evidence of Creative Destruction in Industrial and Developing Countries, Microeconomic Evidence of Creative Destruction in Industrial and Developing Countries, The World Bank Group, 10.1596/1813-9450-3464.

- 54

-

55

Entry, Industry Growth, and the Microdynamics of Industry SupplyJournal of Political Economy 92:733–757.https://doi.org/10.1086/261254

-

56

New Business Starts and Economic Activity – An Empirical InvestigationInternational Journal of Industrial Organization 5:51–66.https://doi.org/10.1016/0167-7187(87)90006-3

-

57

Business failure of new firms: an empirical analysis using a multiplicative hazards modelInternational Journal of Industrial Organization 18:557–574.https://doi.org/10.1016/S0167-7187(98)00035-6

-

58

An Information Version of Pure CompetitionThe Economic Journal 76:786.https://doi.org/10.2307/2229083

-

59

The Dynamics of Firm and Industry Growth: The Swedish Computing and Communications Industry, Doctorial dissertation in EconomicsStockholm: The Royal Institute of Technology.

-

60

The Turnover of Firms and Industry GrowthSmall Business Economics 24:487–495.https://doi.org/10.1007/s11187-005-6446-y

- 61

-

62

Entry, exit and diffusion with learning by doingAmerican Economic Review 79:690–699.

- 63

- 64

-

65

New developments on the oligopoly frontJournal of Political Economy 66:215–232.https://doi.org/10.1086/258035

-

66

Entry and Exit in Swedish Industrial Sectors, Doctorial Dissertation in EconomicsJönköping: Jönköping International Business School.

-

67

The determinants of entry: a study of the canadian manufacturing industriesThe Review of Economics and Statistics 56:58.https://doi.org/10.2307/1927527

-

68

Empirical implications of alternative models of firm dynamicsJournal of Economic Theory 79:1–45.https://doi.org/10.1006/jeth.1997.2358

- 69

- 70

- 71

-

72

Empirical studies of entry and exit: a survey of the evidenceReview of Industrial Organization 9:121–155.https://doi.org/10.1007/BF01035654

- 73

-

74

MOSES on PC: Manual, Initialization, and Calibration87–132, Calibration, MOSES on PC: Manual, Initialization, and Calibration, Stockholm, IUI, p.

-

75

Chapter in MOSES DatabaseA description of the initial 1982 and the synthetic 1990 data base, Chapter in MOSES Database, IUI Research Report Nr 40 1992, Stockholm.

-

76

Why Do Fast Growing Sectors Not Experience Above-Average Entry of New Firms?”Department of Economics, Universiatat Fabra, Ramon Trias Fargas, Barcelona, (Mimeo.

-

77

Innovation, Industry Evolution and Employment253–264, Who Exits from German Manufacturing Industries and Why? Evidence from the Hannover Panel Study, Innovation, Industry Evolution and Employment, Cambridge, Cambridge University Press, p.

-

78

Economic natural selection and the theory of the firmsYale Economic Essay 4:225–272.

-

79

The Dynamics of Market Economies199–232, Schumpeterian Competition in Alternative Technological Regimes, The Dynamics of Market Economies, Stockholm, IUi, p.

Article and author information

Author details

Acknowledgements

Shortened and updated 2006 version of Eliasson et al. (2005) , published under the same title in Eliasson et al. (2005), The conservative institutions in a growing and experimentally organized economy, Stockholm: RATIO. Compared to the 2005 original a long survey of traditional growth modelling has been deleted.

Publication history

- Version of Record published: December 2, 2024 (version 1)

Copyright

© 2024, Eliasson et al.

This article is distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use and redistribution provided that the original author and source are credited.