Economy-Wide Effect of Fiscal Drag in Ethiopia

Figures

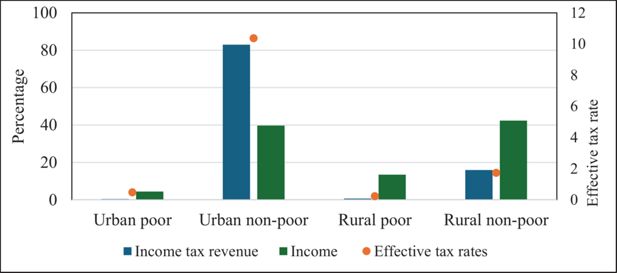

Income tax revenue, income, and effective tax rates by household types. Source: Own computation.

Bottom-up approach. Source: Adapted from Bourguignon and Bussolo (2013).

Tables

Percentage change in household consumption and income.

| Household types | Household consumption | Household income |

|---|---|---|

| Urban poor | 1.31 | -0.06 |

| Urban non-poor | -0.75 | -0.08 |

| Rural poor | 0.70 | 0.16 |

| Rural non-poor | 0.33 | 0.07 |

-

Source: Own computation.

Share of consumption and changes in household consumption and production.

| Item | Share of consumption by urban non-poor | Household consumption expenditure | Production | |||

|---|---|---|---|---|---|---|

| Urban Poor | Urban non-poor | Rural poor | Rural non-poor | |||

| Grain | 20.65 | 0.16 | - 0.09 | 0.38 | 0.18 | 0.14 |

| Livestock | 28.92 | 1.67 | -0.95 | 0.87 | 0.40 | 0.10 |

| Hotel | 41.58 | 1.86 | -1.01 | 0.63 | 0.30 | -0.13 |

| Forest | 18.53 | 2.06 | -1.13 | 1.26 | 0.59 | 0.37 |

| Agro-processing | 25.39 | 0.16 | -0.09 | 0.38 | 0.18 | 0.14 |

| Other service | 60.88 | 1.87 | -1.00 | 0.64 | 0.31 | -0.14 |

| Real estate | 63.86 | 1.88 | -0.99 | 0.65 | 0.32 | -0.34 |

| Transport | 52.93 | 1.87 | -1.00 | 0.64 | 0.31 | 0.13 |

| Alcohol | 53.91 | 0.17 | -0.09 | 0.39 | 0.19 | 0.06 |

| Textile | 27.11 | 0.92 | -0.50 | 0.88 | 0.42 | 0.31 |

-

Source: Own computation.

Percentage change in factor demand by selected activities.

| Items | Agricultural labor | Non-irrigated land | Irrigated land | Agricultural capital | Semi-skilled labor | Skilled labor | Other capital |

|---|---|---|---|---|---|---|---|

| Grain | 0.17 | 0.19 | 0.22 | ||||

| Livestock | 0.20 | 0.04 | |||||

| Hotel | -0.11 | -0.10 | -0.07 | ||||

| Forest | 0.40 | 0.23 | |||||

| Agro-processing | 0.16 | 0.18 | 0.21 | ||||

| Other services | -0.15 | -0.13 | -0.11 | ||||

| Real estate | -0.38 | -0.37 | -0.34 | ||||

| Transport | 0.12 | 0.14 | 0.16 | ||||

| Alcohol | 0.03 | 0.04 | 0.07 | ||||

| Textile | 0.28 | 0.30 | 0.33 |

-

Source: Own computation.

Macroeconomic effects of an increase in the income tax rate.

| Real GDP | 0.04 |

|---|---|

| Real domestic production | 0.04 |

| Real household consumption | 0.03 |

| Real domestic final demand | 0.02 |

| Real import | -0.05 |

| Real export | 0.03 |

| Real intermediate input | 0.05 |

-

Source: Own computation.

Effects of an increase in the income tax rate on government income and expenditure.

| Direct tax | 9.05 |

|---|---|

| Import tax | -0.02 |

| Sales tax | -0.11 |

| VAT | -0.38 |

| Excise tax | -0.04 |

| Government income | 2.89 |

| Government expenditure | -0.08 |

| Government savings | 6.91 |

-

Source: Own computation.

Balanced Macro SAM for the year 2015/16.

| Activity | Commodity | Margin | Factor | Household | Tax | Govt | Kapital | World | Total | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Agri | Indus | Service | Agri | Indus | Service | Labor | Land | Capital | Urban | Rural | direct | Indirect | ||||||||||

| Activity | Agri | 649 | 649 | |||||||||||||||||||

| Indus | 1,124 | 1,124 | ||||||||||||||||||||

| Service | 806 | 806 | ||||||||||||||||||||

| Commodity | Agri | 48 | 320 | 65 | 89 | 199 | 10 | 48 | 779 | |||||||||||||

| Indus | 46 | 365 | 114 | 201 | 342 | 0 | 531 | 13 | 1,613 | |||||||||||||

| service | 4 | 77 | 125 | 172 | 169 | 138 | 166 | 0 | 67 | 917 | ||||||||||||

| Margin | 98 | 70 | 4 | 172 | ||||||||||||||||||

| Factor | Labor | 357 | 221 | 333 | 911 | |||||||||||||||||

| Land | 20 | 20 | ||||||||||||||||||||

| Capital | 174 | 142 | 168 | 483 | ||||||||||||||||||

| Household | Urban | 468 | 0 | 150 | 1 | 66 | 686 | |||||||||||||||

| Rural | 443 | 20 | 333 | 2 | 70 | 868 | ||||||||||||||||

| Tax | Direct | 60 | 12 | 72 | ||||||||||||||||||

| Indirect | 82 | 33 | 115 | |||||||||||||||||||

| Govt | 45 | 72 | 115 | 30 | 262 | |||||||||||||||||

| Kapital | 123 | 176 | 92 | 150 | 541 | |||||||||||||||||

| World | 32 | 338 | 74 | 445 | ||||||||||||||||||

| Total | 649 | 1,124 | 806 | 779 | 1,613 | 917 | 172 | 911 | 20 | 483 | 686 | 868 | 72 | 115 | 262 | 541 | 445 | |||||

-

Source: Own computation.

Percentage change in Factor prices.

| Non-irrigated land | Irrigated land | Agricultural capital | Semi-skilled labor | Skilled labor | Other capital |

|---|---|---|---|---|---|

| 0.27 | 1.83 | 0.20 | -0.07 | -0.07 | -0.12 |

-

Source: Model simulation results.

Percentage distribution of household income by factor types.

| Factor types | Urban poor | Urban nonpoor | Rural poor | Rural nonpoor |

|---|---|---|---|---|

| Agricultural labor | 2.37 | 0.15 | 94.54 | 28.12 |

| Non-irrigated land | 0.16 | 0.04 | 5.23 | 1.08 |

| Irrigated land | 0.23 | 0.45 | ||

| Agricultural capital | 1.07 | 0.06 | 28.84 | |

| Semi-skilled labor | 41.39 | 47.22 | ||

| Skilled labor | 55.01 | 25.43 | 14.83 | |

| Other capital | 27.10 | 26.68 |

-

Source: Model simulation results.

Percentage change in unemployment.

| Unemployment in agricultural labor |

|---|

| -8.24 |

-

Source: Model simulation results.

List of main Account of the 2015/16 SAM for Ethiopia.

| Activities | Commodities | Factors | Households | Taxes | ||||

|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

-

Source: Own compilation.

Income elasticities for Ethiopia.

| Commodities | Urban poor household | Urban non-poor household | Rural poor household | Rural non-poor household |

|---|---|---|---|---|

| Teff | 1.14 | 1.14 | 1.08 | 1.08 |

| Barley | 0.33 | 0.33 | 0.06 | 0.06 |

| Wheat | 0.41 | 0.41 | 0.42 | 0.42 |

| Maize | 0.58 | 0.58 | 0.62 | 0.62 |

| Sorghum | - 0.81 | - 0.81 | 1.00 | 1.00 |

| Finger millet | - 0.81 | -0.81 | 1.00 | 1.00 |

| Oats | 0.33 | 0.33 | 0.64 | 0.64 |

| Rice | 0.13 | 0.13 | 0.64 | 0.64 |

| Horse beans | 0.87 | 0.87 | 1.13 | 1.13 |

| Peas | 0.87 | 0.87 | 1.13 | 1.13 |

| Haricot beans | 0.87 | 0.87 | 1.13 | 1.13 |

| Lentils | 0.87 | 0.87 | 1.13 | 1.13 |

| Vetch | 0.87 | 0.87 | 1.13 | 1.13 |

| Other pulse | 0.87 | 0.87 | 1.13 | 1.13 |

| Neug | 2.10 | 2.10 | 0.96 | 0.96 |

| Linseed | 2.10 | 2.10 | 0.96 | 0.96 |

| Groundnuts | 2.10 | 2.10 | 0.96 | 0.96 |

| Sesame | 2.10 | 2.10 | 0.96 | 0.96 |

| Other cereals | -6.70 | -6.70 | 2.30 | 2.30 |

| Other spices | 0.67 | 0.67 | 0.30 | 0.30 |

| Other oilseeds | 2.10 | 2.10 | 0.96 | 0.96 |

| Peppers | 0.67 | 0.67 | 0.30 | 0.30 |

| Other vegetable | 0.87 | 0.87 | 0.95 | 0.95 |

| Onion | 0.87 | 0.87 | 0.95 | 0.95 |

| Potato and sweat potato | 0.59 | 0.59 | 0.18 | 0.18 |

| Garlic | 0.67 | 0.67 | 0.30 | 0.30 |

| Taro godere | 0.59 | 0.59 | 0.18 | 0.18 |

| Other root crop | 0.59 | 0.59 | 0.18 | 0.18 |

| Bananas | 0.87 | 0.87 | 0.95 | 0.95 |

| Other fruits | 0.87 | 0.87 | 0.95 | 0.95 |

| Chat | 0.85 | 0.85 | 1.39 | 1.39 |

| Coffee | 0.85 | 0.85 | 1.39 | 1.39 |

| Cotton | 0.85 | 0.85 | 1.39 | 1.39 |

| Hops | 0.85 | 0.85 | 1.39 | 1.39 |

| Sugarcane | 0.85 | 0.85 | 1.39 | 1.39 |

| Enset | - 0.39 | -0.39 | 2.12 | 2.12 |

| Flower | 1.50 | 1.50 | 1.72 | 1.72 |

| Livestock | 1.23 | 1.23 | 1.22 | 1.22 |

| Forest | 1.50 | 1.50 | 1.72 | 1.72 |

| Fishing | 0.12 | 0.12 | 0.52 | 0.52 |

| Preserve | 0.12 | 0.12 | 0.52 | 0.52 |

| Vegetable oil | 0.90 | 0.90 | 0.83 | 0.83 |

| Dairy | 0.12 | 0.12 | 0.52 | 0.52 |

| Grain | 0.12 | 0.12 | 0.52 | 0.52 |

| Bakery | 0.12 | 0.12 | 0.52 | 0.52 |

| Sugar | 0.96 | 0.96 | 0.16 | 0.16 |

| Argo-processing | 0.12 | 0.12 | 0.52 | 0.52 |

| Animal feed | 0.12 | 0.12 | 0.52 | 0.52 |

| Alcohol | 0.12 | 0.12 | 0.52 | 0.52 |

| Soft drinks | 0.12 | 0.12 | 0.52 | 0.52 |

| Tobacco | 1.50 | 1.50 | 1.72 | 1.72 |

| Textile | 0.67 | 0.67 | 1.19 | 1.19 |

| Apparel | 0.67 | 0.67 | 1.19 | 1.19 |

| Leather | 0.67 | 0.67 | 1.19 | 1.19 |

| Wood | 1.50 | 1.50 | 1.72 | 1.72 |

| Papier | 1.50 | 1.50 | 1.72 | 1.72 |

| 1.50 | 1.50 | 1.72 | 1.72 | |

| Chemicals | 1.50 | 1.50 | 1.72 | 1.72 |

| Fertilizer | 1.50 | 1.50 | 1.72 | 1.72 |

| Ink | 1.50 | 1.50 | 1.72 | 1.72 |

| Soap detergent | 1.50 | 1.50 | 1.72 | 1.72 |

| Pharmaceutical | 1.50 | 1.50 | 1.72 | 1.72 |

| Rubber | 1.50 | 1.50 | 1.72 | 1.72 |

| Non-metal | 1.50 | 1.50 | 1.72 | 1.72 |

| Metal | 1.50 | 1.50 | 1.72 | 1.72 |

| Electrical | 1.50 | 1.50 | 1.72 | 1.72 |

| Machinery | 1.50 | 1.50 | 1.72 | 1.72 |

| Furniture | 1.50 | 1.50 | 1.72 | 1.72 |

| Gas | 1.50 | 1.50 | 1.72 | 1.72 |

| Construction | 1.50 | 1.50 | 1.72 | 1.72 |

| Water | 1.35 | 1.35 | 0.86 | 0.86 |

| Transport | 1.35 | 1.35 | 0.86 | 0.86 |

| Trade | 1.35 | 1.35 | 0.86 | 0.86 |

| Real | 1.35 | 1.35 | 0.86 | 0.86 |

| Public | 1.35 | 1.35 | 0.86 | 0.86 |

| Private | 1.35 | 1.35 | 0.86 | 0.86 |

| Other service | 1.35 | 1.35 | 0.86 | 0.86 |

| Hotel | 1.35 | 1.35 | 0.86 | 0.86 |

| Health | 1.35 | 1.35 | 0.86 | 0.86 |

| Entertainment | 1.35 | 1.35 | 0.86 | 0.86 |

| Electricity | 1.35 | 1.35 | 0.86 | 0.86 |

| Education | 1.35 | 1.35 | 0.86 | 0.86 |

| Banking | 1.35 | 1.35 | 0.86 | 0.86 |

-

Source: Own compilation based on Hertel (1997) and Tafere et al. (2010).

Frisch elasticity

| Urban poor household | Urban non-poor Household | Rural poor household | Rural non-poor household |

|---|---|---|---|

| -5.85 | -5.85 | -5.85 | -5.85 |

-

Source: Own compilation based on Hertel (1997).

Data and code availability

We used the STAGE 1 variant of the CGE model, which is open source at http://cgemod.org.uk/stage_1.html, and the Social Accounting Matrix can be accessed from the Ministry of Planning and Development of Ethiopia.